The markets are no longer on the verge – they’re making the key step as I’m writing this.

USD Index Breaks New Ground

The didn’t just move to a new July high – it also moved above its June high. Congratulations to everyone who didn’t fall for the bear trap in the previous weeks – this rally is just getting started and profits resulting from it could be enormous before the move is over.

This is exactly what the USD Index is supposed to be doing, given the Peak Chaos theory that I’ve been writing about for some time now.

At first, the USD Index was rallying slowly, but surely, and now it’s accelerating – this is exactly how the HUGE rally started back in 2008 – it was small and slow at first.

Zooming in allows us to see that the recent price action created an inverse head-and-shoulders pattern that the USD Index recently completed and then verified.

The minimum (!) upside target based on this formation is about 101.45, which is close to the May high. That’s where the USD Index might pause or correct, but – by no means – do I expect this to be the end of the rally.

And since precious metals are vulnerable to USD Index’s rallies, the above is likely to trigger declines across the board – also in commodities like .

Indeed, not only moved below its most recent lows; it also moved below its rising support line. This is important as it suggests that the white metal has much further to decline.

Given USD’s momentum, it seems quite likely that silver invalidates its move above its June high, and this is when the bigger declines will start. Simply because it will be then that it will become clear that – despite multiple reasons for silver to move higher in the long run – THIS IS NOT IT with regard to its main breakout. And by “main breakout” I mean the one that will take it to $50 and then beyond.

Platinum: Final Push Before Slide?

Finally, platinum just failed to rally back above its June high, and it moved back below it. This pause likely means that platinum is getting ready to slide, but it’s waiting for the final push.

There are two events that could trigger further moves (up in the USD Index, and down in most other markets, including precious metals, commodities, and miners):

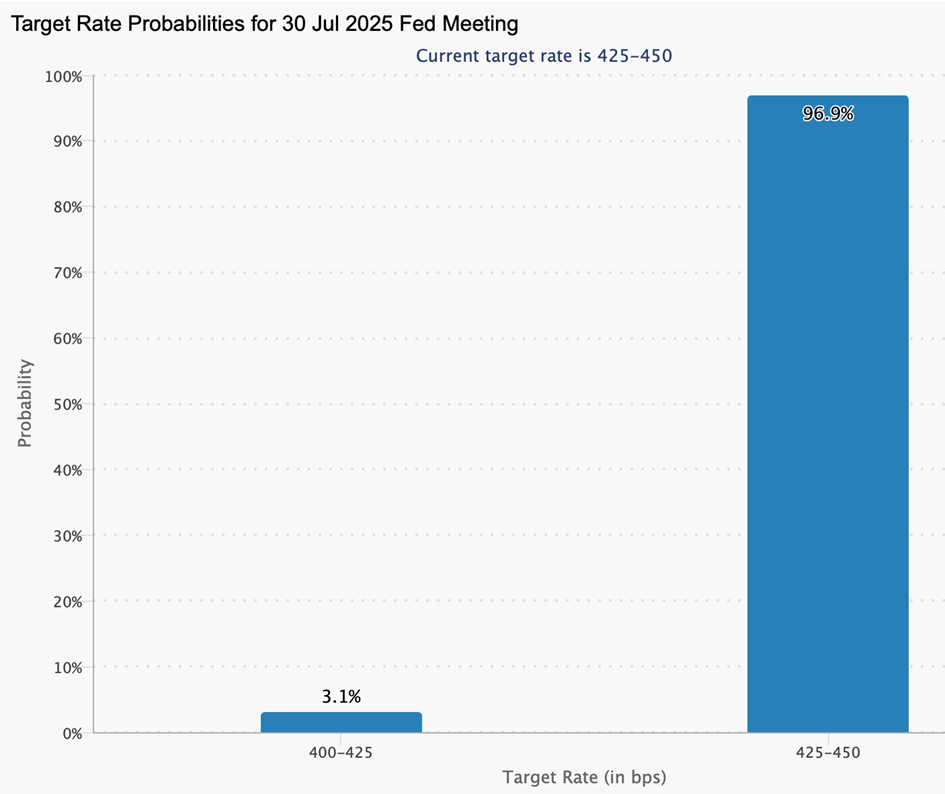

Today’s interest-rate decision from the Fed (almost everyone – including myself – is expecting Powell to keep the rates unchanged, but the key thing is what they will say during the press conference)

The August 1 tariff deadline / implementation. Even if key things are known upfront, this date could still trigger significant “but the rumor, sell the fact” price moves.

The technical signs are clear – USD Index is already rallying, and this move is likely to continue for weeks or months (there will be pauses and corrections along the way, but I mean in general), and the precious metals sector as well as commodities are likely to see big corrections / declines – especially if the general stock market also (finally) slides. Of course, there are ways to profit from all of it.