Why clients leave their firms, strategies for retention, how to use OBBBA to your advantage, and more.

Times are changing; your clients are looking for clarity. Are you offering the strategic guidance they need?

This is a question that tax and accounting professionals must consider as clients try to navigate today’s rapidly changing environment. Persistent inflation, recession worries, trade tensions, and the recent passage of the “One Big Beautiful Bill Act” (OBBBA) are among the reasons why people are reeling.

For advisory firms, this represents a significant opportunity to solidify accounting client retention. By providing clients the proactive guidance they seek, firms can strengthen trust and demonstrate value.

To help firms become the expert advisors their clients need, this article explores effective client retention strategies, how firms can use the new tax legislation to their advantage, and the role technology can play in retention.

Jump to ↓

Why do clients leave accountants?

Client retention strategies for accounting firms

Using new lax legislation to your advantage

How to leverage technology for better client retention

Why do clients leave accountants?

Accounting client retention is not a new concern for firms; however, changes in client expectations, the commoditization of tax prep, and technological advancements have intensified the pressure. Today’s firms cannot become complacent. Those that do, risk losing clients.

To better meet clients’ needs and remain competitive, firms continue to sharpen their focus on advisory services. And rightly so.

According to the 2025 State of Tax Professionals Report by Thomson Reuters Institute, 75% of firms surveyed said their clients strongly desire more tax and business advice. The survey also found that 34% of firms cited advisory as being most critical to their growth strategy in 2025.

However, strengthening client retention isn’t just about providing the right mix of services; it’s about understanding why clients leave their accountants in the first place.

Advising clients is a natural part of completing compliance work, and a growing number of firms are developing a menu of advisory services to market to clients. So, where’s the disconnect?

The true value lies not in the services themselves but in the advisory relationship. Focusing on the advisory relationship rather than just the services allows firms to build trust, better understand clients’ goals, and develop strategic plans.

That’s why firms must not only deliver the right mix of services but also employ effective client retention strategies.

White paper

4 keys to building advisory relationships for your tax and accounting firm

Read white paper ↗

Client retention strategies for accounting firms

Client retention isn’t just about keeping your clients; it’s about strengthening loyalty and providing proactive insights that add value for the client. In other words, it’s about nurturing the advisory relationship.

Here are some tips to consider, as outlined by Shaun Hunley, executive editor, during a Thomson Reuters webcast:

1. Educate yourself

To effectively advise clients, especially during times of legislative change, you need to have a solid understanding of the changes and their implications for your clients. Educating yourself is key and should be your top priority.

2. Analyze client data

Use AI-powered data mining tools to analyze the treasure trove of client data you have at your fingertips. Leveraging these tools enables you to easily provide personalized communication and more proactive, strategic advice.

“You want to pick clients who are kind of on the edge of substantial changes, something that could substantially affect their tax liability, and focus a lot on those clients. You’ll have other clients as well, which you do need to pay attention to, but the bulk is really looking at these core clients that will be substantially affected by any changes,” Hunley said.

3. Model the scenarios

Clients want and respond to proactive advice. An effective way to address this, especially during a time of change, is to model various scenarios for your clients. This helps clients prepare and can ease the anxiety they may feel. Uncertainty is stressful, so do all you can to alleviate it.

“The worst thing you can do is just ignore [the change] and then, after the change happens, you tell them, ‘Hey, by the way, your taxes are going to go up, or this deduction that you’ve loved has gone away,” said Hunley. “You don’t want to react to it, you want to proactively prepare them. The best way to do that, in my opinion, is to model the various scenarios.”

4. Proactively communicate

Further build client trust and keep them engaged through proactive communication. This shows clients you are aware of changes, their potential implications, and that you are there to provide guidance.

End-of-year tax planning is a great opportunity to proactively communicate upcoming changes or potential changes with clients. You might also consider sending clients a mass email or video. This can be an easy way to quickly reach a broad audience with tax-related news and developments.

“One thing I’ve seen a lot of practitioners do, which I think is wonderful, is just coming up with short videos: ‘Here’s what’s going to happen if this happens, if this is extended, if this goes away.’ That way, you can reach a bigger audience with a shorter amount of time,” said Hunley. “… So, basically being creative and presenting this information to your clients is really the best way, in my opinion, you can prepare for what could happen.”

Implementing these strategies further strengthens your role as a trusted advisor, which leads to more loyal client relationships and, ultimately, greater profitability.

Using new lax legislation to your advantage

On July 4th, President Trump signed into law the 2025 Tax Act (P.L. 119-21), formerly known as the “One Big Beautiful Bill,” ushering in a slew of changes, from making permanent several business provisions to extending and enhancing individual tax provisions to cutting various clean energy tax credits. For advisory firms, this represents a prime opportunity to help clients better understand the changes and how they may be impacted.

Underscoring this point, several surveys on taxpayer sentiment found that many Americans lack a clear understanding of the bill. For instance, a Washington Post/Ipsos poll conducted just weeks before the bill’s passage found that 26% of Americans said they had heard nothing at all about the bill, and 40% said they had heard a little about the bill.

By leveraging data mining capabilities, using scenario planning, and proactively communicating, firms can provide their clients with clarity and the actionable insights they need.

For example, the Act is reshaping state and local tax planning (SALT) by increasing the SALT deduction cap and implementing additional income-based phaseouts.

The temporary increase in the SALT cap to $40,000 starting in 2025 and the upcoming 2030 reversion to $10,000 present a window of opportunity for advisory professionals, which can also help firms better manage client expectations.

By assisting clients in deciding whether to restructure pass-through income, elect Pass-Through Entity Tax (PTET) treatment, or reconsider state residency, firms can reinforce their role as strategic advisors.

This is, of course, just one example of the advisory opportunities that have surfaced with the passage of the Act.

How to leverage technology for better client retention

It is also important not to overlook the vital role that innovative technology plays in improving client retention. For instance, with the right AI-powered tax advisory solution in place, firms can deliver specialized services that lay the groundwork for longer, more meaningful client relationships.

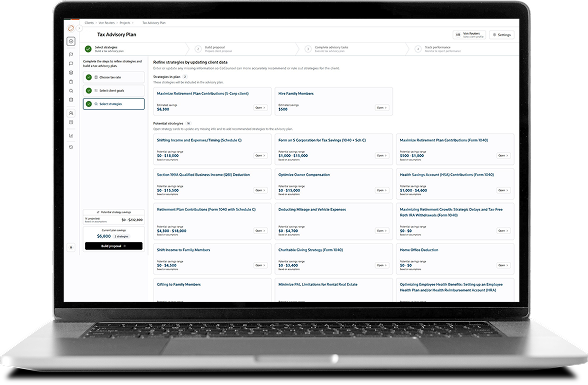

With Thomson Reuters Ready to Advise, you can:

Identify the optimal tax planning strategy for each client with AI analysis.

Execute tax strategies quickly with agentic AI providing step-by-step guidance.

Create comprehensive profiles that provide tax situations, financial goals, and suggested strategies for each client.

The time to act is now. Become an expert advisor to your clients with insights, revolutionary automation, and data-driven tax strategies. Be the source of confidence your clients need as they navigate the changing tax legislation in 2025 and beyond.

AI tax planning

Elevate your tax planning advisory services with Ready to Advise

Explore features ↗