After a chaotic first half of U.S. policy upheaval and trade shocks that unleashed a wild but brief rollercoaster on financial markets, the International Monetary Fund’s assessment is that global growth and inflation remain pretty much on even keel.

IMF economists make the case that economic activity around the world is still relatively subdued compared with historical averages and inflation slightly elevated. But these quibbles are essentially within margins of error in its midyear global forecasts.

Revising up a prior outlook that was made in the white heat of April’s U.S. tariff turmoil, the IMF on Tuesday reckoned the world will sail on with a 3.0% expansion this year and 3.1% next – the latter two tenths slower than 2024 but exactly the average growth rate of the past 10 years.

Virtually every major economy’s expected growth was nudged up, with the only exception being a marginal shaving of the forecast for Japan’s 2026 expansion. To put it mildly, this is not the singular economic shock some feared in April as trade war drums sounded loudly. And even the IMF’s outlook back then was well shy of the deep recession many were fretting about. To be fair to the IMF, it’s been chasing a moving target on tariffs just like everyone else. Despite greater clarity on Washington’s endgame over the past week, the issue would have been still in the air as the Fund was formulating these forecasts.

But it’s hard to escape the fact that as the largest economy in the world embarks on a unilateral protectionist push that upends decades of multilateral agreements and conventions, there’s little obvious or immediate economic fallout.

That must feel uncomfortable for a doyen of multilateralism such as the IMF – not least given its decades-long espousal of the so-called ‘Washington Consensus’, the orthodox economic policies that put free and open trade at the apex of its prescriptions.

STILL HURTING

Explaining the Fund’s relatively benign forecast update, IMF chief economist Pierre-Olivier Gourinchas noted that a sharp drop in the dollar flattered the overall global picture, both statistically and by loosening financial conditions broadly.

Gourinchas also cited multiple “crosscurrents” blurring the outlook – such as the frontloading of imports to beat the tariffs, offsetting fiscal stimuli in Europe, tax cuts in the United States and softer energy prices worldwide.

And he added that even though a bullet had been dodged, an effective U.S. tariff rate of 17% would still reverberate around the globe. “It’s going to continue hurting with tariffs at that level, even though it’s not as bad as it could have been,” he said, referring to the 24% rate assumed back in April.

Different IMF scenarios highlighted what could yet go wrong.

But as the full recovery in financial markets since April already nods to, President Donald Trump’s tariff war and use of trade levies as a revenue-raising tool to reduce income taxes has fallen into place with relatively minor macro costs so far.

The risk for the IMF is that after years of holding free trade up as central to economic progress and stability, the lack of a clear impact from such a breach of orthodoxy undermines that very case both in America and abroad.

What’s more, other aspects of the Washington Consensus – such as independent central banking or even capital controls – may now be seen as less canonical than previously assumed too as a result.

Trump, of course, is already pushing the central bank taboo.

And yet again the IMF felt the need to push back.

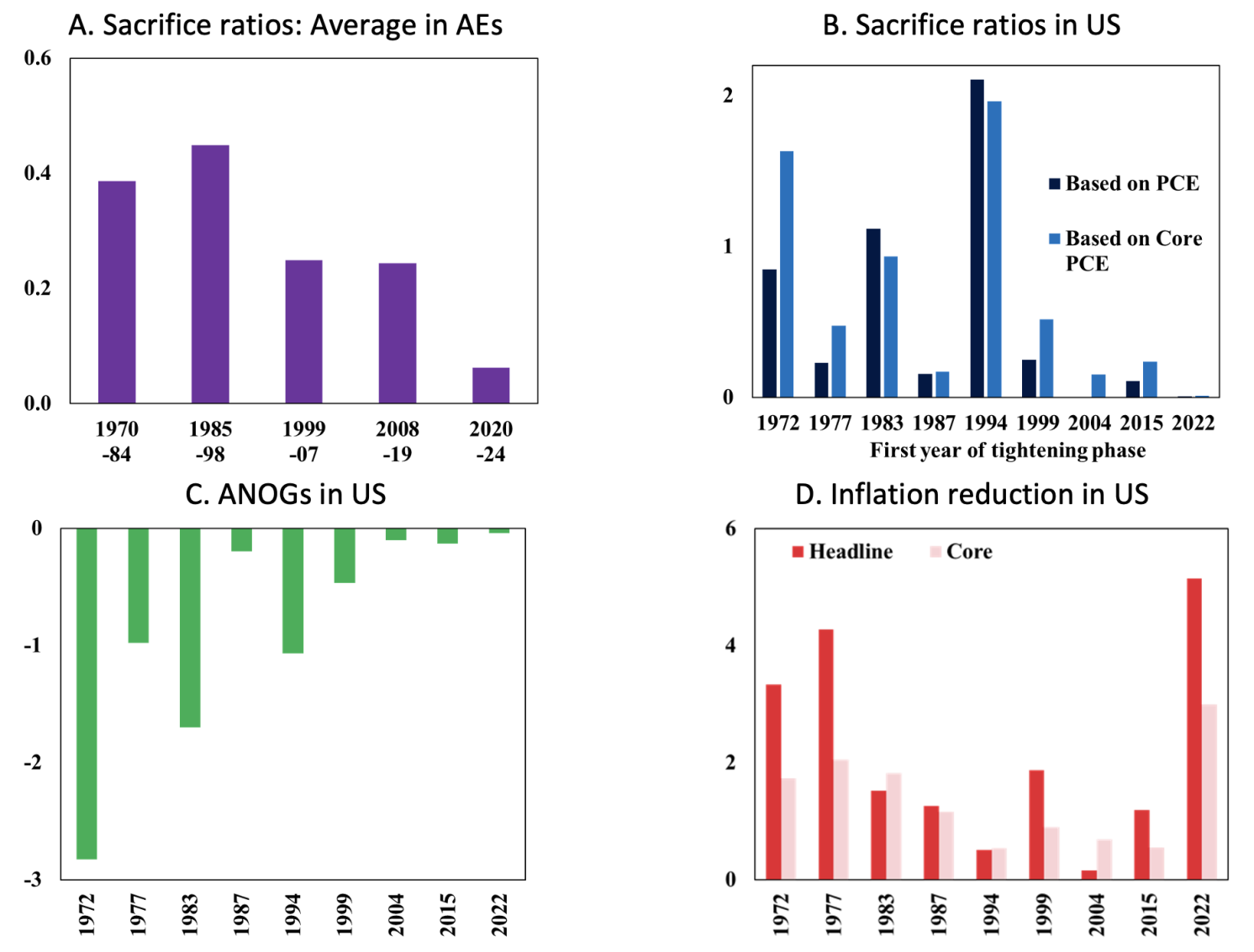

“This is really a core plank for macroeconomic stability overall,” Gourinchas said of central bank independence on Tuesday. “That’s one of the hard-learned lessons of the last 40 years.”

Not unlike difficulties pro-European politicians in Britain had identifying the precise damage caused by the Brexit referendum in its immediate aftermath, there’s a chance the real cost of unraveling global policy orthodoxies similarly take years to realize. A slow burn rather than an instant crash.

For the IMF and supporters of an open rules-based multilateral order, a bigger crisis than the one that’s unfolding or that they are forecasting may have been more useful longer term.

The opinions expressed here are those of the author, a columnist for Reuters