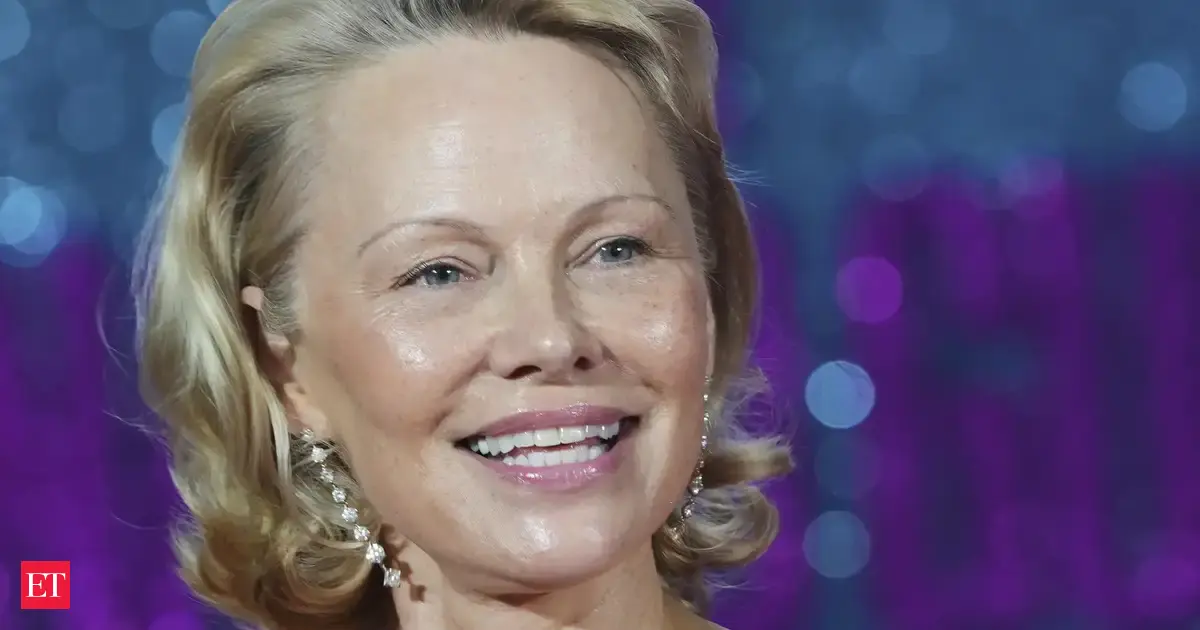

It’s indeed an interesting time to have you on the show. Lately, the Indian markets haven’t been performing well, while globally there’s been a lot happening — especially around tariffs, and there’s also anticipation of a rate cut in the near future. So, let’s begin with the global setup, since you’ve always advocated that one should not concentrate a portfolio in a single geography. Given the latest tariff developments and the current global sentiment, help us understand: where do you see potential outperformance, and which markets look attractive to you right now?Devina Mehra: Yes, as I always say, not only should you be global, but “global” doesn’t mean just the US. You need to diversify across countries because no single theme lasts forever — whether it’s countries, asset classes, or industries within a country. These things keep changing. We do rebalance globally — although we haven’t done it yet for this quarter — but currently, we are somewhat underweight on the US. Since January, we’ve maintained that stance. We’ve been overweight on Europe, overweight on China even earlier, and slightly overweight on India. So, broadly, that’s our global allocation. Of course, individual countries have their own opportunities, but at a broader level, Europe has been outperforming the US. That’s been one major trend. And China, after years of underperformance — and I may have quoted this before — its market hit a high in 2007, and despite GDP growing sixfold since then, that high wasn’t breached until recently. So that setup is also significant.

Regarding tariffs, there have been some agreements, like Japan announcing investments into the US, though eventually they clarify these are company-level decisions. So it’s like kicking the can down the road. But markets seem to have accepted it as business as usual.Since you’re underweight on the US, where globally are you placing your overweight bets currently?Devina Mehra: As I mentioned, we’ve been underweight US since January and overweight Europe. We’ve been overweight on China since last year, and we’re slightly overweight on India. And Europe, in particular, has outperformed the US quite meaningfully this year.

When you say you’re overweight on India, what looks attractive to you? Traditionally, during times of uncertainty, investors are advised to stick with blue chips — the “buy and forget” approach. But currently, even blue chips aren’t delivering on earnings. So, where do you see safety in the Indian market?Devina Mehra: When I say we’re slightly overweight India, it’s just that — a slight overweight in our global portfolios, not a huge one. I smiled when you mentioned “buy and forget,” because in markets there’s really no such thing. The definition of a blue chip keeps changing. If you look at the Sensex or Nifty history, you’ll see that many companies once considered blue chips have completely faded away — the Thapar group, Scindia Steamships, Mafatlal, Hindustan Motors (which made the Ambassador car), Premier Automobiles (which made old Fiats). These were all considered blue-chip companies when the Sensex was created.In fact, the only company in the original Sensex list with a relatively short history back then was Indian Hotels. The rest had decades of legacy. And if you look at older portfolios — like those from our grandparents’ era — you’ll find many names from these old business groups, such as JK, Thapar, Modi, Scindia, Mafatlal, all of which are now history.Even in the Nifty, the composition has changed dramatically. At one point, there were hardly any banks. Now, banks and financials hold the largest weight. In the late ’90s, PSUs dominated — MTNL, BSNL, BHEL, ONGC, Indian Oil, HPCL, BPCL, and others. Then came a time when people forgot PSUs were even investable. So the takeaway is: the stocks that lead one bull market are rarely the same ones that lead the next.The notion of “just buy a stock and wait for 20 years” doesn’t hold true across the board. Survivorship bias is very real. People remember the few winners — like HDFC Bank or Kotak Mahindra — but forget the many that failed: Times Bank, Global Trust, Centurion Bank, and several PSU banks. Even Yes Bank had major issues.

I recently saw someone’s mother’s portfolio from the early 2000s — untouched for over 20 years — and it included names like DSQ Software and Pentamedia, which haven’t aged well. So yes, markets evolve, and buy-and-forget isn’t a viable strategy.

Indeed. And looking ahead, the next key headline is the August 1 tariff deadline. There’s been some movement globally, but negotiations are still underway for India. Given that, and everything you just shared, what’s your advice for market participants now? How should they manage risk amid global uncertainty and a lackluster domestic earnings season?Devina Mehra: So far, domestic earnings have been mixed, but I believe we’ll start seeing some improvement from the second quarter onwards. That was my view earlier as well. There have been some encouraging macro signals — GDP came in ahead of estimates. More importantly, inflation, especially in food and crude, has come down, which helps household budgets.

In India, household finances are quite stretched. If prices of essentials like dal and oil go up, people cut back on other items like soap or shampoo. That’s been a drag for nearly two years. But now, prices are not only growing slower, they’re actually falling — especially in the food thali category. While that’s not great news for the agricultural segment (since realisations drop), for urban and non-farm consumers, it creates more room in the budget and boosts consumption.

Crude also impacts industries due to its role in downstream products. So, I believe we’ll eventually see margin improvements as well, along with better revenue growth.

As for investors, I always say: good investing is boring. People often tell me I repeat the same advice. That’s because good advice doesn’t change every two weeks. You should never be 100% in equities, but for your equity allocation, it usually makes sense to stay invested.

Often, when there’s fear and uncertainty — like now — that’s when markets can make sharp upward moves, and you don’t want to miss those. Yes, the market could go down, but the key is evaluating risk versus reward. If you miss the 10 best days over a 40-year period, you lose two-thirds of your returns. So most of the time, you simply can’t afford to sit it out.