Updated on July 22nd, 2025 by Bob Ciura

Monthly dividend stocks can be an attractive investment option for those seeking stable income. That is because monthly dividend stocks provide a predictable and consistent stream of cash flow.

Monthly dividends allow investors to receive more frequent payments than stocks which pay quarterly or semi-annual dividend payouts.

As a result, monthly dividend stocks can help to cover living expenses, or supplement other sources of income.

There are over 80 monthly dividend stocks that currently offer a monthly dividend payment.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

However, not all monthly dividend stocks are equally safe. There are many examples of monthly dividend stocks reducing or eliminating their dividends.

Overall, despite the positive attributes attached to monthly dividend stocks, their risk profile can be elevated as they strive to maintain their more frequent payouts.

In this article, we have analyzed the 10 monthly dividend stocks from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system.

The 10 safest monthly dividend stocks below have been arranged in order, based on their Dividend Risk Scores. If there is a tie, their ranking is determined by their payout ratio, with the lowest payout ratio earning a higher place.

Table of Contents

Safest Monthly Dividend Stock #10: Realty Income (O)

Realty Income is a retail real estate focused REIT that owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties.

This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Realty Income’s diversified portfolio comprises 15,627 commercial properties across eight countries, with 79.9% in retail, 14.4% in industrial, 3.2% in gaming, and 2.5% in other sectors.

Geographically, 84.6% of annualized base rent originates from the United States, 12.6% from the United Kingdom, and 2.8% from continental Europe.

On May 5, 2025, Realty Income Corporation reported its financial results for the first quarter ended March 31, 2025. The company achieved total revenue of $1.38 billion, surpassing analyst expectations of $1.27 billion.

Net income available to common stockholders was $249.8 million, or $0.28 per diluted share, compared to $129.7 million, or $0.16 per share, in the same period of the previous year.

Funds from Operations (FFO) per share increased to $1.05 from $0.94, while Adjusted Funds from Operations (AFFO) per share rose to $1.06 from $1.03, reflecting a 2.9% year-over-year growth.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

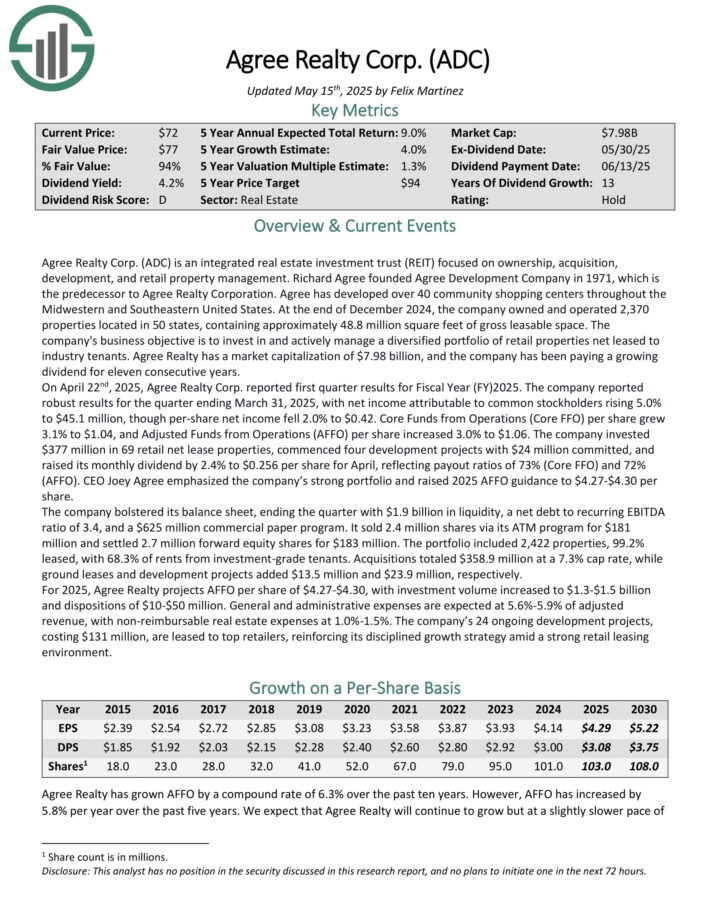

Safest Monthly Dividend Stock #9: Agree Realty (ADC)

Agree Realty is an integrated real estate investment trust (REIT) focused on ownership, acquisition, development, and retail property management.

Agree has developed over 40 community shopping centers throughout the Midwestern and Southeastern United States.

On April 22nd, 2025, Agree Realty Corp. reported first quarter results for Fiscal Year (FY)2025. The company reported robust results for the quarter ending March 31, 2025, with net income attributable to common stockholders rising 5.0% to $45.1 million, though per-share net income fell 2.0% to $0.42.

Core Funds from Operations (Core FFO) per share grew 3.1% to $1.04, and Adjusted Funds from Operations (AFFO) per share increased 3.0% to $1.06.

The company invested $377 million in 69 retail net lease properties, commenced four development projects with $24 million committed, and raised its monthly dividend by 2.4% to $0.256 per share for April, reflecting payout ratios of 73% (Core FFO) and 72% (AFFO).

The company bolstered its balance sheet, ending the quarter with $1.9 billion in liquidity, a net debt to recurring EBITDA ratio of 3.4, and a $625 million commercial paper program.

The portfolio included 2,422 properties, 99.2% leased, with 68.3% of rents from investment-grade tenants. Acquisitions totaled $358.9 million at a 7.3% cap rate, while ground leases and development projects added $13.5 million and $23.9 million, respectively.

For 2025, Agree Realty projects AFFO per share of $4.27-$4.30, with investment volume increased to $1.3-$1.5 billion and dispositions of $10-$50 million.

Click here to download our most recent Sure Analysis report on ADC (preview of page 1 of 3 shown below):

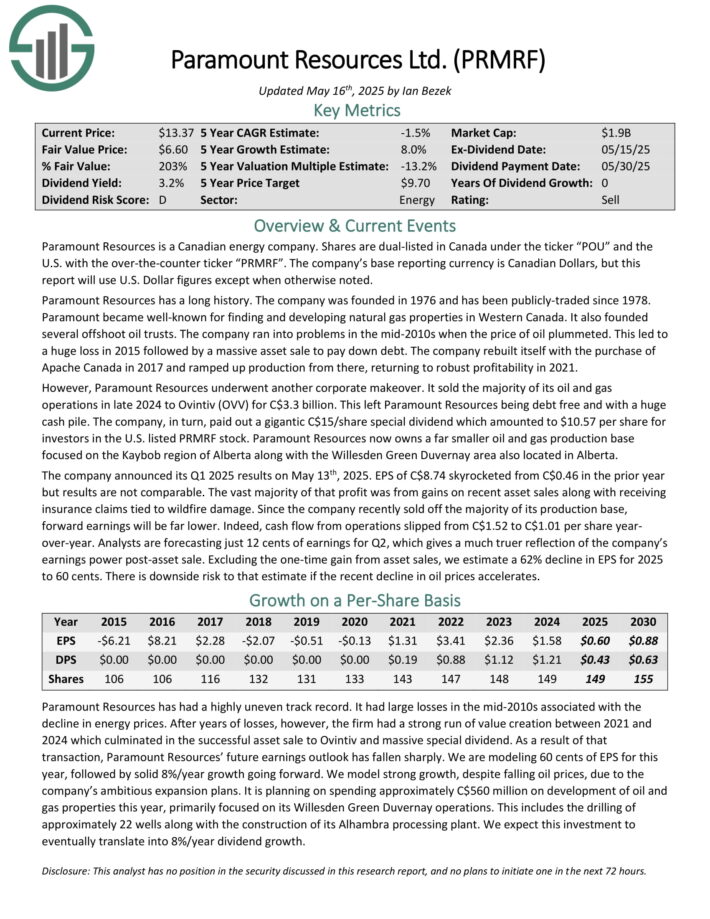

Safest Monthly Dividend Stock #8: Paramount Resources (PRMRF)

Paramount Resources is a Canadian energy company. Paramount Resources has a long history. The company was founded in 1976 and has been publicly-traded since 1978.

Paramount Resources now owns a far smaller oil and gas production base focused on the Kaybob region of Alberta along with the Willesden Green Duvernay area also located in Alberta.

The company announced its Q1 2025 results on May 13th, 2025. EPS of C$8.74 skyrocketed from C$0.46 in the prior year but results are not comparable. The vast majority of that profit was from gains on recent asset sales along with receiving insurance claims tied to wildfire damage.

Since the company recently sold off the majority of its production base, forward earnings will be far lower. Indeed, cash flow from operations slipped from C$1.52 to C$1.01 per share year-over-year.

Analysts are forecasting just 12 cents of earnings for Q2, which gives a much truer reflection of the company’s earnings power post-asset sale.

Click here to download our most recent Sure Analysis report on PRMRF (preview of page 1 of 3 shown below):

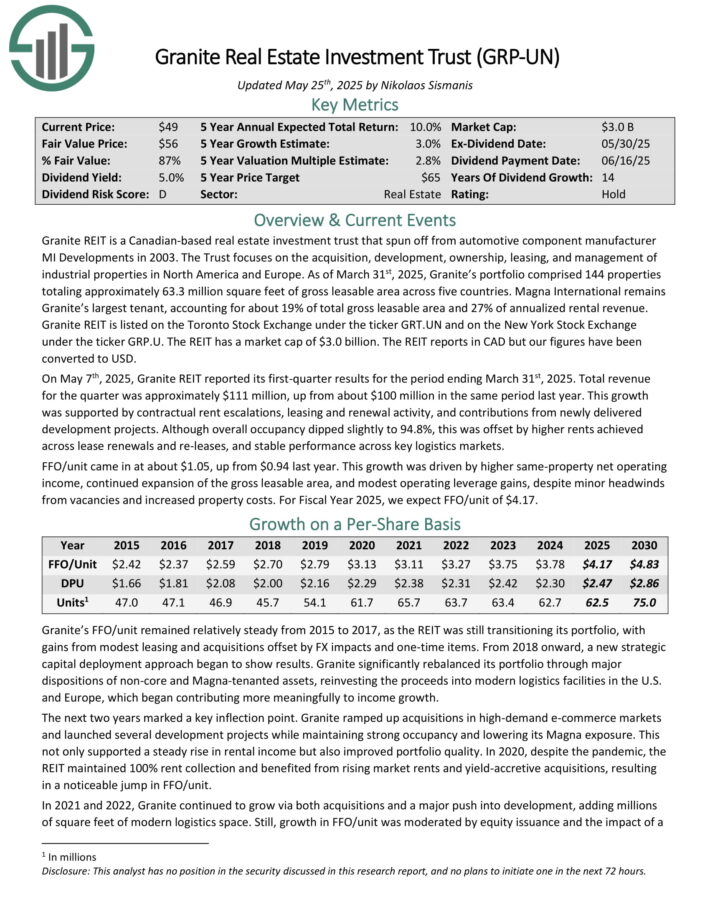

Safest Monthly Dividend Stock #7: Granite Real Estate Investment Trust (GRP.U)

Granite REIT is a Canadian-based real estate investment trust that spun off from automotive component manufacturer MI Developments in 2003.

The Trust focuses on the acquisition, development, ownership, leasing, and management of industrial properties in North America and Europe.

As of March 31st, 2025, Granite’s portfolio comprised 144 properties totaling approximately 63.3 million square feet of gross leasable area across five countries.

Magna International remains Granite’s largest tenant, accounting for about 19% of total gross leasable area and 27% of annualized rental revenue. The REIT reports in CAD but our figures have been converted to USD.

On May 7th, 2025, Granite REIT reported its first-quarter results for the period ending March 31st, 2025. Total revenue for the quarter was approximately $111 million, up from about $100 million in the same period last year.

This growth was supported by contractual rent escalations, leasing and renewal activity, and contributions from newly delivered development projects.

Although overall occupancy dipped slightly to 94.8%, this was offset by higher rents achieved across lease renewals and re-leases, and stable performance across key logistics markets.

FFO/unit came in at about $1.05, up from $0.94 last year. This growth was driven by higher same-property net operating income, continued expansion of the gross leasable area, and modest operating leverage gains, despite minor headwinds from vacancies and increased property costs.

Click here to download our most recent Sure Analysis report on GRP.UN (preview of page 1 of 3 shown below):

Monthly Dividend Stock #6: Savaria Corporation (SISXF)

Savaria Corporation, founded in 1979, is a leading provider of mobility solutions, specializing in accessibility products such as stairlifts, home and commercial elevators, platform lifts, and medical beds.

Headquartered in Canada, Savaria serves a growing market of elderly and physically challenged individuals. The company has expanded significantly over the years, both organically and through acquisitions, positioning itself as a key player in the accessibility market.

It reports its financials in CAD. All figures in this report have been converted to USD unless otherwise noted. The stock trades at a market cap of $1.00 billion.

On May 7th, 2025, Savaria reported its Q1 results for the period ending March 31st, 2025. Revenues increased by 5.2% to $158.57 million. This growth was driven by organic revenue growth of 0.8% and a 3.3% positive impact from foreign exchange fluctuations, with the acquisition of Matot contributing positively.

Gross profit was $59.94 million, a 10.4% increase year-over-year, resulting in a gross margin of 37.8%. Operating income rose by 19.8% to $15.29 million, while Adjusted EBITDA grew 17.2% to $29.27 million USD, with a margin of 18.5%.

Net income was $8.99 million, or $0.12 per share, compared to $8.37 million, or $0.12 per share, in Q1 2024. For the year, IFRS EPS was $0.69.

Click here to download our most recent Sure Analysis report on SISXF (preview of page 1 of 3 shown below):

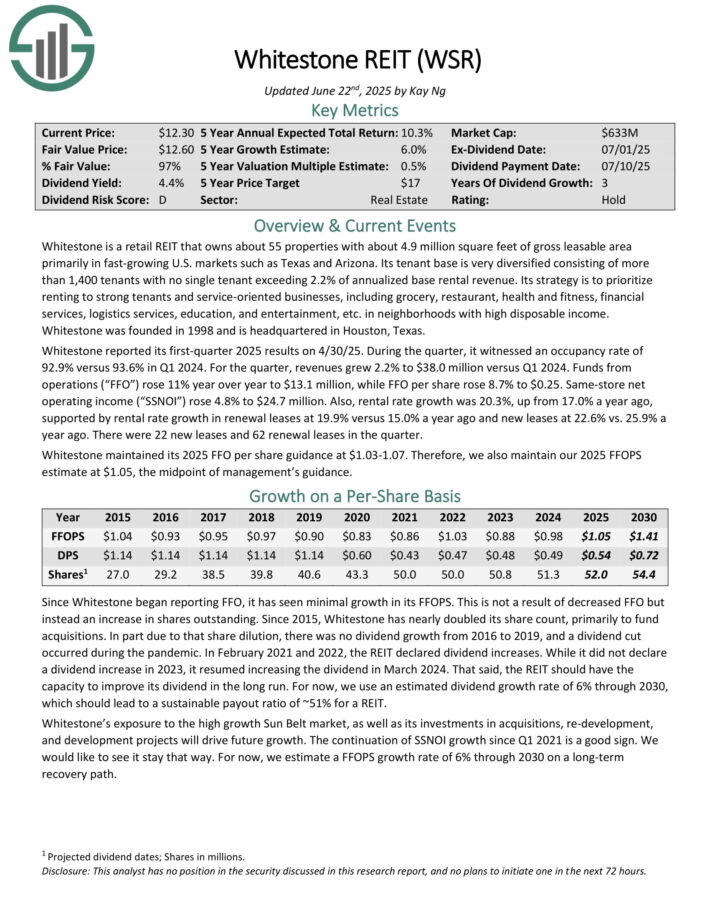

Safest Monthly Dividend Stock #5: Whitestone REIT (WSR)

Whitestone is a retail REIT that owns about 55 properties with about 4.9 million square feet of gross leasable area primarily in fast-growing U.S. markets such as Texas and Arizona.

Its tenant base is very diversified consisting of more than 1,400 tenants with no single tenant exceeding 2.2% of annualized base rental revenue.

Its strategy is to prioritize renting to strong tenants and service-oriented businesses, including grocery, restaurant, health and fitness, financial services, logistics services, education, and entertainment, etc. in neighborhoods with high disposable income.

Whitestone reported its first-quarter 2025 results on 4/30/25. During the quarter, it witnessed an occupancy rate of 92.9% versus 93.6% in Q1 2024. For the quarter, revenues grew 2.2% to $38.0 million versus Q1 2024. Funds from operations (“FFO”) rose 11% year over year to $13.1 million, while FFO per share rose 8.7% to $0.25.

Same-store net operating income (“SSNOI”) rose 4.8% to $24.7 million. Also, rental rate growth was 20.3%, up from 17.0% a year ago, supported by rental rate growth in renewal leases at 19.9% versus 15.0% a year ago and new leases at 22.6% vs. 25.9% a year ago. There were 22 new leases and 62 renewal leases in the quarter.

Whitestone maintained its 2025 FFO per share guidance at $1.03-1.07.

Click here to download our most recent Sure Analysis report on WSR (preview of page 1 of 3 shown below):

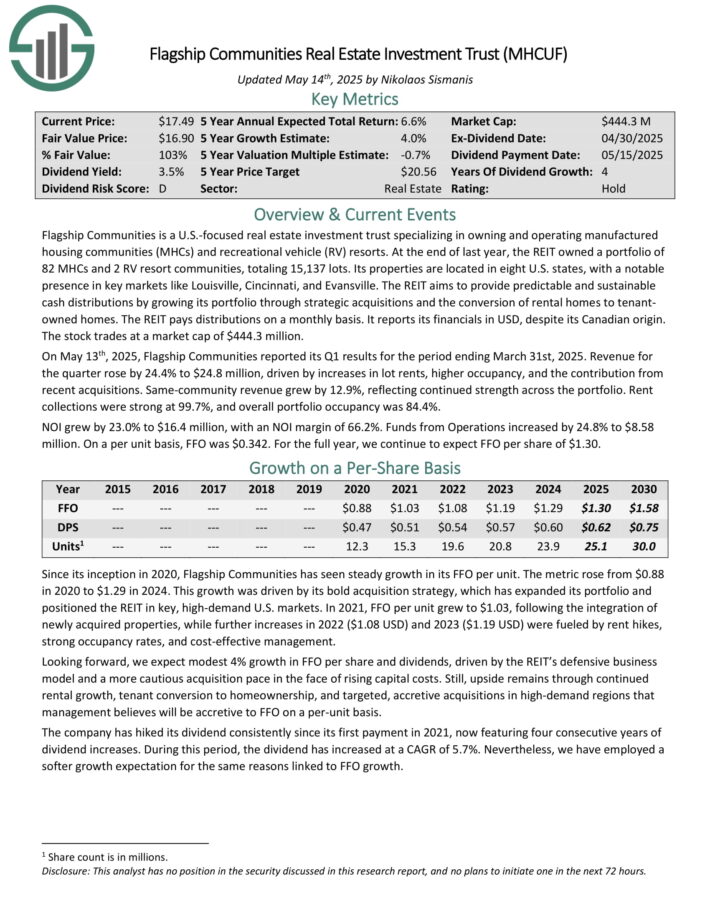

Safest Monthly Dividend Stock #4: Flagship Communities Real Estate (MHCUF)

Flagship Communities is a U.S.-focused real estate investment trust specializing in owning and operating manufactured housing communities (MHCs) and recreational vehicle (RV) resorts.

At the end of last year, the REIT owned a portfolio of 82 MHCs and 2 RV resort communities, totaling 15,137 lots. Its properties are located in eight U.S. states, with a notable presence in key markets like Louisville, Cincinnati, and Evansville.

It reports its financials in USD, despite its Canadian origin. On May 13th, 2025, Flagship Communities reported its Q1 results for the period ending March 31st, 2025.

Revenue for the quarter rose by 24.4% to $24.8 million, driven by increases in lot rents, higher occupancy, and the contribution from recent acquisitions. Same-community revenue grew by 12.9%, reflecting continued strength across the portfolio. Rent collections were strong at 99.7%, and overall portfolio occupancy was 84.4%.

NOI grew by 23.0% to $16.4 million, with an NOI margin of 66.2%. Funds from Operations increased by 24.8% to $8.58 million. On a per unit basis, FFO was $0.342.

Click here to download our most recent Sure Analysis report on MHCUF (preview of page 1 of 3 shown below):

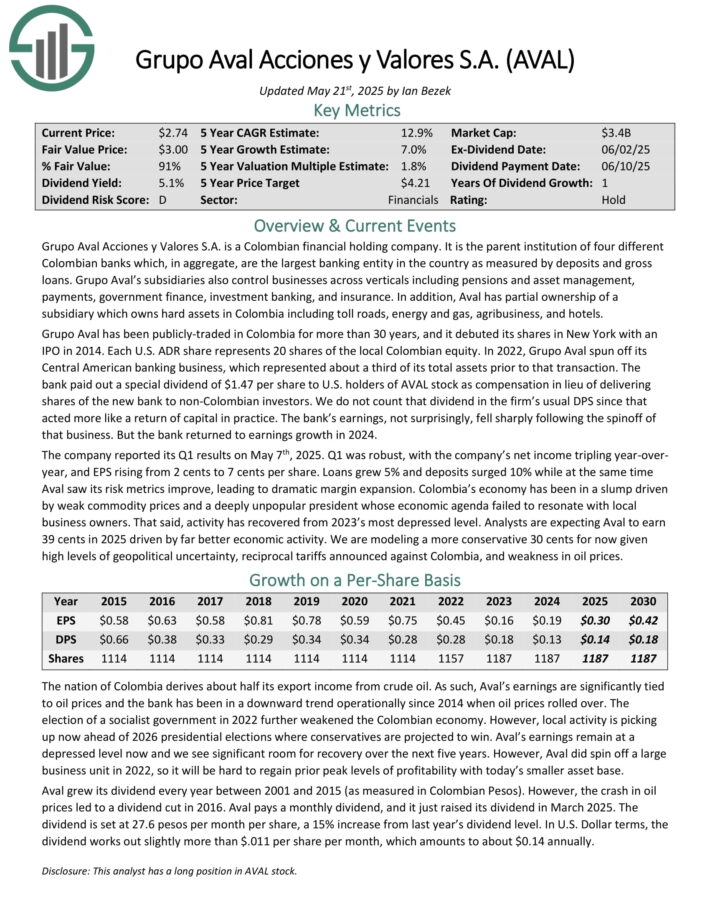

Safest Monthly Dividend Stock #3: Grupo Aval Acciones y Valores S.A. (AVAL)

Grupo Aval Acciones y Valores S.A. is a Colombian financial holding company. It is the parent institution of four different Colombian banks which, in aggregate, are the largest banking entity in the country as measured by deposits and gross loans.

Grupo Aval’s subsidiaries also control businesses across verticals including pensions and asset management, payments, government finance, investment banking, and insurance.

In addition, Aval has partial ownership of a subsidiary which owns hard assets in Colombia including toll roads, energy and gas, agribusiness, and hotels.

The company reported its Q1 results on May 7th, 2025. Q1 was robust, with the company’s net income tripling year-over-year, and EPS rising from 2 cents to 7 cents per share.

Loans grew 5% and deposits surged 10% while at the same time Aval saw its risk metrics improve, leading to dramatic margin expansion. Analysts are expecting Aval to earn 39 cents in 2025 driven by far better economic activity.

Click here to download our most recent Sure Analysis report on AVAL (preview of page 1 of 3 shown below):

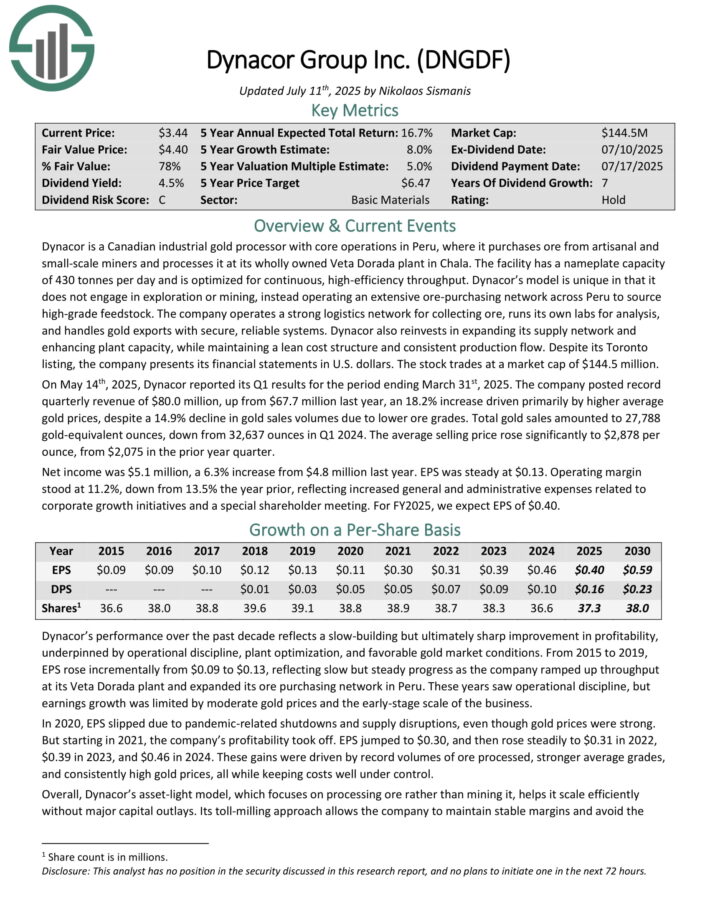

Safest Monthly Dividend Stock #2: Dynacor Group (DNGDF)

Dynacor is a Canadian industrial gold processor with core operations in Peru, where it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The facility has a nameplate capacity of 430 tonnes per day and is optimized for continuous, high-efficiency throughput.

Dynacor’s model is unique in that it does not engage in exploration or mining, instead operating an extensive ore purchasing network across Peru to source high-grade feedstock.

The company operates a strong logistics network for collecting ore, runs its own labs for analysis, and handles gold exports with secure, reliable systems.

Dynacor also reinvests in expanding its supply network and enhancing plant capacity, while maintaining a lean cost structure and consistent production flow. Despite its Toronto listing, the company presents its financial statements in U.S. dollars.

On May 14th, 2025, Dynacor reported its Q1 results for the period ending March 31st, 2025. The company posted record quarterly revenue of $80.0 million, up from $67.7 million last year, an 18.2% increase driven primarily by higher average gold prices, despite a 14.9% decline in gold sales volumes due to lower ore grades.

Total gold sales amounted to 27,788 gold-equivalent ounces, down from 32,637 ounces in Q1 2024. The average selling price rose significantly to $2,878 per ounce, from $2,075 in the prior year quarter.

Click here to download our most recent Sure Analysis report on DNGDF (preview of page 1 of 3 shown below):

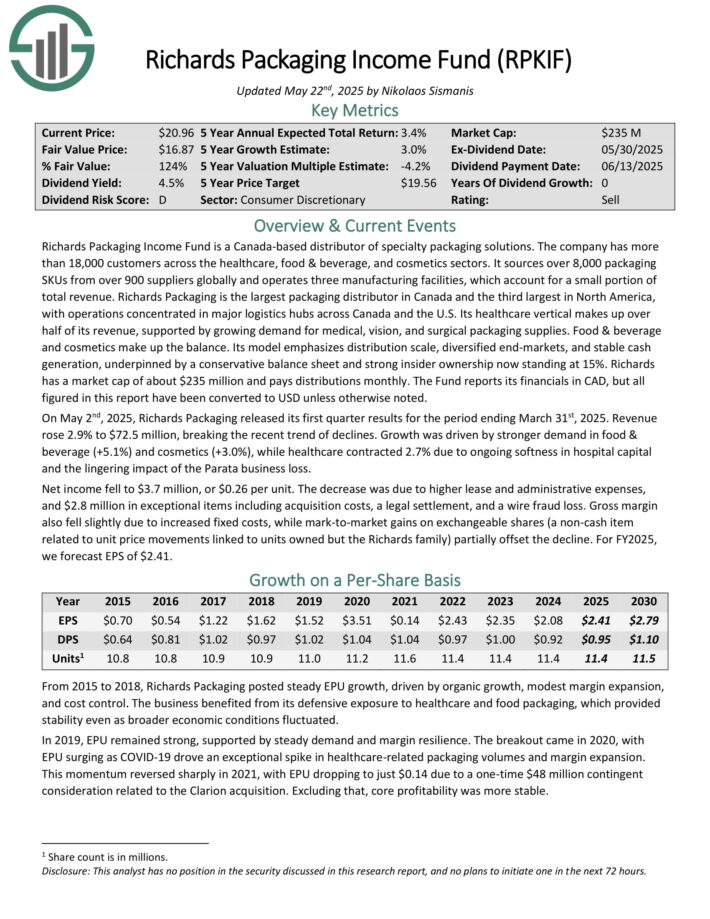

Safest Monthly Dividend Stock #1: Richards Packaging Income Fund (RPKIF)

Richards Packaging Income Fund is a Canada-based distributor of specialty packaging solutions. The company has more than 18,000 customers across the healthcare, food & beverage, and cosmetics sectors.

It sources over 8,000 packaging SKUs from over 900 suppliers globally and operates three manufacturing facilities, which account for a small portion of total revenue.

Richards Packaging is the largest packaging distributor in Canada and the third largest in North America, with operations concentrated in major logistics hubs across Canada and the U.S.

Its healthcare vertical makes up over half of its revenue, supported by growing demand for medical, vision, and surgical packaging supplies. Food & beverage and cosmetics make up the balance.

Its model emphasizes distribution scale, diversified end-markets, and stable cash generation, underpinned by a conservative balance sheet and strong insider ownership now standing at 15%.

The Fund reports its financials in CAD, but all figured in this report have been converted to USD unless otherwise noted.

On May 2nd, 2025, Richards Packaging released its first quarter results for the period ending March 31st, 2025. Revenue rose 2.9% to $72.5 million, breaking the recent trend of declines.

Growth was driven by stronger demand in food & beverage (+5.1%) and cosmetics (+3.0%), while healthcare contracted 2.7% due to ongoing softness in hospital capital and the lingering impact of the Parata business loss.

Click here to download our most recent Sure Analysis report on RPKIF (preview of page 1 of 3 shown below):

Final Thoughts

Monthly dividend stocks can be an attractive option for investors seeking a steady source of income throughout the year.

While no investment comes without risk, some monthly dividend stocks have demonstrated a history of financial stability, consistent earnings, and reliable dividend payments.

Our list of the 10 safest monthly dividend stocks includes companies from a variety of industries that rank highly based on their payout ratios and high yields.

Nevertheless, there are numerous other monthly dividend stocks available, each with its unique risk factors. Monthly dividend stocks carry elevated risks, so investors should be sure to conduct thorough research before buying.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].