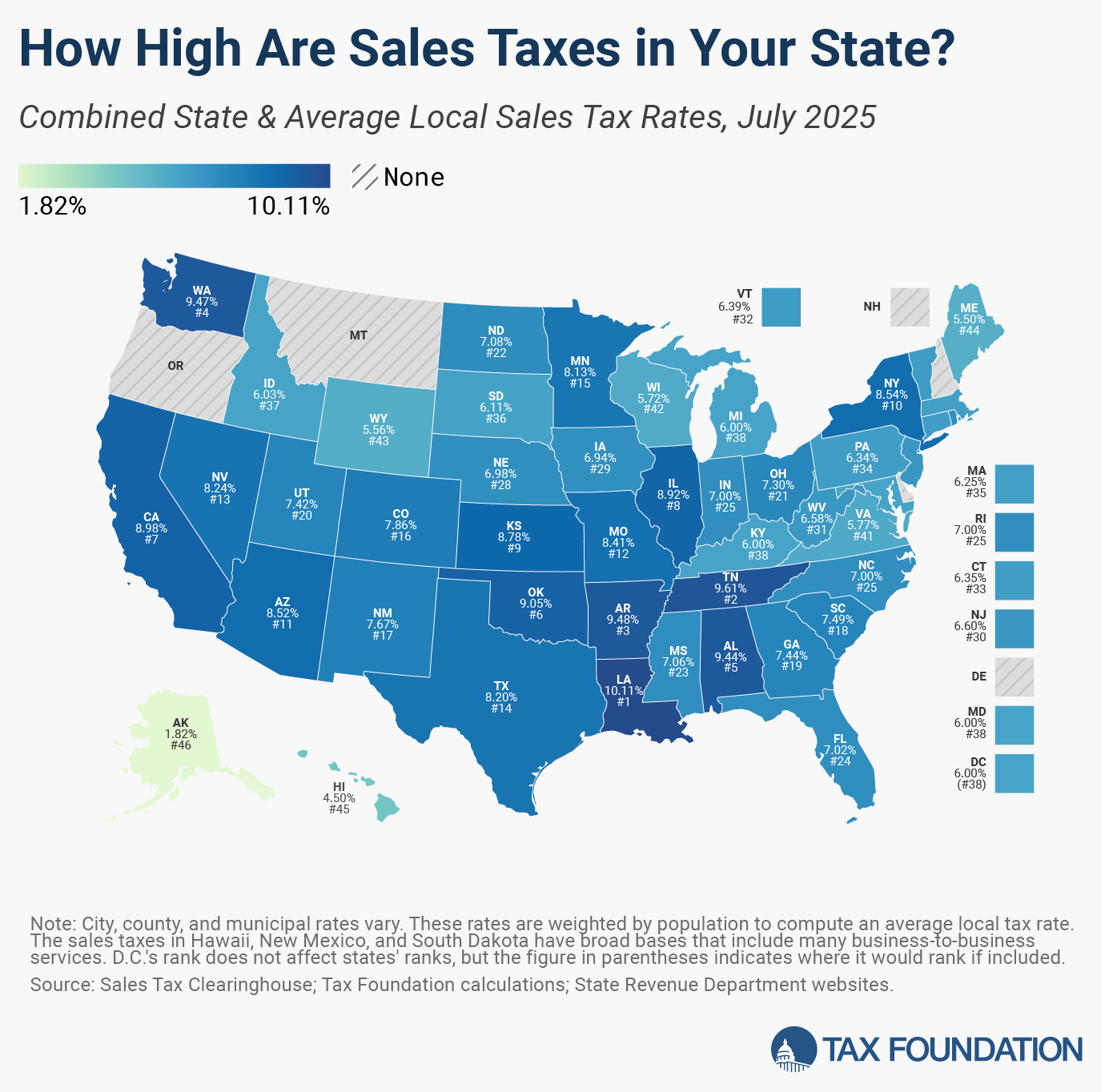

State Sales Tax Rates

Five states forego statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Of these, only Alaska allows localities to impose local sales taxes.

California has the highest state-level sales tax rate, at 7.25 percent.[1] Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee. The lowest non-zero state-level sales tax is in Colorado, which has a rate of 2.9 percent. Five states follow with 4 percent rates: Alabama, Georgia, Hawaii, New York, and Wyoming.[2]

Louisiana is the most recent state to raise its sales tax rate. The state rate increased from 4.45 to 5.0 percent in January, reversing a prior reduction implemented in July 2018. This rate increase was part of a broader tax reform package that yielded a 3 percent flat individual income tax, a 5.5 percent corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

, full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

, and franchise tax repeal.

Prior to that, South Dakota cut its state sales tax rate in 2023, a reduction set to expire after 2026, and New Mexico lowered the rate of its state-level sales tax—a hybrid tax the state refers to as its gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding.

—from 5.125 percent to 5 percent in July 2022. Notably, if the revenue from the gross receipts tax in any single fiscal year from 2026 to 2029 is less than 95 percent of the previous year’s revenue, then the state’s rate will return to 5.125 percent on the following July 1.

Before that, the most recent statewide rate reduction was Louisiana’s now-reversed cut in July 2018. Sales tax rate reductions have been relatively rare in recent years, as state lawmakers have instead prioritized income tax cuts, which yield more economic benefit, reducing individual or corporate income tax rates (or both) in 28 states since 2021. The continued erosion of sales tax bases has also been a factor.

Local Sales Tax Rates

The five states with the highest average local sales tax rates are Alabama (5.44 percent), Louisiana (5.11 percent), Colorado (4.96 percent), Oklahoma (4.55 percent), and New York (4.54 percent).

The first half of 2025 represents an unusually busy period for local sales tax rate changes, with many localities across the country raising rates and only a few lowering them or allowing higher rates to sunset. These increases were largest on net in California, Wyoming, Arizona, Utah, Florida, Ohio, and Tennessee.

In California, a countywide 0.25 percent increase in Los Angeles’s sales tax, intended to address homelessness and fund affordable housing initiatives, helped drive the average local rate upward, with Butte (1 percent), Humboldt (0.5 percent), and Sonoma (0.25 percent) also raising county rates, while Mariposa County’s rate declined by 0.5 percent. Many cities also raised rates, with Fontana, Moreno Valley, Escondido, Clovis, San Marcos, San Ramon, Buena Park, Napa, Apple Valley, Davis, and others raising rates by 1 percentage point. Most changes took effect April 1, though a few increases were effective July 1.

Illinois similarly had rate increases across a wide range of jurisdictions, although generally much smaller ones. Two counties and 48 other municipal governments increased rates since January 1, with McLean County (1 percent increase) the largest population jurisdiction to do so. Other notable increases include 1 percent in the city of Rock Island, 0.75 percent in the village of Bartlett, and 0.5 percent in Whiteside County.

Washington likewise saw a raft of local tax increases. Among the most significant were a 0.1 percent increase in Spokane’s sales tax for public safety and a 0.2 percent increase in Vancouver for cultural access programs. Sales tax rates increased countywide in Lewis and Kittitas (both 0.2 percent) as well, and in many other jurisdictions, often for transportation benefit districts.

An unusual situation in Florida has been wound down. Previously, two Hillsborough County discretionary sales surtaxes totaling 1 percent had been temporarily suspended to offset collections under a Hillsborough transportation surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services.

that was collected for three years before being struck down as unconstitutional in 2021. Revenues from the unconstitutional surtax were intended to be used as temporary replacement funding sources for the suspended surtaxes. That process came to a close on May 31, after which the county’s 1 percent higher rate was restored.

Other states saw fewer rate changes, though some were significant. In Arizona, Phoenix’s sales tax rate increased by 0.5 percent on July 1. Tennessee’s Davidson County, home of Nashville, also saw a 0.5 percent tax increase, bringing Nashville’s rate to 9.75 percent as of February 1. North Dakota saw sales tax increases in Bismarck (1.5 to 2 percent), Fargo (2 to 2.25 percent), and Hillsboro (2.5 to 3 percent). Seven small jurisdictions in New Mexico raised rates, the largest of which were Las Cruces (a 0.325 percentage point increase) and Roswell (0.375 percent). The Central Ohio Transit Authority imposed a 0.5 percent sales tax rate increase for Franklin County, Ohio, along with the portions of four other counties that fall within the transit district.

In Oklahoma, Cotton and Tillman counties raised rates from 2 to 3 percent, while Muskogee County’s rate rose from 0.65 to 1.499 percent. Utah’s Cache and Servier counties exercised the authority to impose an additional 0.3 percent sales tax to fund transportation, while Hatch County implemented a 1.1 percent resort community tax, and Huntsville, Mapleton, and Saratoga Springs all adopted their own sales tax increases. And in Wyoming, reduced rates in Crook and Fremont counties were offset by 1 percent increases in Teton County and in the city of Casper, which adopted its increase on a temporary basis.

Some cities in New Jersey are in “Urban Enterprise Zones,” where qualifying sellers may collect and remit at half the 6.625 percent statewide sales tax rate (3.3125 percent), a policy designed to help local retailers compete with neighboring Delaware, which forgoes a sales tax. We represent this anomaly as a negative 0.03 percent statewide average local rate (adjusting for population as described in the methodology section below), and the combined rate reflects this subtraction. Despite the slightly favorable impact on the overall rate, this lower rate represents an implicit acknowledgment by New Jersey officials that their 6.625 percent statewide rate is uncompetitive with neighboring Delaware’s lack of a sales tax.

The Role of Competition in Setting Sales Tax Rates

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions’ rates. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs. For example, evidence suggests that Chicago-area consumers make major purchases in surrounding suburbs or online to avoid Chicago’s 10.25 percent sales tax rate.

At the statewide level, businesses sometimes locate just outside the borders of high sales-tax areas to avoid being subjected to their rates. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant. At one time, Delaware actually used its highway welcome sign to remind motorists that Delaware is the “Home of Tax-Free Shopping.”

State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate.

Sales Tax Bases: The Other Half of the Equation

Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

This report ranks states based on tax rates and does not account for differences in tax bases (e.g., the structure of sales taxes, defining what is taxable and nontaxable). States can vary greatly in this regard. For instance, most states exempt groceries from the sales tax, others tax groceries at a limited rate, and still others tax groceries at the same rate as all other products. Some states exempt clothing or tax it at a reduced rate.

Tax experts generally recommend that sales taxes apply to all final retail sales of goods and services but not intermediate business-to-business transactions in the production chain. These recommendations would result in a tax system that is not only broad-based but also “right-sized,” applying once and only once to each product the market produces. Despite agreement in theory, the application of most state sales taxes is far from this ideal, and occasionally gets worse. Ideally, states would modernize their sales tax regimes to better align with personal consumption in a changing economy.

Hawaii has the broadest sales tax in the United States, but it taxes many products multiple times and, by one estimate, ultimately taxes 119 percent of the state’s personal income. This base is far wider than the national median, where the sales tax applies to 36 percent of personal income.

Methodology

Sales Tax Clearinghouse publishes quarterly sales tax data at the state, county, and city levels by ZIP code. We weight these numbers according to the most recent Census population figures to give a sense of the prevalence of sales tax rates in a particular state. This is a change from previous editions, where we used figures available every decade. While changes due to the new weighting were mostly trivial, we show changes in rank based on January 1 figures recalculated under the new population weighting. Due to the updated population weighting, this report is not strictly comparable to previously published editions, though differences amount to minor rounding errors.

It should also be noted that while the Census Bureau reports population data using a five-digit identifier that looks much like a ZIP code, this is actually a ZIP Code Tabulation Area (ZCTA), which attempts to create a geographical area associated with a given ZIP code. This is done because a surprisingly large number of ZIP codes do not actually have any residents. For example, the National Press Building in Washington, DC, has its own ZIP code solely for postal reasons.

For our purposes, ZIP codes that do not have a corresponding ZCTA population figure are omitted from calculations. These omissions result in some amount of inexactitude but overall do not have a significant effect on resultant averages because proximate ZIP code areas that do have ZCTA population numbers capture the tax rate of those jurisdictions.

Stay informed.

Get the latest tax data, news and analysis.

Subscribe

[1] This number includes mandatory add-on taxes that are collected by the state but distributed to local governments. Because of this, some sources will describe California’s sales tax as 6.0 percent. A similar situation exists in Utah and Virginia.

[2] The sales taxes in Hawaii, New Mexico, and South Dakota have bases that include many business services, so they are not strictly comparable to other sales taxes.