As the second half of the year begins, several bullish setups are emerging—each supported by seasonal patterns and historical data.

is approaching multi-year highs following a strong June, while technical signals in the broader market and semiconductor sector point to continued momentum. Meanwhile, recent policy developments may have longer-term implications for retail investor participation.

In this article, we’ll explore three setups worth watching in July—and the factors that could support their strength in the weeks ahead.

1. Silver Set for July Bull Run?

Silver had a fantastic month in June, rising almost 10%—outpacing Wall Street—and is now approaching 13-year highs. There are two main reasons for this:

While not to the same extent as , silver also has safe-haven characteristics.

It has been undervalued for months, as reflected by the gold/silver ratio, which indicates how many ounces of silver are needed to buy one ounce of gold. To calculate it, simply divide the price of gold by the price of silver. When the ratio rises, it means silver is becoming cheaper relative to gold.

Demand is also rising due to its use in solar panels and its essential role in the semiconductor industry, especially as artificial intelligence continues to boom.

Demand is also rising due to its use in solar panels and its essential role in the semiconductor industry, especially as artificial intelligence continues to boom.

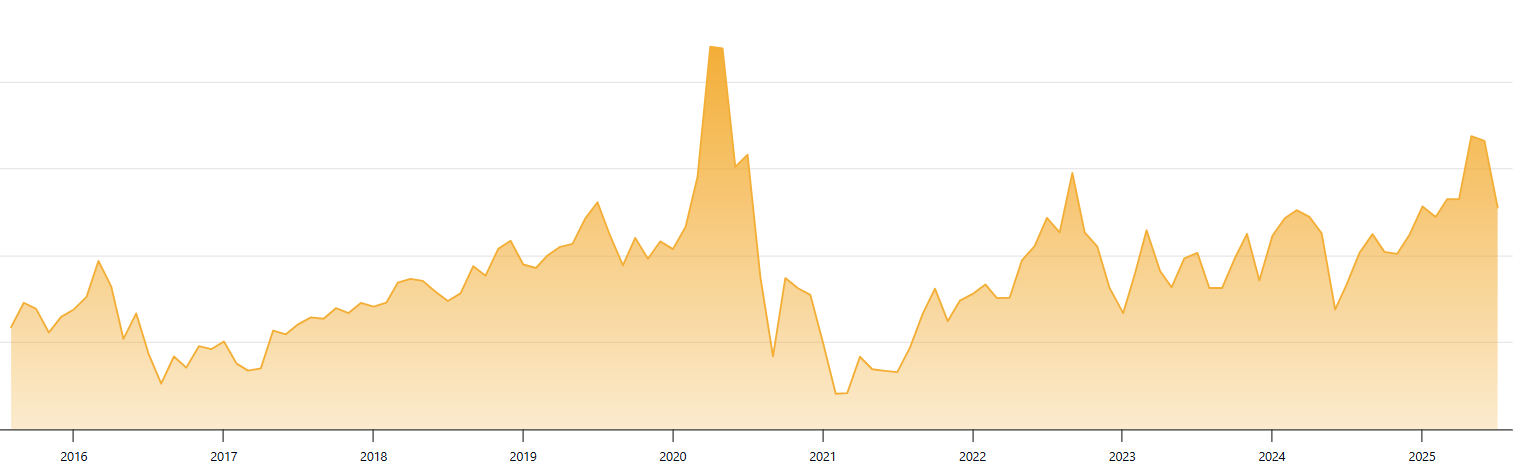

Interestingly, if we look at the last 10 years of the most well-known ETF tracking the physical price of silver—the iShares Silver Trust (NYSE:), which manages $17 billion—July emerges as the strongest month, with an average gain of 4.5%, ahead of the second-best month, December, which averages 2.7%.

This brings to mind a long-standing seasonal pattern: silver tends to rise from the end of one year through the first month and a half of the next. This pattern has been observed for over half a century—specifically, over the last 52–53 years. The timeframe in question spans from mid-December (specifically December 16) to mid-February (around February 20–21). Over this period, since 1968, silver has averaged a +7.20% gain between December 16 and February 20–21.

Why? According to Seasonax, the explanation lies in industrial demand—orders for silver are typically placed during this time, causing demand (and thus prices) to spike.

2. Golden Cross in S&P 500, Semiconductors Signals July Gains

Last week, the S&P 500 triggered the well-known bullish signal called the “golden cross” or “golden crossover,” which occurs when the 50-day moving average crosses above the 200-day moving average.

Traditional technical analysis sees this as a buy signal. However, more accurately, it’s a confirmation that the current uptrend remains in place and is likely to continue. In other words, it signals strength in the ongoing bullish trend.

Traditional technical analysis sees this as a buy signal. However, more accurately, it’s a confirmation that the current uptrend remains in place and is likely to continue. In other words, it signals strength in the ongoing bullish trend.

It’s been more than two years since the S&P 500 last triggered this pattern—the previous occurrence was on February 2, 2023. Since then, the index has gained 49%.

Looking at history, over the past 97 years, the S&P 500 has risen an average of just over 10% in the year following a golden crossover. Focusing only on the last 20 golden crossovers, the average return is even higher—around 13%.

A similar crossover has also been triggered in the semiconductor sector index. The last time it occurred was in January 2023, and it resulted in a 140% gain over the following year and a half.

A similar crossover has also been triggered in the semiconductor sector index. The last time it occurred was in January 2023, and it resulted in a 140% gain over the following year and a half.

3. Trump’s “One Big Beautiful Bill” Could Benefit Robinhood

Trump’s “One Big Beautiful Bill,” which passed the Senate last week, could prove both interesting and beneficial for Robinhood Markets Inc (NASDAQ:) stock—perhaps even more so than if the company had been included in the (which it ultimately was not).

The bill proposes the creation of tax-deferred investment accounts for newborn American children, including a one-time government contribution of $1,000, with the option for additional private contributions of up to $5,000 per year.

The bill proposes the creation of tax-deferred investment accounts for newborn American children, including a one-time government contribution of $1,000, with the option for additional private contributions of up to $5,000 per year.

This initiative would give an entire generation the chance to experience the power of long-term stock market investing—mirroring the S&P 500—and the compounding magic of reinvested returns.

Robinhood currently has over 26 million customers aged 18 and older, and this measure could bring in many more. Considering that around 3.7 million babies are born in the U.S. each year—and each would arrive with $1,000 in a market-tracking account—the potential impact is substantial.

***

Subscribe now for up to 50% off amid the summer sale and instantly unlock access to several market-beating features, including:

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.