The politics surrounding taxes and the larger economy are revealing new opportunities in some municipal bonds and more reasons to sell others, according to a panel of experts.

Bonds connected to some universities and hospitals will likely see the biggest negative impact from the passage of the One Big Beautiful Bill Act’s package of higher taxes on college endowments and cuts to Medicaid spending. But the industry’s fear that the federal exemption for most interest income could be eliminated has proven unfounded, three portfolio managers noted in a discussion about municipal bonds at Morningstar’s conference in Chicago last week.

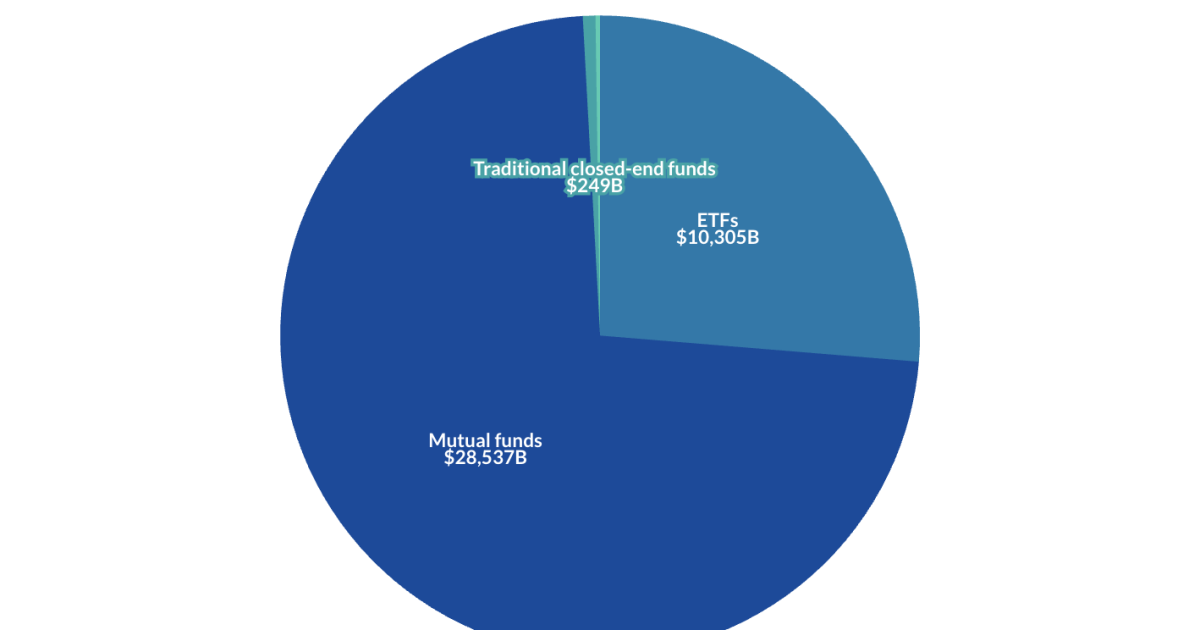

President Donald Trump’s trade wars may also affect municipal bonds, based on “the extent that it creates uncertainty and potentially weakens the economy,” said Courtney Wolf, a portfolio manager with Capital Group, the parent company of American Funds. However, municipal bonds include almost 21,000 individual securities across 17 different categories analyzed by Morningstar, with issuers ranging from small municipalities, colleges and hospitals to giant ones and durations and credit qualities of varying lengths and grades. So the politics could play out differently in each municipal bond, even as the sector of the investment universe remains a key source of diversification and tax savings at the federal, state and local levels for many investors.

“That’s the great thing about being active managers in the muni space is that you can get ahead of some of those things,” Wolf said. “At the end of the day, it really comes down to, are you getting paid to take that risk?”

So if investors deem barriers to one particular vehicle’s future credit and yields to be a “high probability event,” that presents them with “a real opportunity to sell that bond into the market and buy something that’s much more insulated,” she added.

READ MORE: Volatility breeds interest in fixed-income stability

Munis in general

Many investors wondering about their portfolios’ possibilities with municipal bonds pay close attention to the ratio of their yields compared to U.S. Treasury notes, the panel’s moderator, Elizabeth Foos, an associate director of fixed-income strategies with Morningstar Research Services, wrote in an analysis of the asset class last year.

That ratio typically “hovers near 80% to 90%, with anything over 100% suggesting that munis are a very good deal as they’re yielding more than a comparable U.S. Treasury,” she wrote. “While the choppy waters aren’t appealing to all investors, many municipal portfolio managers see the market volatility as an opportunity to uncover attractive valuations.”

That combination of possible volatility and tax advantages explains the appeal of municipal bonds in particular, and many of the top firms in asset management are focused on the general attraction of fixed-income products in the current environment. In a keynote at the conference, Vanguard CEO Salim Ramji specifically cited his excitement on investors’ behalf about bonds. The idea that, “if you need active management, you need to pay a higher fee to outperform” is a myth, based on the “empirical evidence just of the past decade” in bonds, Ramji said.

“Most investors, certainly most of our 50 million investors, what they probably need more of today is more fixed income. The rate environment is looking better. They’re entering retirement. There’s been a fantastic run-up in the past decades in U.S. equities, and so they need some balance in their portfolio, but they’re just paying too much for it,” he said. “Sure, there are things to do with private credit and other private asset classes, but if you look at what’s here and now, I think there’s an opportunity for investors to benefit now from better-quality, lower-cost, fixed income than exists in the marketplace as a whole.”

But municipal bond investment managers are looking much more closely at that asset class specifically and what will become of universities, hospitals and state and local governments if Trump and his Republican allies in Congress pass the giant tax and spending bill as soon as this week. Hospitals that provide care to a lot of patients through Medicaid spending are facing a lot of risks from the legislation, noted Curtis White, a portfolio manager with the Tax-Aware Fixed Income Group of JPMorgan Chase.

READ MORE: Tax Cuts and Jobs Act expiration: A guide for financial advisors

Hospitals and universities in focus

In that vein, bonds connected to universities may be ripe for a change to, for example, a “water and sewer bond with the same spread,” since new taxes on colleges’ endowments could affect their fixed-income issuances, White noted. That’s why the ramifications to both those parts of the municipal bond universe and state and local governments’ budgets based on “the federal policy changes that are coming through” represent important barometers, White said.

“It’s getting to a point where some of these state and local governments are going to have to start making tough decisions,” he said. “That’s just a high focus for our analyst team.”

Budgetary strains on state and local governments with the end of Covid-era federal reimbursement programs next year and the cuts to Medicaid under the legislation add up to a good time to sell many hospital municipal bond instruments, noted David Hammer, the head of municipal bond portfolio management for PIMCO.

That won’t be true, though, for all of the municipal bonds in the health care sector, and certainly not for the highest rated municipal fixed-income securities, he said.

“I think we’ve seen the worst of it in high-quality munis,” Hammer said. “The lowest-quality portions of the credit market are a very different story. … We’re likely to experience significant credit widening over the next year or two.”