While the potential for conflict poses substantial risks to global stability and markets, certain sectors historically tend to outperform.

The following five stocks could potentially see a boost in such a scenario.

Looking for more actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners and save 45%!

As tensions between the U.S., Iran, and Israel escalate, investors are bracing for potential market ripple effects. Historical data shows Middle East conflicts often trigger short-term pullbacks of roughly ~6%, though markets typically recover within weeks unless oil supplies are severely disrupted.

Source: Investing.com

While armed conflict inflicts devastating human and economic costs, certain industries historically capitalize on geopolitical instability. Based on market trends and insights from recent Israel-Iran tensions, here are five stocks that could see gains in the event of a US-Iran-Israel war, along with the factors driving their potential.

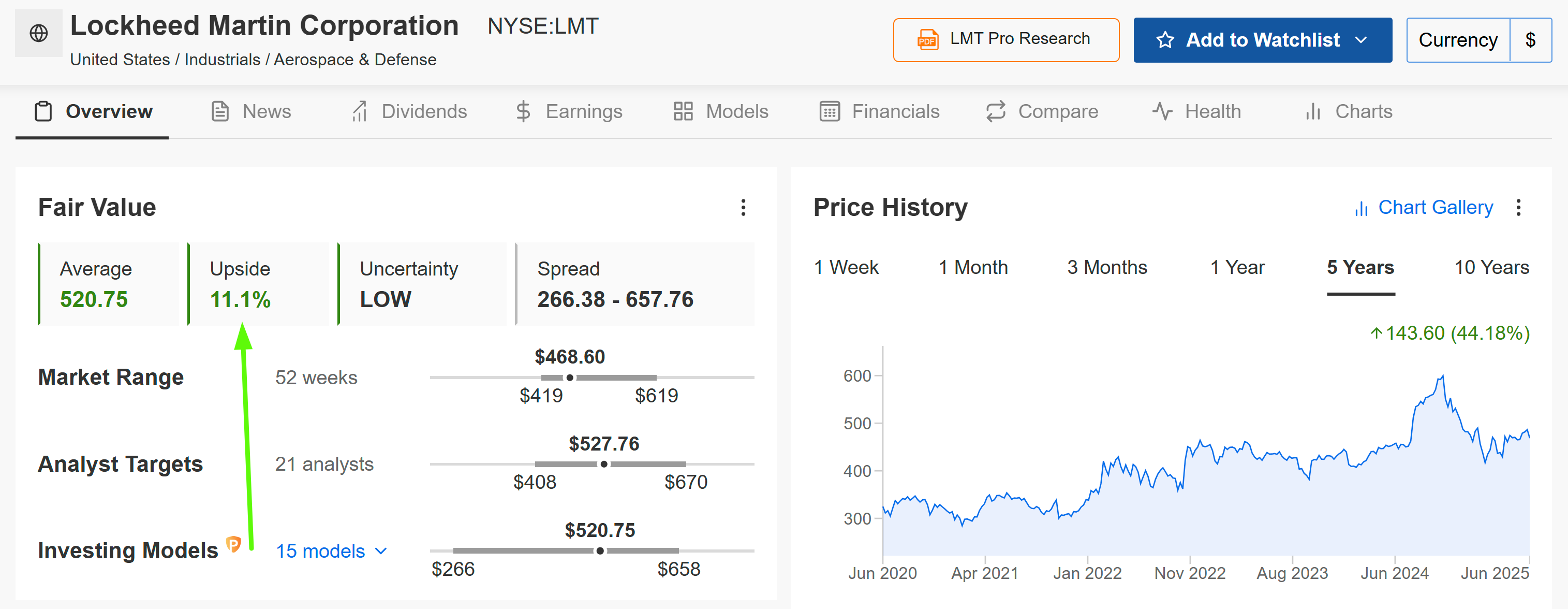

1. Lockheed Martin

Sector: Defense & Aerospace (Fighter Jets, Missile Defense Systems)

Catalyst: Surge in military demand for missiles, drones, and fighter jets.

Why It Benefits:

Israel relies heavily on US-made defense systems like Lockheed’s (NYSE:) THAAD missile interceptors to counter Iranian ballistic missiles as well as F-35 jets.

Pentagon spending could spike further amid broader regional instability.

Source: InvestingPro

It is worth noting that the InvestingPro Fair Value price target sits at $520.75, implying a potential +11.1% upside, with the high end of Wall Street estimates at around $528.

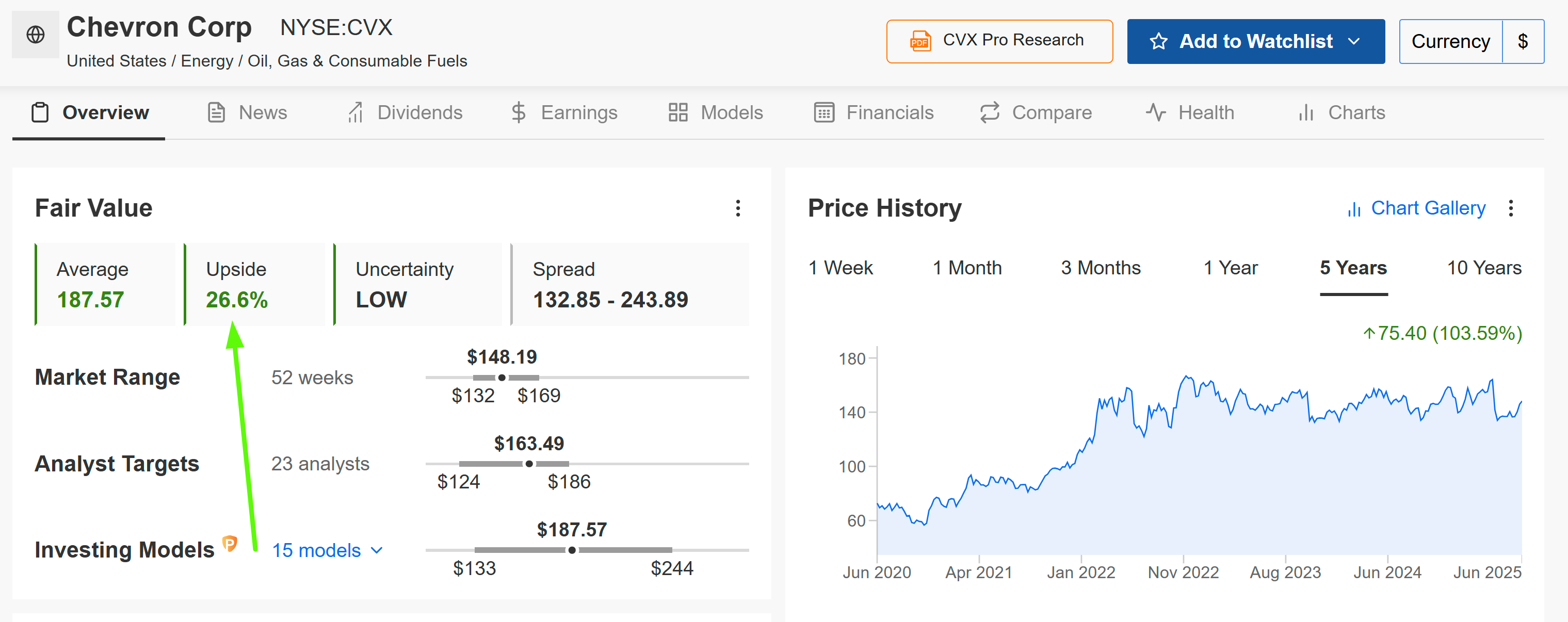

2. Chevron

Sector: Energy

Catalyst: Oil supply disruptions in the Strait of Hormuz.

Why It Benefits:

Iran has threatened to block the Strait, through which 20% of global oil passes. A US-Iran-Israel war threatening Middle East oil routes could push above $90-$100/barrel.

Chevron’s (NYSE:) diversified global operations (including Israel’s Leviathan gas field) would profit from higher oil and gas prices.

Source: InvestingPro

With a Fair Value of $187.57, CVX stock presents a sizable upside potential of +26.6% from its current price of $148.19.

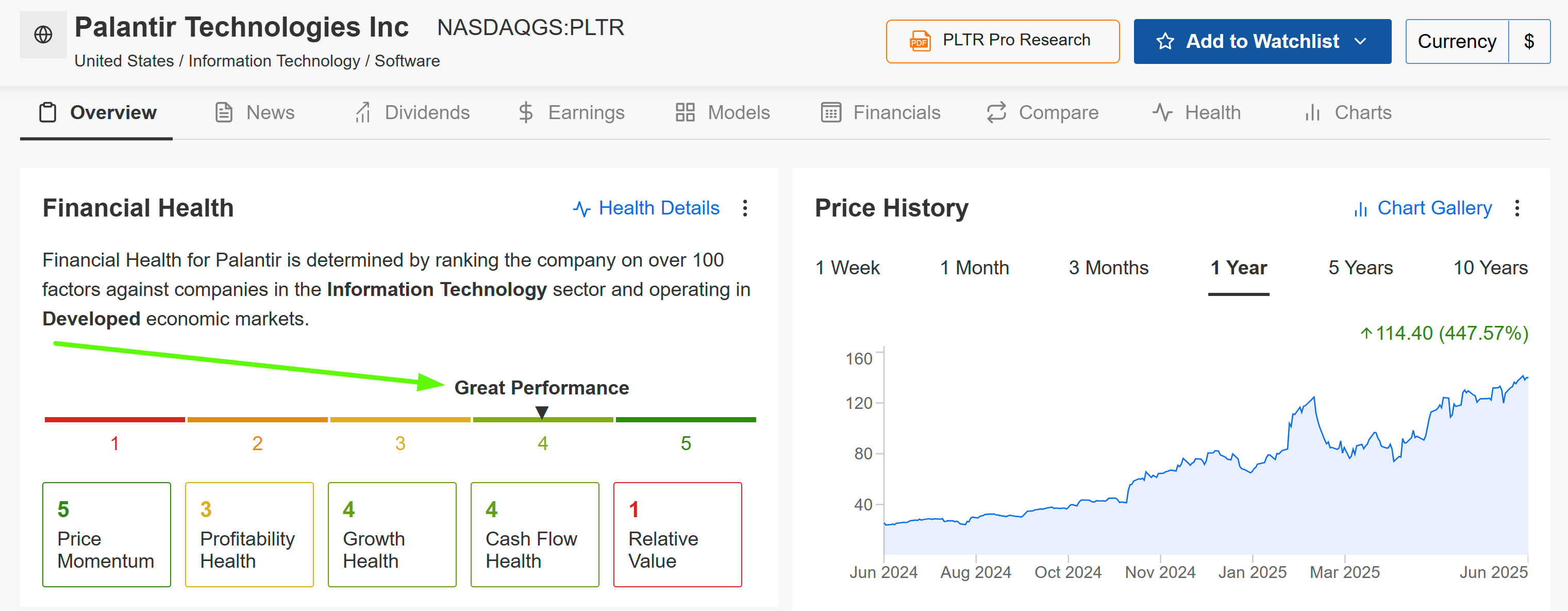

3. Palantir

Sector: Cybersecurity/Data Analytics

Catalyst: Demand for AI-driven defense and surveillance tools.

Why It Benefits:

Israeli and US agencies use Palantir’s (NASDAQ:) AI platforms for intelligence, targeting, and disaster response.

Recent $178M Pentagon contract highlights its role in modern warfare.

Source: InvestingPro

Palantir’s InvestingPro Financial Health score stands at a “GREAT” level—one of the highest possible tiers. This score reflects the company’s robust profit margins, strong cash position, and accelerating revenue growth.

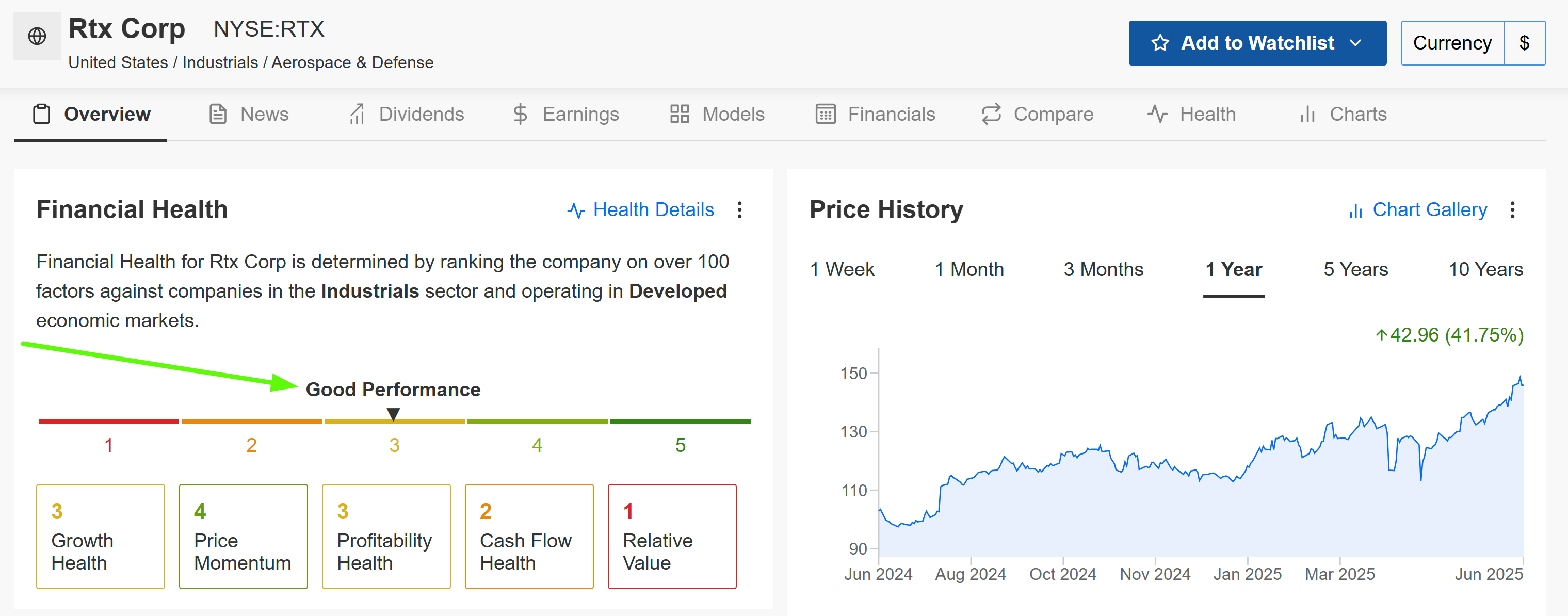

4. RTX

Sector: Defense & Aerospace (Missiles, Radar, Air Defense Systems)

Catalyst: Surge in demand for advanced missile defense systems and radar technology amid heightened aerial threats.

Why It Benefits:

Raytheon’s portfolio includes the Iron Dome system, co-developed with Israel, which has proven critical in defending against drones and ballistic missiles fired from Iran.

Rtx Corp’s (NYSE:) Tomahawk cruise missiles and AN/TPY-2 radar systems are critical for precision strikes and detecting threats like Iranian proxies’ rocket attacks.

Source: InvestingPro

RTX earns a “GOOD” InvestingPro Financial Health label, with a 2.54 score. The stock last closed at $145.87, sitting near its 52-week high—a testament to strong recent momentum.

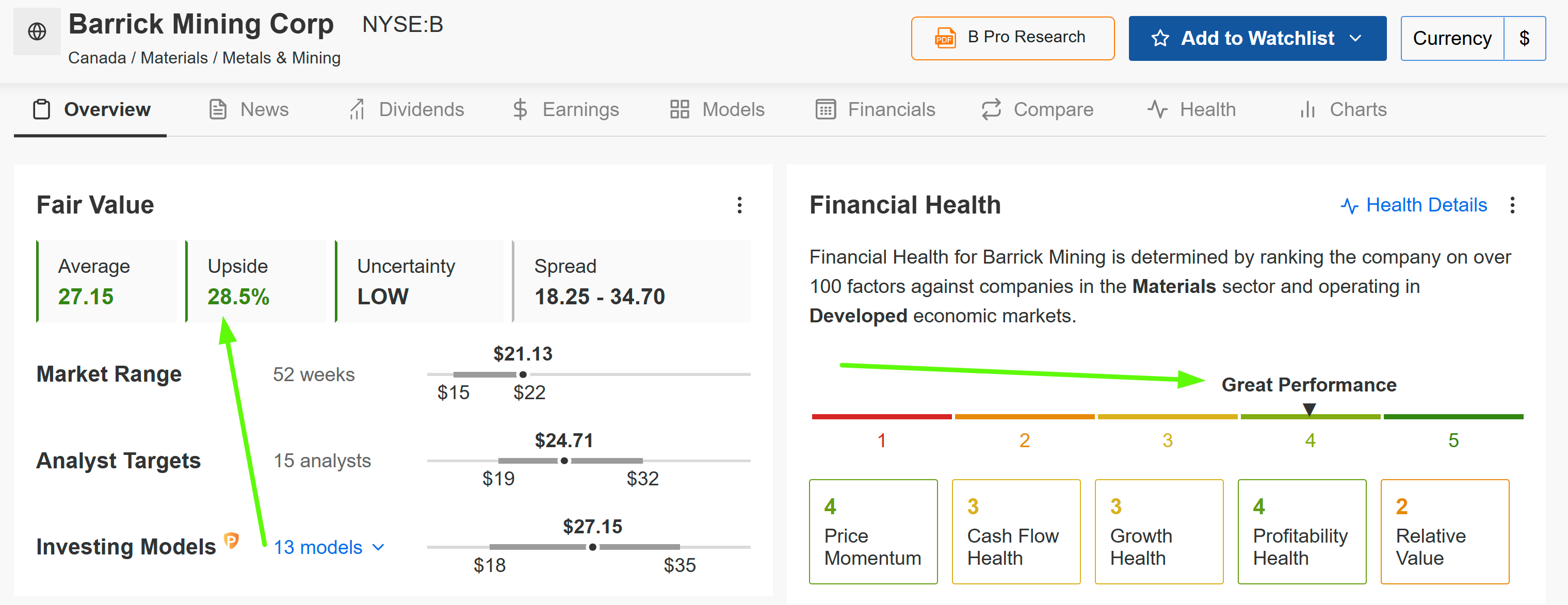

5. Barrick Mining

Sector: Precious Metals

Catalyst: Flight to safe-haven assets.

Why It Benefits:

Gold prices historically rise during geopolitical crises (e.g., +15% after the Russia-Ukraine war).

Barrick Mining (NYSE:), one of the world’s largest gold miners, offers direct exposure to price surges.

Source: InvestingPro

Barrick Mining stands out with a robust InvestingPro Financial Health score of 3.28 and a “GREAT” rating—well above the sector average. Its Fair Value price target of $27.15 implies +28.5% upside potential.

Conclusion

These five stocks highlight the diverse ways in which geopolitical events can shape investment opportunities, though investors should remain mindful of the broader risks and volatility that accompany such scenarios. As tensions in the Middle East unfold, keeping a close eye on these names could provide a strategic edge in navigating uncertain markets.

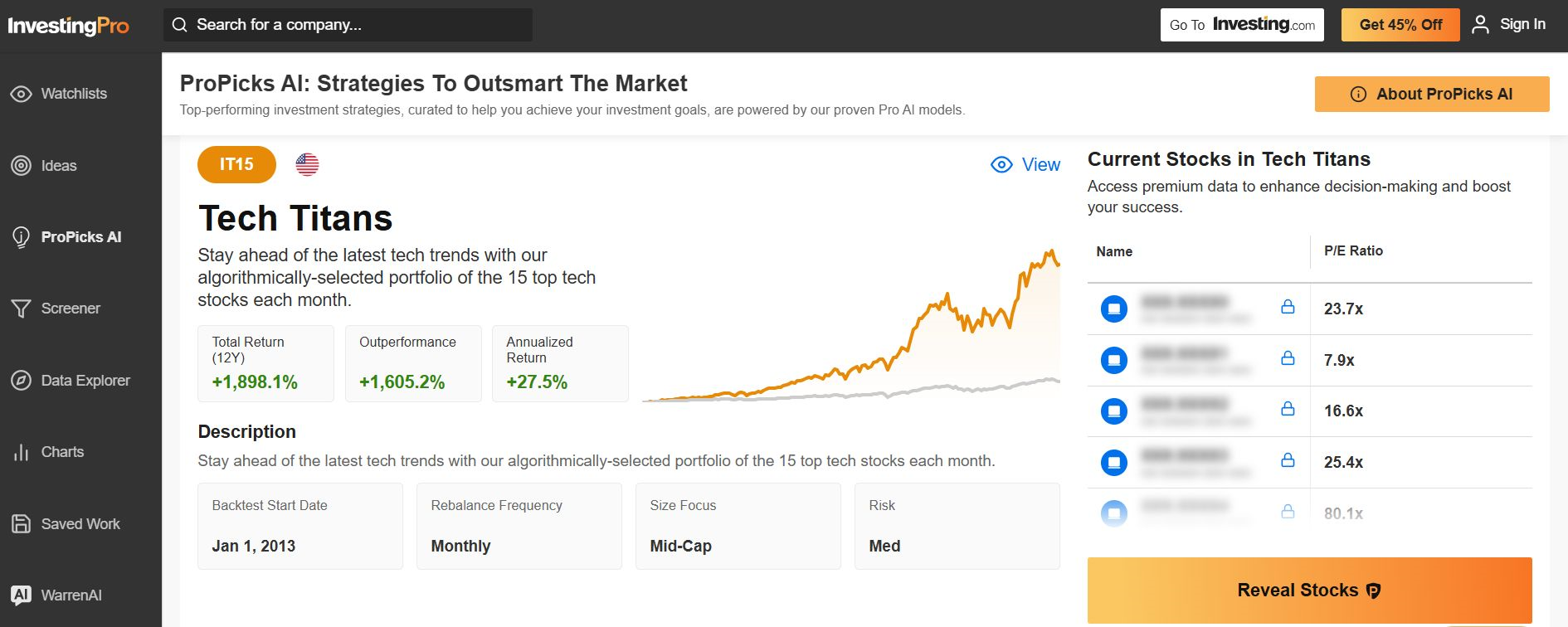

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for 45% off and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with a proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.