How advisory firms charge for financial advice has long been a central question in the profession. While many firms have historically relied on commission-based compensation methods – reflecting a sales-driven approach – financial advice has evolved with technological advancements and a greater focus on financial planning, with the Assets Under Management (AUM) fee emerging as the primary compensation model. Now, as financial advicers expand their services beyond traditional planning into more holistic, personalized advice, the very definition of financial advice continues to evolve. As a result, firms must continually reassess how they structure their fees to align with their growing range of services.

For firms evaluating pricing strategies, considering how others in the industry are adapting provides useful insights. Despite ongoing changes in the philosophy of financial advice, new Kitces Research on How Financial Advisors Actually Do Financial Planning finds that 86% of advisory firms still rely on AUM fees as their primary method of charging for advice. While this model remains widespread, firms have adopted different ways of structuring their AUM fees to align with their service models and client needs.

At the same time, AUM-based pricing is not without its criticisms. One common concern is that an advisor managing a $4M portfolio does not necessarily do twice the work of one managing a $2M portfolio, despite the fee being twice as high. However, most firms do not price their services in such a strictly proportional manner. Only firms using a flat fee structure, where a single rate applies to the entire portfolio regardless of size, use this kind of direct fee scaling. Instead, graduated and cliff pricing structures – which apply tiered or blended rates as assets grow – help balance costs across different client segments. These structures can also help advisors remain competitive on pricing, which may explain why 58% of firms use graduated fee structures, making them the most common pricing approach.

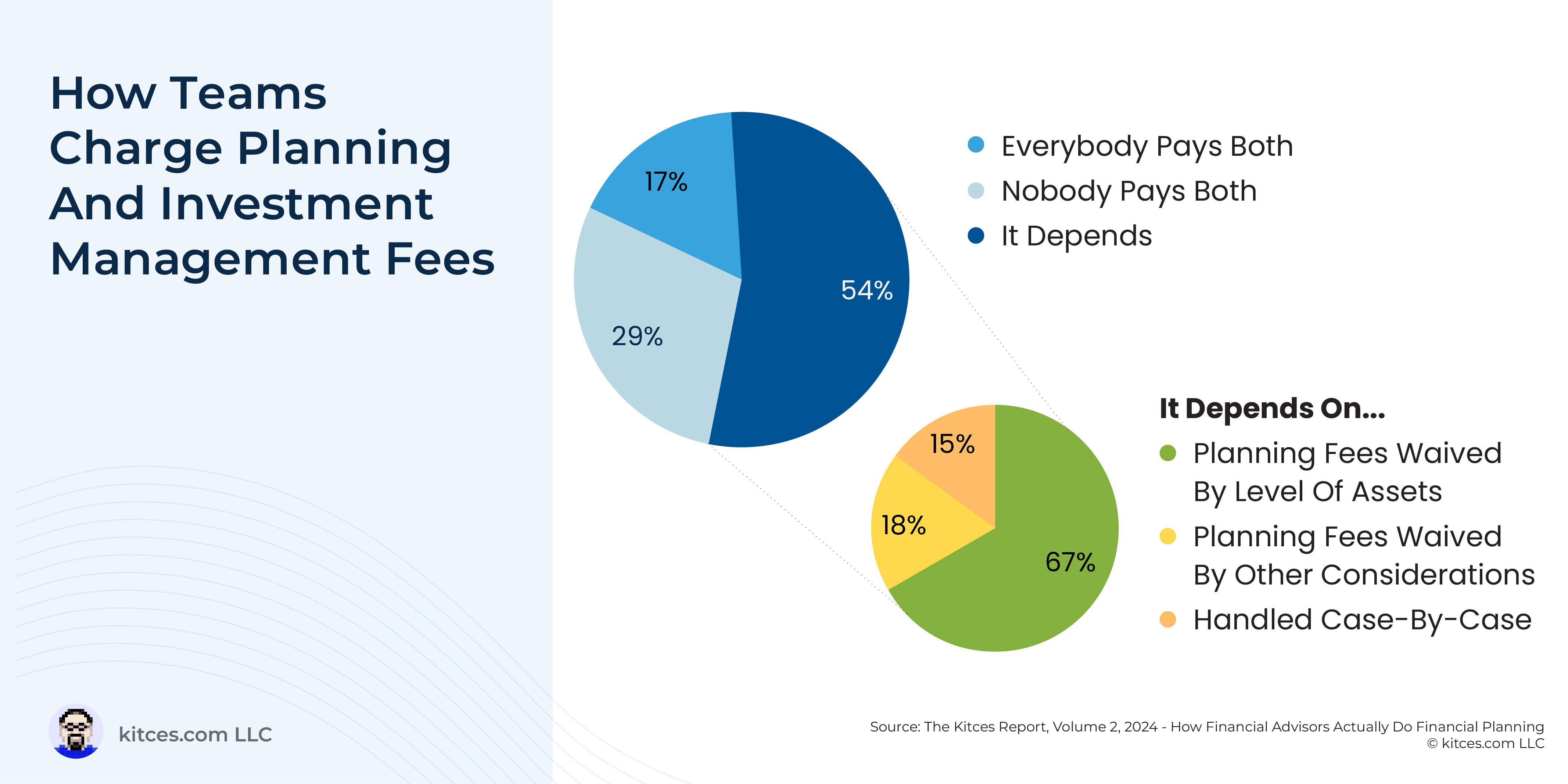

Despite its widespread use, AUM-based pricing has its limitations – it exposes firms to market risks and restricts the types of clients they are able to serve. To mitigate this, some firms ‘unbundle’ their fees, separating investment management, financial planning, and other services into distinct project-based, hourly, or retainer fees instead of covering everything under a single AUM fee. Notably, across nearly all client segments, research finds that the total fees charged by advisors who offer bundled and unbundled services tend to be nearly identical, suggesting that unbundling could be a viable way to make financial advice more accessible to clients with smaller portfolios. Another way firms reduce reliance on AUM fees is by using multiple charging methods, such as combining AUM fees with project-based or retainer fees. In fact, 72% of advisory firms use more than one charging method, allowing for greater flexibility in serving a broader range of clients.

Ultimately, as financial planning becomes more comprehensive and customized, fee structures are evolving to reflect this shift. While the mechanics of charging fees may not always change, the broader conversation around fees has continued to develop. At the same time, a wider range of fee structures could help firms serve a more diverse client base by expanding access to financial advice, which has traditionally remained concentrated in high-net-worth households. In other words, as financial planning becomes increasingly comprehensive, firms have the opportunity not only to refine their pricing models but also to rethink how they define – and deliver – value!Read More…