Markets are back on edge this morning thanks in part to rising tension between the US-Iran. Safe havens are once again experiencing inflows with hitting an Asian session high around $3377/oz.

Asian Market Wrap

Looking at the Asian session, stock futures and the dollar dropped after President Donald Trump announced plans to set new tariff rates within two weeks, increasing trade tensions.

and fell 0.3%, while European stock futures dropped 0.8%.

Trump also mentioned sending letters to trading partners about the tariffs, and Commerce Secretary Howard Lutnick said the European Union might be one of the last to finalize a deal with the U.S.

Asian stocks remained mostly unchanged.

This new tariff threat came just a day after U.S. and Chinese officials had positive talks to ease tensions. While the U.S. is also negotiating with countries like India and Japan to reduce tariffs, some investors believe Trump’s comments are meant to speed up negotiations.

However, it’s uncertain if he will stick to the two-week timeline, as similar deadlines in the past have often been delayed or not acted on.

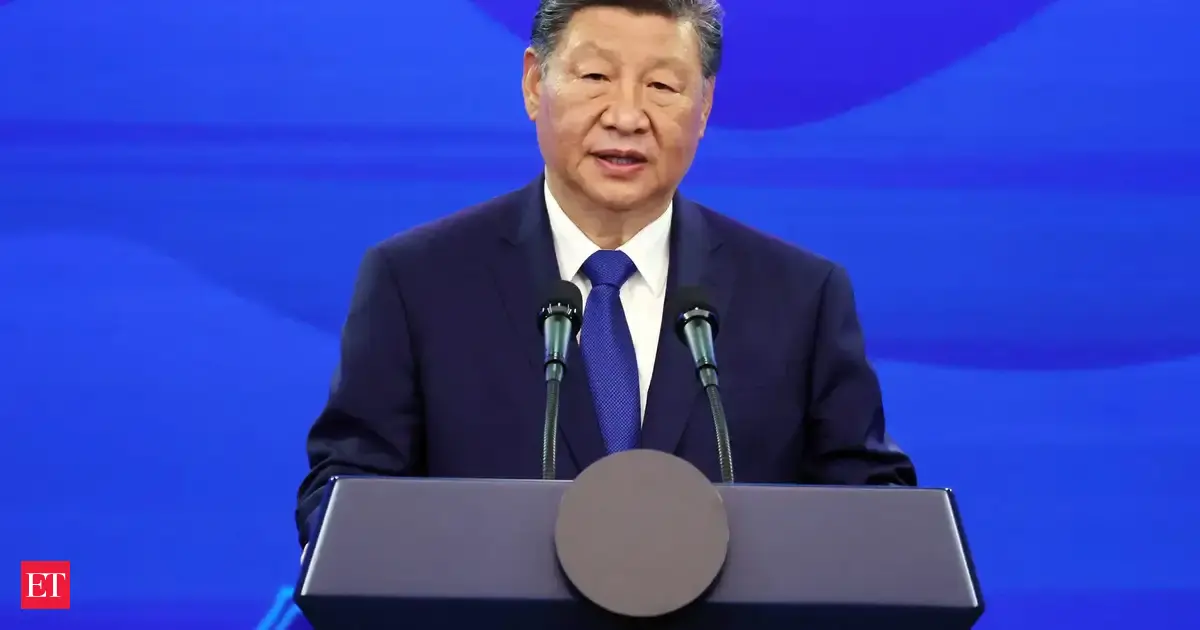

US-Iran Tension on the Rise

President Donald Trump announced on Wednesday that U.S. personnel are being moved out of the Middle East because it “could be a dangerous place.” He also stated that the U.S. will not let Iran develop a nuclear weapon.

Earlier, Reuters reported that the U.S. is planning a partial evacuation of its embassy in Iraq and will allow military families to leave certain areas in the Middle East due to increased security risks. However, neither U.S. nor Iraqi sources specified what those risks are. News of the evacuation caused oil prices to rise by over 4%.

rose by $3 following reports of the U.S. embassy evacuation in Baghdad, with reaching $69.18 per barrel.

Earlier, Britain’s maritime agency warned that rising tensions in the Middle East could lead to more military activity, potentially affecting shipping in key waterways like the Gulf, Gulf of Oman, and the Strait of Hormuz near Iran. It advised ships to be cautious when traveling through these areas.

The UK’s Foreign Office said it is closely watching the situation and will keep its Iraq embassy operations under review after the U.S. actions.

The developments over the last 24 hours come as Iran conducted an espionage operation which resulted in thousands of military documents belonging to Israel being stolen. That coupled with Iran’s insistence that so far the nuclear deal being discussed does not adequately address Iran’s concerns but only those of the US and allies.

For now, tension is teetering on a knife-edge, and anything could happen. Any escalation here could lead to increased volatility and a spike in haven demand.

UK GDP Contracts the Most in Nearly Two Years

The shrank by 0.3% in April 2025, its first drop in six months and the biggest since October 2023. This followed a 0.2% growth in March and was worse than the expected 0.1% decline. The downturn was caused by several factors, including higher energy bills, increased employer National Insurance contributions, higher Stamp Duty rates, and major tariffs announced by President Trump.

The services sector, which had the biggest impact on the GDP drop, fell by 0.4%. Significant declines were seen in legal services (-10.2%), advertising and market research (-3.4%), and wholesale trade (-3.2%). Production also fell by 0.6%, with manufacturing down 0.9% and electricity and gas dropping 4.3%. On the other hand, the construction sector grew by 0.9%, showing some strength.

Despite April’s decline, the economy still grew by 0.7% over the three months leading up to April.

GDP Growth MoM

Source: TradingEconomics, ONS

The concern for the UK economy is today’s data follows on from weak jobs data and a rise in . This would hint that the clouds may be gathering for the UK economy. A weaker job market, seasonal trends and global uncertainty that remains all suggest that the UK economy could continue to struggle in Q3.

The European Open

The London open has seen the near its lowest point of 2025 while stocks pulled back slightly from record highs. Rising tensions in the Middle East and worries about the fragile trade truce between the U.S. and China pushed investors toward safer assets.

A U.S. report on Wednesday showed that overall price increases stayed low in May, mainly due to cheaper gasoline, cars, and housing. However, many economists believe inflation will rise as U.S. tariffs start to have a bigger impact.

The dollar, which has dropped about 10% against other currencies this year, hit its lowest level since late April, which was also its weakest in three years.

Traditional safe-haven assets gained ground. The and both strengthened, causing the dollar to drop about 0.6% against each. Meanwhile, gold stayed steady at $3,350 an ounce.

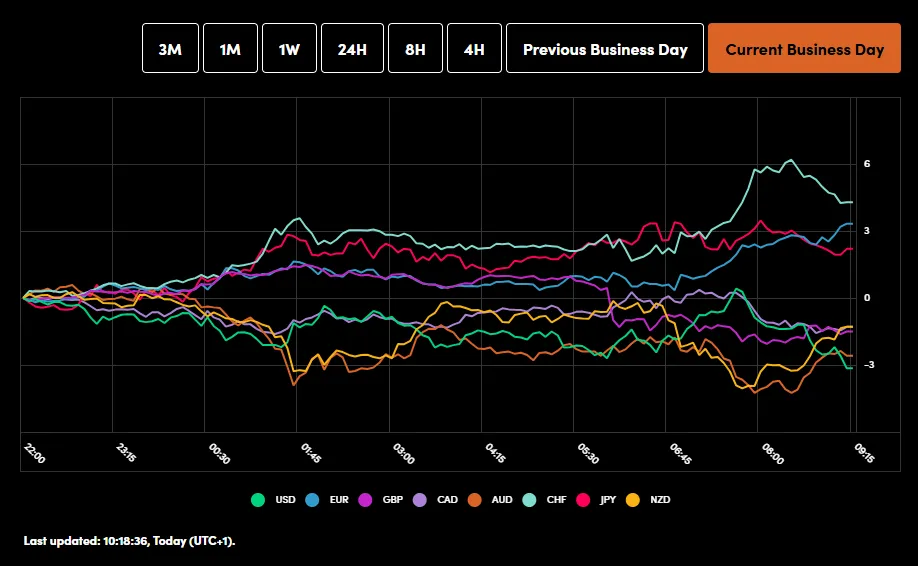

Currency Power Balance

Source: OANDA Labs

Global stocks paused their strong rally since early April, with the MSCI All-Country World Index down 0.1%, just below Wednesday’s record high. In Europe, the fell 0.8%, mainly due to losses in airlines and carmakers as oil prices rose. U.S. stock futures for the and also dropped 0.5%.

The optimism from earlier in the week, after U.S.-China trade talks ended positively and President Trump called it a “great deal with China,” had faded by Thursday. Markets now appear to have shifted focus to Iran with the IAEA this morning adding to uncertainty.

The U.N.’s nuclear watchdog, made up of 35 nations, passed a resolution on Thursday stating that Iran has violated its non-proliferation obligations. This is the first time in nearly 20 years that such a declaration has been made, according to diplomats at the private meeting. This comes after Iran accused members of the IAEA of leaking the name of Iranian nuclear scientists and other sensitive information to Israel, further complicating matters.

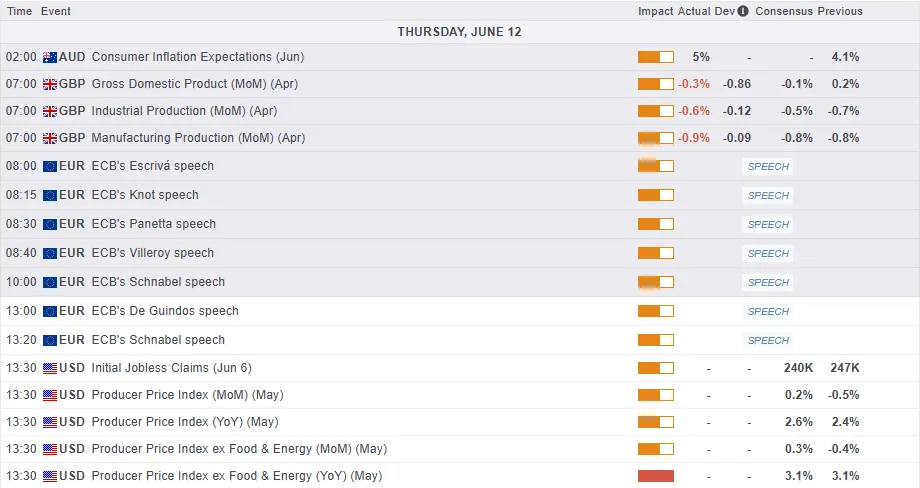

Economic Data Releases and Final Thoughts

Looking at the economic calendar, today’s focus will be on US numbers which may be a better gauge of inflationary pressure as companies will provide an update. Price pressures may not have been passed to consumers yet and thus may not be visible in the data but may show up in the PPI data.

The comments from businesses may also be key as to how they see price pressures holding up thus far and what they expect from the months ahead.

The data, together with trade deals and, now of course, Geopolitical developments in the Middle East, are all factors that could stoke volatility and shake markets ahead of the weekend.

Chart of the Day – DAX Index

From a technical standpoint, the has now surrendered the 24000 handle and is approaching key support at 23471.

The index is tracking global markets as sentiment has taken a hit this morning on rising geopolitical risks.

The risk of further downside at this stage remains closely linked to overall market sentiment which remains in a state of flux.

Developments around the US-Iran could be the catalyst for moves for the rest of the week even with US PPI data scheduled later in the day.

Immediate support below the 232471 handle may be found at 23212 and potentially the 50-day MA at 22922.

A recovery from here may face a hurdle at 23870 before the 24000 handle comes back into focus.

DAX Daily Chart, June 12. 2025

Source: TradingView.com

Original Post