Two companies that stand out in this regard are Diamondback Energy and T. Rowe Price.

These firms not only provide attractive dividend payouts and yields, but also demonstrate strong fundamentals that make them appealing choices for the long haul.

Looking for more actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for just $9.

Investing in dividend stocks can be a powerful strategy for building wealth over the long term, particularly when the companies behind those dividends have a strong track record of financial stability, growth, and consistent payout increases.

Two such companies that stand out for their dividend reliability and long-term potential are Diamondback Energy (NASDAQ:) and T. Rowe Price Group (NASDAQ:). Both firms operate in distinct sectors—energy and financial services, respectively—offering investors diversification while delivering attractive dividends and growth prospects.

Here’s a closer look at why these stocks are top picks for income-focused investors.

1. Diamondback Energy

Annual Dividend Payout: $5.44 per share

Dividend Yield: 3.96%

Dividend Payout Streak: 8 years

Diamondback Energy is trading at a sharp discount, with the stock down a bruising 16.1% over the past six months and a 27.4% slide in the past year. Yet, beneath the surface pain, analysts see a recovery window: the InvestingPro Fair Value price target sits at $168.02, implying a potential +22.2% upside, with the high end of Wall Street estimates at a striking $225.00.

Source: InvestingPro

FANG’s technical signals are a study in contrasts. On one hand, the one-hour chart is a patchwork: RSI at 51.5 signals neutrality, while short-term oscillators lean bearish. But MACD and ROC tilt bullish, and moving averages for longer periods (SMA50/100/200, EMA50/100/200) all flash “Buy”—suggesting that while the short-term is choppy, the intermediate trend may be turning.

The stock has been consolidating above its 52-week low of $114.00, far off the $214.50 high, but with technicals starting to show budding bullishness after a long slide.

Source: Investing.com

Fundamentally, FANG’s story is a paradox of operational strength and market skepticism. The company boasts industry-leading break-even costs at $36/bbl, dominant Midland Permian acreage, and eight consecutive years of dividend payments—a $5.44 payout yielding 3.9%.

Cash flows comfortably cover interest payments, and profitability is robust: Q1 2025 EPS of $4.83 blew past forecasts, and revenue topped $4.05 billion. Analysts expect EPS to land between $13.80 and $16.30 for the year.

2. T. Rowe Price

Annual Dividend Payout: $5.08 per share

Dividend Yield: 5.45%

Dividend Payout Streak: 40 years

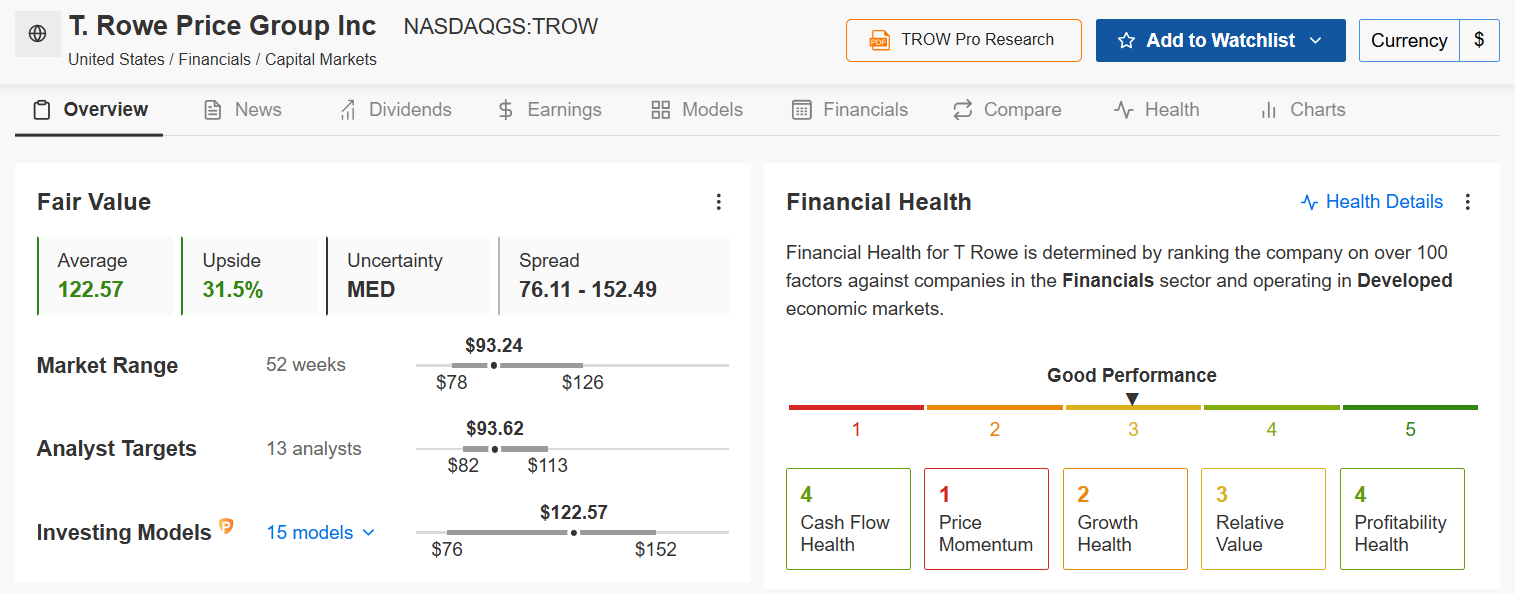

T. Rowe Price is also navigating stormy seas, with the stock at $93.24—down 17.5% over six months and 20.2% for the year, hugging the lower end of its $77.85–$125.81 52-week range.

Source: Investing.com

Technical analysis is a tale of uncertainty: on the one-hour chart, momentum is mixed. RSI at 54.1 is neutral, but stochastics and MACD are bullish, and CCI confirms a “Buy.” However, short-term moving averages (SMA5/EMA5) say “Sell,” while longer-term (SMA20/50/200, EMA20/200) lean “Buy.” The net result is ongoing indecision, with daily and weekly technicals mostly flashing “Sell” or “Strong Sell,” but some glimmers of hope in the short-term oscillators.

On the fundamental side, TROW is a model of stability with a few cracks showing. The firm has paid dividends for 40 consecutive years, currently offering a $5.08 payout (5.45% yield), and boasts a fortress balance sheet, with liquid assets comfortably covering short-term obligations.

The company faces fee pressure and negative investment flows, with analysts revising down earnings estimates and warning of margin compression as investor sentiment shifts toward passive strategies. Yet, the bull case hinges on TROW’s push into ETFs and insurance, areas with growth potential that could diversify its revenue stream and reverse the outflows.

Source: InvestingPro

With a Fair Value of $122.57, TROW stock presents a sizable upside potential of +31.5% from its current price.

Bottom Line

Both stocks are licking their wounds from tough six-month stretches, but FANG shows early signs of technical recovery, while TROW’s chart is a coin toss between stabilization and further drift.

The technicals and fundamentals tell a story of patience: the worst may be priced in, but the next act requires a catalyst—be it oil’s rebound, or TROW’s ETF ambitions finally bearing fruit.

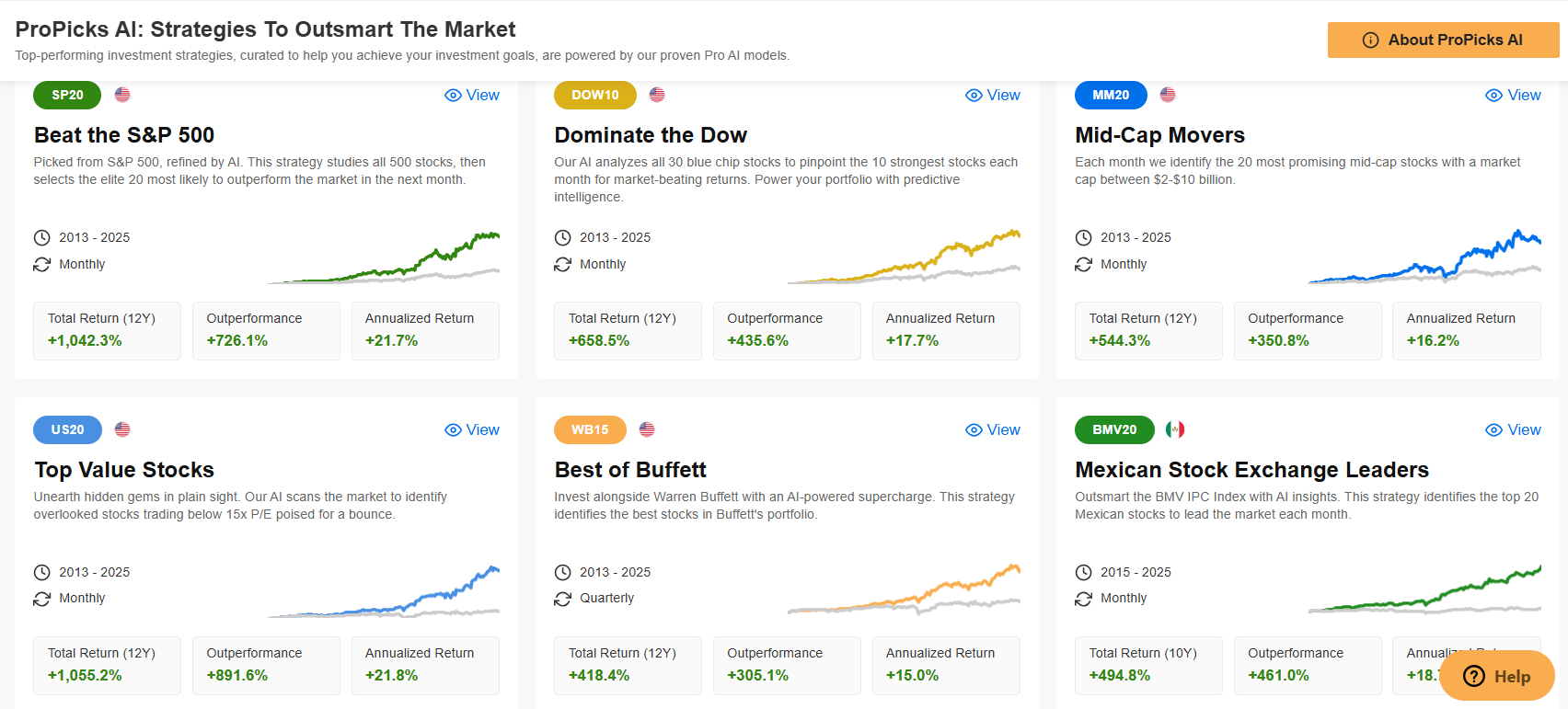

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for 45% off and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.