Some bearish bond investors in Japan and the US appear to believe that a paradigm shift is underway in the sovereign bond markets. To wit, consider the following statement from Jim Bianco on Thoughtful Money: “If these deficits are really going to kick in and cause problems, these rates are going to go much higher than this.” The bond market paradigm shift we observe is that some people believe the governments and central banks of the largest nations are no longer managing interest rates. For those who believe in this paradigm shift, we ask a simple question: Why Would They Stop Now?

The governments and central banks of developed countries have long-standing policies that keep high levels of public and private debt serviceable. Moreover, these same policies aim to incentivize further debt accumulation. The bearish voices in the bond market, claiming a paradigm shift is underway, show a disregard for history. Bond bulls and bears can all agree that global fiscal debt trends are not sustainable. However, do you think the governments are now willing to pay the price for such malfeasance?

Two years ago, the Japanese government uncapped its interest rates, and not surprisingly, they have surged higher. However, with their approaching 3%, they announced that they are considering adjusting their debt issuance patterns. As shown below, its 30-year bond fell 35 basis points after the announcement. Bond yields in the US and around the world fell in sympathy. Governments around the world will preserve their debt-driven financial systems and economies by keeping a lid on interest rates. Again, ponder the one simple question if you believe in the paradigm shift: why would the governments and central banks stop manipulating the bond market now?

What To Watch Today

Earnings

No earnings releases today.

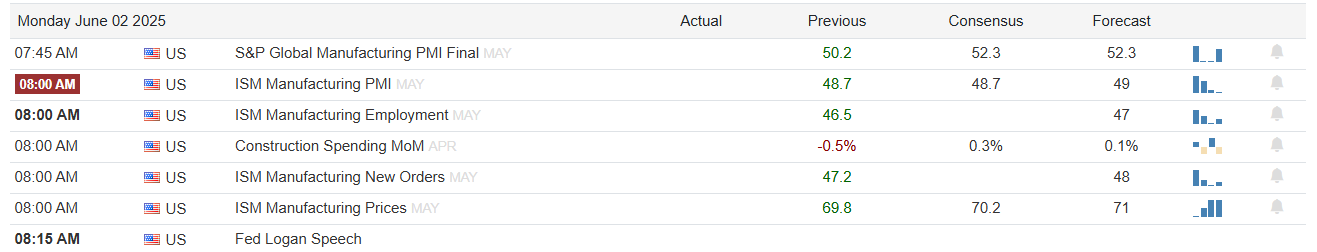

Economy

Market Trading Update

How this seems to be an “unstoppable” bull market. However, that doesn’t mean markets won’t pause before attempting to move higher. As we noted last week, the consolidation was expected.

“Even with Bessent’s comments, that market remains overbought in the short term, and a further consolidation process is likely to occur next week. At the end of this week, we removed our short-market hedge, added to bonds, and reduced equity exposure. If the market is going to consolidate, we can allow cash to act as the primary hedge. However, if the 200-DMA is violated, the 50-DMA will become the next critical support. From a bullish perspective, the 20 and 50-DMAs are now sloping positively, which should provide rising support levels. Overall, we suspect that the market will stabilize. Of course, there are always risks to be aware of, so increased cash levels are essential now.”

Most notably, this past week was the successful test of the 200-DMA. The pullback to that previous broken resistance level and subsequent bounce highly suggests that the April correction is complete and that market control returns to the Bulls. As such, there is very little resistance between current levels and all-time highs. However, as noted last week, with the markets still overbought on a momentum basis, further consolidation will be unsurprising before an advance to new highs occurs. With the MACD sell signal triggered and money flows declining, another test of the 200-DMA next week would be unsurprising.

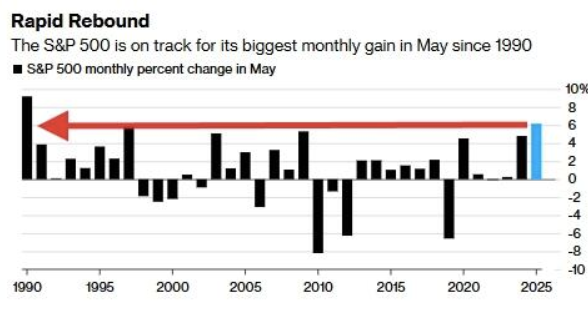

Interestingly, the old saying “April Showers Bring May Flowers ” seems apropos, as the tariff-driven sell-off in April sprouted a very strong May advance. Notably, the had its best month of May since 1990.

However, as noted above, with the market short-term overbought and very bullish, we should expect the market to “struggle” somewhat in June as corporate share buybacks subside and companies go into blackout before Q2 earnings season begins. Furthermore, we have often stated that earnings remain overly optimistic, which concerns markets moving forward.

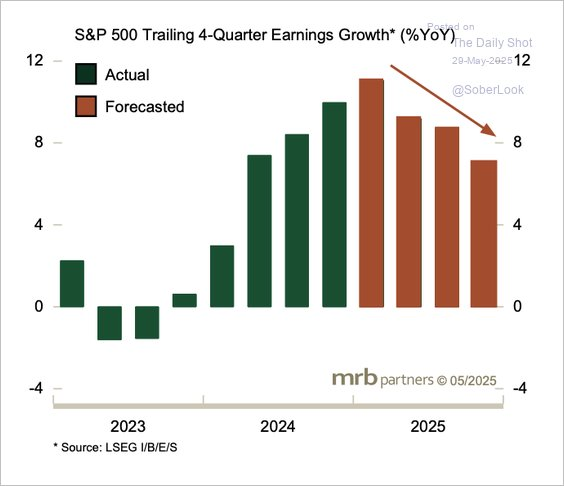

According to MRB Partners, the Q1 earnings season is expected to be the peak for the earnings growth cycle. Given the high correlation between forward earnings estimates and market returns, this commentary should not be readily dismissed.

That said, investors must be most careful of “market narratives.” These narratives can potentially be far more harmful than helpful to investors who get swept up in the emotions generated by headline-grabbing rationalizations. Such is the topic for this week’s #BullBearReport

The Week Ahead And PCE Prices

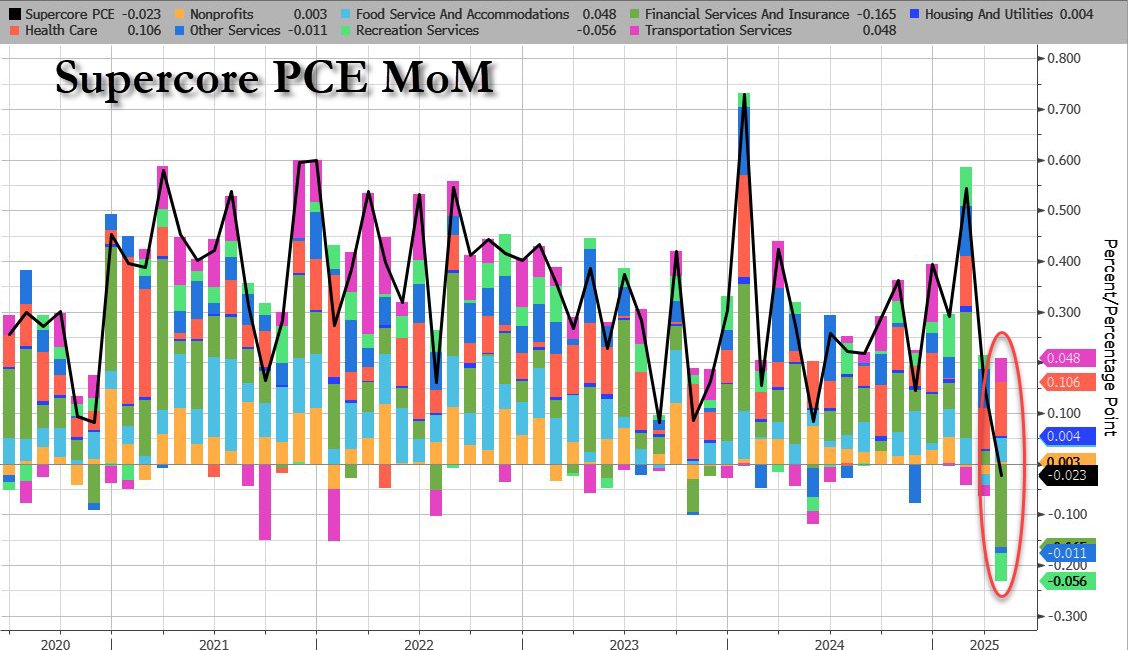

The trend of lower-than-expected inflation data continued on Friday with PCE prices. The monthly and price indexes rose by 0.1% following a similar increase last month. The is now down to 2.1% on a year-over-year basis. Importantly, the supercore PCE, which measures core services excluding housing, is negative for the first time since the pandemic began. The Fed has frequently noted this as a critical inflation indicator. To wit is the following quote regarding the supercore PCE from Jerome Powell in 2022:

This may be the most important category for understanding the future evolution of core inflation

With inflation running below expectations for several months, the Fed’s concerns about tariff inflation may subside. If so, the labor market will likely be their key data point to assess when and how much to by. Accordingly, the labor market has generally been good. This week, the report on Tuesday, the report on Wednesday, and the BLS on Friday will further inform the Fed about the labor market. Also of interest will be the and surveys. In particular, traders will focus on the employment, new orders, and prices sub-indices.

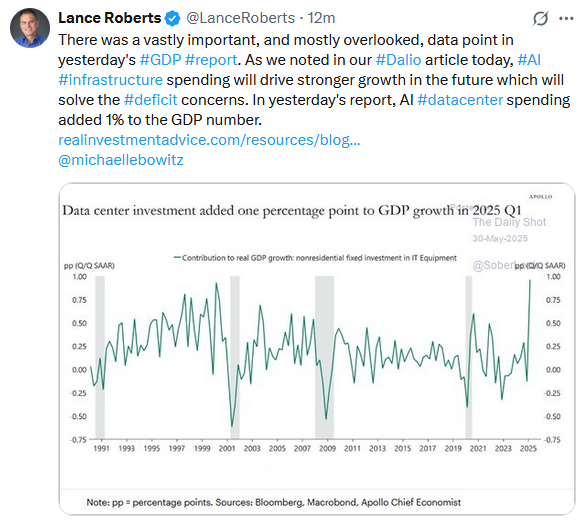

Tweet of the Day