Armed with some data from our friends at CrunchBase, I broke down the largest global startup funding rounds for April 2025. I have included some additional information such as industry, round type, a brief description of the company, investors in the round, company location, and total equity funding raised for the company to further the analysis.

13. SandboxAQ $150.0M

Round: Series EDescription: Palo Alto-based SandboxAQ develops AI and quantum technology solutions that enhance biopharma, cybersecurity, and materials science. Founded by Jack Hidary in 2016, SandboxAQ has now raised a total of $950.0M in total equity funding and is backed by NVIDIA, Google, BNP Paribas, S32, and US Innovative Technology Fund.Investors in the round: Beyond Alpha Ventures, BNP Paribas, Google, Horizon Kinetics LLC, NVIDIA, Ray DalioIndustry: Artificial Intelligence (AI), Cyber Security, Information Technology, Quantum Computing, SaaSFounders: Jack HidaryFounding year: 2016Location: Palo AltoTotal equity funding raised: $950.0M

13. Thunes $150.0M

13. Thunes $150.0M

Round: Series DDescription: Singapore-based Thunes provides a global payments infrastructure that enables businesses and financial to send and receive funds in various currencies. Founded by Eric Barbier and Peter Caluwe in 2016, Thunes has now raised a total of $352.0M in total equity funding and is backed by Insight Partners, Bessemer Venture Partners, Checkout.com, Vitruvian Partners, and Endeavor Catalyst.Investors in the round: Apis Partners, Vitruvian PartnersIndustry: Financial Services, FinTech, Mobile Payments, PaymentsFounders: Eric Barbier, Peter CaluweFounding year: 2016Location: SingaporeTotal equity funding raised: $352.0M

12. Altruist $152.0M

12. Altruist $152.0M

Round: Series FDescription: Culver City-based Altruist is a modern custodian that offers a digital investment platform for financial advisors to manage their clients’ investments. Founded by Jason Wenk in 2018, Altruist has now raised a total of $601.5M in total equity funding and is backed by Insight Partners, ICONIQ Growth, Venrock, Salesforce Ventures, and Endeavor Catalyst.Investors in the round: Baillie Gifford, Carson Family Office, Geodesic Capital, GIC, ICONIQ Growth, Salesforce VenturesIndustry: Asset Management, Financial Services, FinTechFounders: Jason WenkFounding year: 2018Location: Culver CityTotal equity funding raised: $601.5M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC Tech, LA Tech, London Tech)TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here.

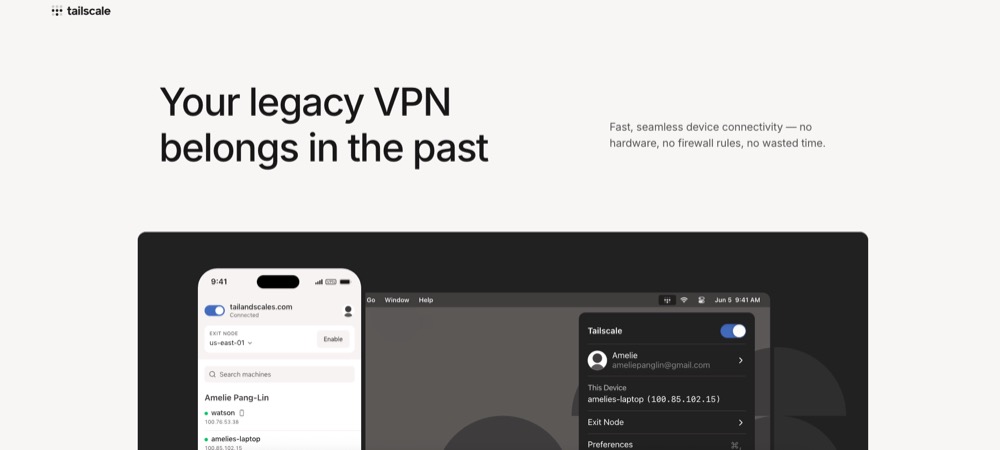

11. Tailscale $160.0M

11. Tailscale $160.0M

Round: Series CDescription: Toronto-based Tailscale is a software company that provides zero-configuration virtual private networks (VPNs) for secure connectivity. Founded by Avery Pennarun, David Carney, and David Crawshaw in 2019, Tailscale has now raised a total of $275.0M in total equity funding and is backed by Accel, Insight Partners, Uncork Capital, Inovia Capital, and Heavybit.Investors in the round: Accel, Anthony Casalena, CRV, Heavybit, Insight Partners, Uncork CapitalIndustry: Cyber Security, Information Technology, Infrastructure, Network SecurityFounders: Avery Pennarun, David Carney, David CrawshawFounding year: 2019Location: TorontoTotal equity funding raised: $275.0M

10. Electra $186.0M

10. Electra $186.0M

Round: Series BDescription: Boulder-based Electra produces clean iron using low-temperature electrochemistry powered by renewables to decarbonize and transform steel production. Founded by Sandeep Nijhawan in 2020, Electra has now raised a total of $299.3M in total equity funding and is backed by National Science Foundation, Lowercarbon Capital, Temasek Holdings, Valor Equity Partners, and S2G Investments.Investors in the round: BHP Ventures, Breakthrough Energy Ventures, Builders Vision, Capricorn Investment Group, Collaborative Fund, Earth Venture Capital, Interfer, Lowercarbon Capital, Nucor Corporation, Rio Tinto, Roy Hill, S2G Investments, Temasek Holdings, Toyota Tsusho, Yamato KogyoIndustry: Energy, Industrial, Renewable EnergyFounders: Sandeep NijhawanFounding year: 2020Location: BoulderTotal equity funding raised: $299.3M

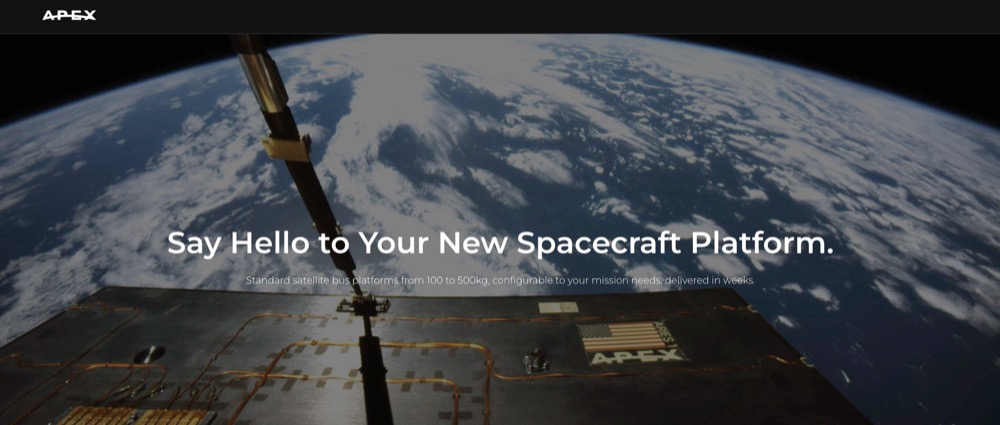

9. Apex $200.0M

9. Apex $200.0M

Round: Series CDescription: Los Angeles-based Apex designs and manufactures satellite buses tailored for various space missions. Founded by Ian Cinnamon and Maximilian Benassi in 2022, Apex has now raised a total of $322.0M in total equity funding and is backed by StepStone Group, Andreessen Horowitz, Village Global, 8VC, and Lux Capital.Investors in the round: 8VC, Andreessen Horowitz, Point72 Ventures, StepStone Group, Washington Harbour PartnersIndustry: Aerospace, Commercial, ManufacturingFounders: Ian Cinnamon, Maximilian BenassiFounding year: 2022Location: Los AngelesTotal equity funding raised: $322.0M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC Tech, LA Tech, London Tech)TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here.

9. Base Power $200.0M

9. Base Power $200.0M

Round: Series BDescription: Austin-based Base Power is a modern energy provider that specializes in residential backup battery systems and electricity plans. Founded by Zachary Dell in 2023, Base Power has now raised a total of $268.0M in total equity funding and is backed by Andreessen Horowitz, Valor Equity Partners, Lightspeed Venture Partners, Thrive Capital, and Altimeter Capital.Investors in the round: Addition, Altimeter Capital, Andreessen Horowitz, Jackson Moses, Lightspeed Venture Partners, Terrain, Thrive Capital, Trust Ventures, Valor Equity PartnersIndustry: Battery, Electrical Distribution, Energy, Energy Management, Energy Storage, Industrial, Power GridFounders: Zachary DellFounding year: 2023Location: AustinTotal equity funding raised: $268.0M

9. Persona $200.0M

9. Persona $200.0M

Round: Series DDescription: San Francisco-based Persona is an identity verification and management platform that enables businesses to automate and streamline their verification processes. Founded by Charles Yeh and Rick Song in 2018, Persona has now raised a total of $417.5M in total equity funding and is backed by Founders Fund, Coatue, Bond, First Round Capital, and Index Ventures.Investors in the round: Bond, Chemistry, Coatue, First Round Capital, Founders Fund, Index Ventures, Ribbit CapitalIndustry: Cyber Security, Fraud Detection, Identity Management, Information Technology, SaaSFounders: Charles Yeh, Rick SongFounding year: 2018Location: San FranciscoTotal equity funding raised: $417.5M

9. Supabase $200.0M

9. Supabase $200.0M

Round: Series DDescription: San Francisco-based Supabase is an open-source Firebase alternative that provides a full PostgreSQL database. Founded by Anthony Wilson and Paul Copplestone in 2020, Supabase has now raised a total of $396.1M in total equity funding and is backed by Y Combinator, Accel, Craft Ventures, Lightspeed Venture Partners, and Coatue.Investors in the round: Accel, Coatue, Craft Ventures, Felicis, Taylor Otwell, Y CombinatorIndustry: Artificial Intelligence (AI), Database, Developer Tools, Information Services, Information Technology, SoftwareFounders: Anthony Wilson, Paul CopplestoneFounding year: 2020Location: San FranciscoTotal equity funding raised: $396.1M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC Tech, LA Tech, London Tech)TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here.

9. CMR Surgical $200.0M

9. CMR Surgical $200.0M

Round: VentureDescription: Cambridge-based CMR Surgical develops and manufactures robotic surgical systems to enhance precision and efficiency in minimally invasive surgery. Founded by Luke Hares, Mark Slack, and Martin Frost in 2014, CMR Surgical has now raised a total of $1.3B in total equity funding and is backed by Lightrock, Trinity Capital, Ally Bridge Group, SoftBank Vision Fund, and Cambridge Innovation Capital.Investors in the round: Trinity CapitalIndustry: Health Care, Medical, Medical Device, RoboticsFounders: Luke Hares, Mark Slack, Martin FrostFounding year: 2014Location: CambridgeTotal equity funding raised: $1.3B

8. Mainspring Energy $258.0M

8. Mainspring Energy $258.0M

Round: Series FDescription: Menlo Park-based Mainspring Energy provides power generation technology using linear generators for clean energy. Founded by Adam Simpson, Matt Svrcek, and Shannon Miller in 2010, Mainspring Energy has now raised a total of $726.0M in total equity funding and is backed by General Catalyst, Temasek Holdings, Khosla Ventures, Alumni Ventures, and Lightrock.Investors in the round: Climate Pledge Fund, DCVC, Gates Frontier Fund, General Catalyst, Khosla Ventures, LGT group, Lightrock, M&G Investments, Marunouchi Innovation Partners, Pictet Private Equity Investors S.A., Temasek HoldingsIndustry: Clean Energy, Energy, Oil and GasFounders: Adam Simpson, Matt Svrcek, Shannon MillerFounding year: 2010Location: Menlo ParkTotal equity funding raised: $726.0M

7. True Anomaly $260.0M

7. True Anomaly $260.0M

Round: Series CDescription: Centennial-based True Anomaly is builds space security and resilience at the intersection of spacecraft, software, and autonomy. Founded by Even Rogers and Kyle Zakrzewski in 2022, True Anomaly has now raised a total of $400.6M in total equity funding and is backed by Menlo Ventures, Accel, Rocketship.vc, Eclipse Ventures, and Riot Ventures.Investors in the round: 645 Ventures, Accel, ACME Capital, Champion Hill Ventures, Eclipse Ventures, Menlo Ventures, Meritech Capital Partners, Narya Capital, Riot Ventures, Space.VCIndustry: Aerospace, Artificial Intelligence (AI), Manufacturing, Military, National SecurityFounders: Even Rogers, Kyle ZakrzewskiFounding year: 2022Location: CentennialTotal equity funding raised: $400.6M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC Tech, LA Tech, London Tech)TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here.

6. Chaos $275.0M

6. Chaos $275.0M

Round: Series CDescription: Los Angeles-based Chaos Industries develops advanced technologies for defense and critical industries. Founded by Bo Marr, Brett Cummings, Gavin Hood, and John Tenet in 2022, Chaos has now raised a total of $490.0M in total equity funding and is backed by StepStone Group, Accel, Valor Equity Partners, 8VC, and New Enterprise Associates.Investors in the round: 8VC, Accel, New Enterprise Associates, Overmatch Ventures, StepStone Group, Tru Arrow Partners, Valor Equity PartnersIndustry: Aerospace, Government, Military, National SecurityFounders: Bo Marr, Brett Cummings, Gavin Hood, John TenetFounding year: 2022Location: Los AngelesTotal equity funding raised: $490.0M

5. Runway $308.0M

5. Runway $308.0M

Round: Series DDescription: New York-based Runway is an applied AI research company that creates AI-powered content creation tools for the media and entertainment sectors. Founded by Alejandro Matamala Ortiz, Anastasis Germanidis, and Cristobal Valenzuela Barrera in 2018, Runway has now raised a total of $544.5M in total equity funding and is backed by General Atlantic, Madrona, NVIDIA, Google, and Lux Capital.Investors in the round: Baillie Gifford, Fidelity, General Atlantic, NVIDIA, SoftBankIndustry: Apps, Artificial Intelligence (AI), Generative AI, Machine Learning, Software, Video EditingFounders: Alejandro Matamala Ortiz, Anastasis Germanidis, Cristobal Valenzuela BarreraFounding year: 2018Location: New YorkTotal equity funding raised: $544.5M

4. DennoKotsu ¥2.5B

4. DennoKotsu ¥2.5B

Round: Series DDescription: Tokushima-based Denno Kotsu specializes in taxi dispatch systems and contract dispatch services for taxi companies. Founded by Bando Yuki and Okada Ikuhiro in 2015, DennoKotsu has now raised a total of $348.3M in total equity funding and is backed by Uber, Japan Post Investment, NTT DOCOMO Ventures, Mitsubishi Corporation, and Iyogin Capital.Investors in the round: Awagin Capital, DAIICHI KOUTSU SANGYO, Daiwa Motor Transportation, Iyogin Capital, Japan Post Investment, Kokusai Motorcars, Mitsubishi Corporation, MK, Sanwa Transportation, Tokushima Taisho Bank, Tsubame Motors, UberIndustry: Automotive, Software, Task Management, Taxi Service, TransportationFounders: Bando Yuki, Okada IkuhiroFounding year: 2015Location: TokushimaTotal equity funding raised: $348.3M

The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties (NYC Tech, LA Tech, London Tech)TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here.

3. Chainguard $356.0M

3. Chainguard $356.0M

Round: Series DDescription: Kirkland-based Chainguard is a cloud-native development platform that provides low-to-zero CVE container images for building and running applications. Founded by Dan Lorenc, Kim Lewandowski, and Ville Aikas in 2021, Chainguard has now raised a total of $612.0M in total equity funding and is backed by Sequoia Capital, Lightspeed Venture Partners, IVP, Spark Capital, and Salesforce Ventures.Investors in the round: Amplify Partners, Datadog Ventures, IVP, Kleiner Perkins, Lightspeed Venture Partners, MANTIS Venture Capital, Redpoint, Salesforce Ventures, Sequoia Capital, Spark Capital, Windproof Partners (fka Kerrest & Co.)Industry: Cloud Security, Developer Tools, Enterprise Software, Open Source, SecurityFounders: Dan Lorenc, Kim Lewandowski, Ville AikasFounding year: 2021Location: KirklandTotal equity funding raised: $612.0M

2. Plaid $575.0M

2. Plaid $575.0M

Round: VentureDescription: San Francisco-based Plaid develops financial technology infrastructure that enables applications to connect with users’ bank accounts and financial data. Founded by William Hockey and Zachary Perret in 2013, Plaid has now raised a total of $1.3B in total equity funding and is backed by Franklin Templeton, Norwest Venture Partners, Andreessen Horowitz, BoxGroup, and BlackRock.Investors in the round: BlackRock, Fidelity, Franklin Templeton, New Enterprise Associates, Ribbit CapitalIndustry: Banking, Financial Services, FinTech, InsurTech, Wealth ManagementFounders: William Hockey, Zachary PerretFounding year: 2013Location: San FranciscoTotal equity funding raised: $1.3B

1. Safe Superintelligence $2.0B

1. Safe Superintelligence $2.0B

Round: VentureDescription: Palo Alto-based Safe Superintelligence develops AI solutions prioritizing safety in artificial intelligence. Founded by Daniel Gross, Daniel Levy, and Ilya Sutskever in 2024, Safe Superintelligence has now raised a total of $3.0B in total equity funding and is backed by Andreessen Horowitz, NVIDIA, Sequoia Capital, Lightspeed Venture Partners, and Alphabet.Investors in the round: Alphabet, Andreessen Horowitz, DST Global, Greenoaks, Lightspeed Venture Partners, NVIDIAIndustry: Artificial Intelligence (AI), Information Technology, Internet, Software EngineeringFounders: Daniel Gross, Daniel Levy, Ilya SutskeverFounding year: 2024Location: Palo AltoTotal equity funding raised: $3.0B