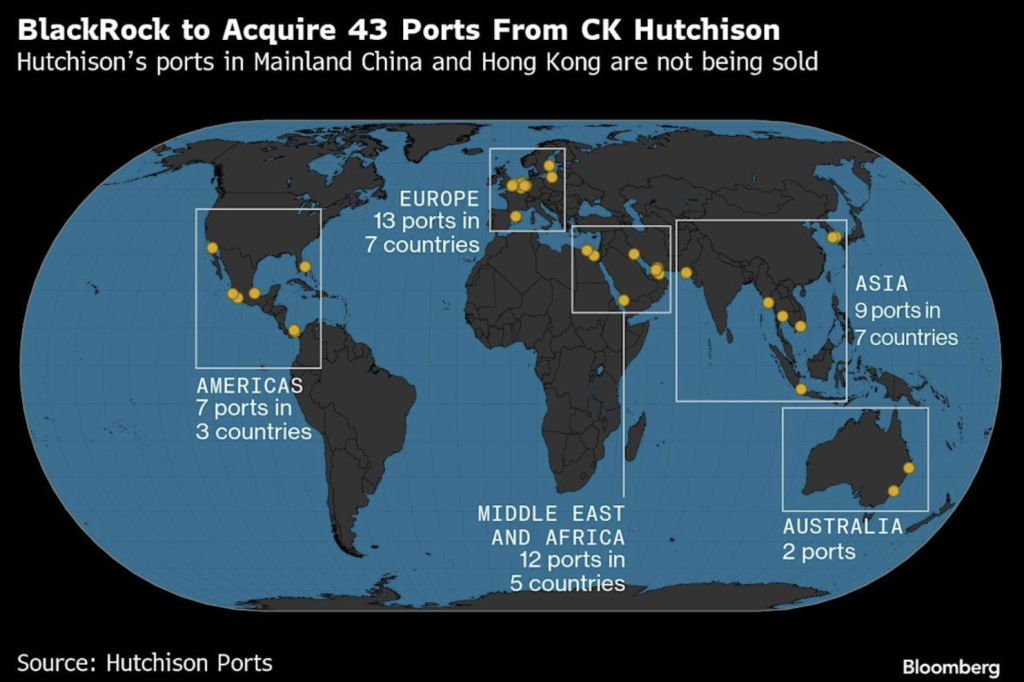

On Wednesday at the company’s annual general meeting Hong Kong-based conglomerate CK Hutchison reiterated its commitment to obtain multiple regulatory approvals before moving forward with the sale of its 43 global ports outside of mainland China and Hong Kong.

Hutchison is facing heavy pressure in China and Panama over the proposed $23 billion deal with US investment firm BlackRock and the Italian tycoon-controlled Mediterranean Shipping Company, leading to questions over whether the deal will proceed at all and if so, in what form?

The Trump administration worked closely with BlackRock during the lead up to the proposed sale and helped instigate it with its pressure on Hutchinson, showcasing that this is essentially a hostile takeover attempt spearheaded by Washington.

China is now countering with pressure on Hutchison, but it remains unclear if Beijing will opt for the nuclear option that could damage Hong Kong’s financial center standing. More on that below, but first a quick recap of the proposed deal.

CK Hutchison Holdings in March announced that it was selling all its overseas ports, including two at the Panama Canal, to a consortium led by BlackRock in a deal worth $23 billion.

It might be a fair price for Hutchison and its founder Li Ka-shing, the ninety-six-year-old billionaire who was knighted by Queen Elizabeth in 2000, but as a recent paper from Global Capital Allocation highlights:

A defining feature of the current global system is the willingness of the Great Powers to use their economic and financial strength to achieve geopolitical or economic goals. This rise of geoeconomics is a major departure from the last twenty years of policy making and has the potential to dramatically alter the landscape of the global economic and financial system.

And so despite Hutchison’s aims to refocus the debate on legal due process and shareholder interests (it’s now offer roughly $3 per share as a bonus to shareholders if the deal goes through), there’s no escaping the fact that the proposed deal is right in the middle of the geoeconomic war between Washington and Beijing and will have major implications regardless of which way it goes.

China in a Bind?

Beijing’s alarmed reaction to the Hutchison deal is often depicted in Western media as heavy handed, and it does appear as though the government in China was caught off guard, but it’s important to note that BlackRock in this case is mostly synonymous with the US, and the proposed sale is part of the US effort to kneecap China’s economy through sanctions, bans, tariffs, and setting up roadblocks for Chinese investments and companies around the world.

While Team Trump was holding meetings with BlackRock, it was also putting the squeeze on Hutchison. From the WSJ:

In the days before finalizing the deal, Fink held calls with Trump, Secretary of State Marco Rubio, Treasury Secretary Scott Bessent and national security adviser Michael Waltz, ultimately garnering the administration’s blessing, according to people close to the deal.

Behind the scenes, Hutchinson executives had grown uneasy that a hostile Trump administration could make life hard on their sprawling global conglomerate…

Hutchinson executives had weighted selling these and dozens more ports before, but the timing wasn’t right. With Trump applying pressure — and Hutchinson shares trading at a substantial discount to the company’s underlying assets — that changed. …executives were surprised by Trump’s decision to revoke special trade privileges for Hong Kong, and Panama authorities had just announced an audit of Hutchinson’s contract.

Hutchison was also going to get hit hard by “Liberation Day.” Chief among China’s concerns with the Hutchinson deal is that the new ownership could, under pressure from Washington, raise prices on or refuse Chinese ships or allow the US to militarize the ports and use them to enact a maritime blockade of China. These fears are not unfounded. The US is already actively working towards some of those goals while having discussed the others. And we can see how global chokepoints and the ports in the proposed deal overlap:

So criticism of the deal in China was swift. The Hong Kong and Macao Affairs Office of the State Council of China issued a strongly worded comment on the matter yesterday, directly stating that the transaction is not an “ordinary commercial activity,” but rather a hegemonic act in which the United States employs state power—through coercion, pressure, and inducements—to seize the legitimate rights and interests of another country, all masked as “commercial behavior” and essentially representing power politics. Here are some of the legitimate concerns raised by Chinese officials in the commentary:

Once the Panama Canal is “Americanized” and “politicized,” the United States will undoubtedly use it for political purposes to advance its own political agenda, and China’s shipping and trade will inevitably be controlled by the US. If the United States were to implement measures such as selective capacity restrictions or imposing “political surcharges,” Chinese companies’ logistics costs and supply chain stability would face great risks. Some netizens also noted that through this deal, BlackRock would control about 10.4% of the world’s container terminal throughput, joining the ranks of the world’s top three port operators, and it is entirely possible that it would work in concert with US policies to suppress China, raising costs for Chinese cargo and squeezing the market share of Chinese shipping companies. Moreover, this transaction creates a major gap in the port network that Chinese companies have built up over the years, thereby allowing American interests to erode their overseas development advantages. Other netizens even point out that the United States might use this transaction as a “template” to spark a wave of port mergers and acquisitions worldwide through political pressure, thereby controlling more critical ports globally and employing “long-arm jurisdiction” to suppress China, leaving Chinese vessels with “no reliable haven.”

This is by no means mere fearmongering. According to a draft executive order from the US government, plans are already underway to charge Chinese vessels special docking fees, and the US will urge its allies to take similar measures, otherwise facing retaliation. If all of the United States’ calculated moves succeed, they will undoubtedly impact China’s shipbuilding, shipping, foreign trade, and even the Belt and Road Initiative, and will directly affect Hong Kong’s efforts to consolidate and elevate its position as an international shipping and trade center, while threatening and undermining the normal global order and safety of shipping and trade.

Beijing responded by launching a regulatory review of the deal —although the company’s base is in Hong Kong and there aren’t direct Chinese assets involved in the sale — and said the deal shouldn’t be implemented without its approval. That was in response to a WSJ report earlier in the month that said there are discussions to exclude two Panama Canal ports as a way to appease Beijing.

Can China Block the Sale?

No according to Bloomberg, which claims that Beijing can pressure Hutchison but that “because the deal involves only overseas assets it is unlikely to need Beijing’s sign-off.” It also notes that CK Hutchison and sister company CK Asset Holdings Ltd. are registered in the Cayman Islands.

There’s a little more to it than that, though, according to Reuters:

The State Administrative Market Regulation Authority could have extra-territorial jurisdiction by applying the anti-monopoly law, if a deal outside mainland China has the effect of eliminating or restricting competition in China’s domestic market.

Authorities could also use the Measures for Security Review or Foreign Investments, implemented in 2021, to examine foreign direct investments in important fields relating to national security, including infrastructure.

Felix Ng, a partner at law firm Haldanes, said the measures removed the exclusion of acquisitions of interest held by foreign companies, “suggesting that PRC authorities may have the power to review foreign-to-foreign transactions if the target involves PRC-related entities”.

There’s also the nuclear option: the 2020 National Security Law, which goes after “terrorism,” subversives, secessionists, and colluders with foreign forces.” Could that come into play?

“Given the sensitivities, there would be room for further investigation under the broad sweep of the National Security Law, particularly over collusion or espionage,” said Simon Young, a professor at the University of Hong Kong law school.

The offence of collusion would have to involve a person or company intending to disrupt the policies of the Chinese or Hong Kong governments to create serious consequences, Young said.

But should China go this route to nix the deal, it would involve it taking a much more state-heavy approach in Hong Kong, which could hurt the financial center’s global standing. As of now, it is third in the Global Financial Centres Index behind New York City and London.

One can imagine Washington is pleased. It’s like an economic Ukraine or Taiwan. If Beijing acts to block the sale, the US will no doubt hit the gas on more economic isolation efforts, painting China as unfriendly to outside business interests. That’s not to say the strategy makes much sense or will work, but that’s the way it looks.

Why Could Panama Ports Be Excluded?

In April, Panama’s controller general created another headache for the sale when he claimed that CK Hutchison had not properly renewed its contract to operate the ports in 2021 and owed the government $300 million in fees.

The allegation could significantly delay the BlackRock deal and, according to the New York Times, could allow more time for Beijing to “meddle” in the proposed deal.

In the meantime, the “main investor” of the group seeking to buy the global ports is considering excluding the Panama ports from the rest of the deal. Gianluigi Aponte and his son Diego Aponte, the Italian tycoons who control Mediterranean Shipping Co., are reportedly having discussions about moving ahead with the purchase of 41 ports on five continents, leaving BlackRock and Hutchison to figure out the disputes over the other two.

Even at just 41 ports, such a deal could have enormous impact—unless we believe the Aponte family in a US satellite state is willing to stand up to Washington when Uncle Sam comes demanding a crackdown on Chinese ships.

Joker Geoeconomics

As BlackRock Chairman Larry Fink said in his recent annual letter to investors, ports ‘will define the future’ and are as critical to future infrastructure of the global economy as data centers and power grids. The world’s largest asset manager’s wager that despite the new era of geoeconomics, global trade will continue to rise enough to justify this port investment, might pan out. But it’s also a bet on the safe stewardship of the US empire, and that’s far more risky as the US embraces chaos.

Michael Roberts points out in a recent post “Geonomics, nationalism and trade,” the US is attempting to muscle its way out of a profitability crisis:

And there are few rules—if any—in pursuit of that goal. The Hutchison-BlackRock ports deal is just one piece of the larger strategy—if one can call it that. It’s more a mash up of kleptocratic short cuts masquerading as one. Here’s Roberts:

This hegemonic crude power politics is now being made logical and even advantageous to all Americans by right-wing economists. In a new book called Industrial Policy for the United States, Marc Fasteau and Ian Fletcher, two economists beloved by the Maga crowd.

…F&F’s apparently ‘neutral’ industrial strategy is no such thing when it comes to China because as they say, China is “the first combined military and economic threat America has faced in more than 200 years.” They put it bluntly: “An increasing number of Chinese industries are in acute rivalry with high-value American industries, and China’s gains are our losses. The US cannot remain a military superpower without being an industrial superpower.” This sums up the motivation for the switch from neoclassical laisser faire, free trade economics that has dominated the academic ivory towers of economic departments and international economic agencies up to now. America’s (and Europe’s) economic domination has been weakened to the point that there is a significant risk that China will rule globally within a generation. So the gloves are off.

But there are at least a few issues. First off, industrial strategy isn’t helped by the destruction of government services, further unleashing parasitic finance, and simply going all in on military and homeland security budgets. Sure, all the ICE brutality might make for a more terrified and exploitable workforce at home that will help further decimate labor, but it doesn’t do much for rebuilding industry. Furthermore, Roberts points out the following:

F&F’s industrial strategy will not work. In economies, productivity growth and lower costs depend on increased investment in productivity-enhancing sectors. But in capitalist economies that depends on the willingness of profit-driven companies to invest more. If profitability is low and/or falling, they will not do so. That’s the experience of the last two decades, in particular. F&F want a return to war-time policies and cold war strategy to build domestic industry, science and military forces. But that would only work if there was a massive switch to direct public investment through publicly owned companies with a national industrial plan. F&F don’t want that and neither does Trump.

And so we’re left Washington engaging in more shakedowns like the Hutchison deal and tariff threats. As one of China’s most respected international relations scholars, Wang Jisi, said recently:

“When the world’s most powerful country abandons its principles and loses any sense of morality, it becomes exceedingly dangerous and may inflict great harm upon the world.”

I don’t know of states having a sense of “morality,” but the great harm part sounds spot on. That leads to the unenviable task of confronting an actor with little to no rules without plunging the world into even deeper chaos.