Something important is about to happen next week…

The U.S. statistics were just released. They were better than expected, but overall, well within the previous range of values – nothing to write home about.

Markets’ reaction was relatively small and in perfect tune with the technical patterns that I had already described previously.

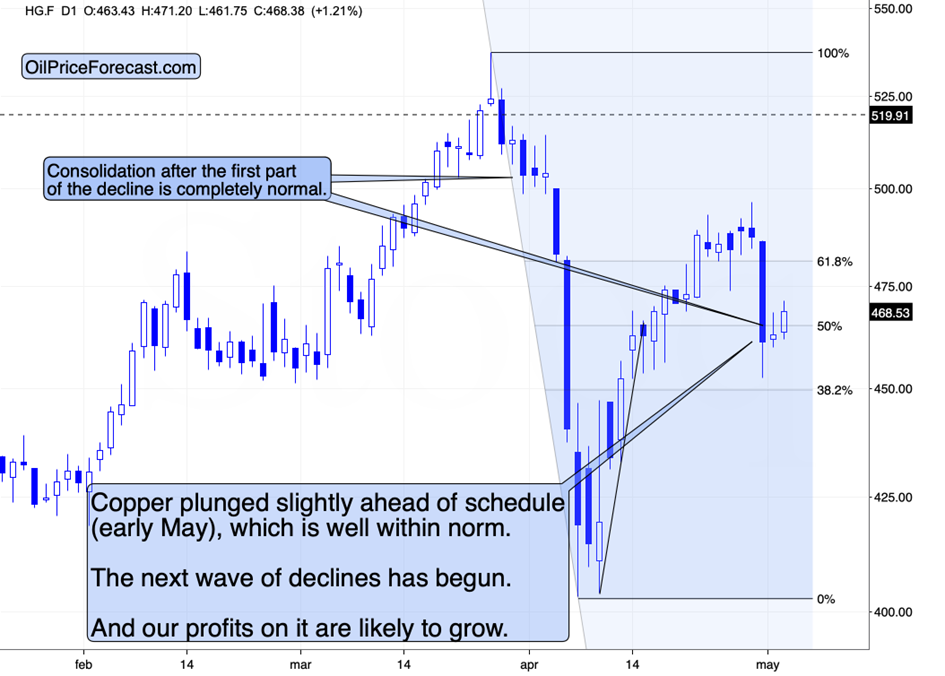

corrected a bit after breaking below the previous intraday lows. This consolidation is normal, and it’s unlikely to result in any meaningful rebound as no major support level was reached (except for the early April high, which was almost reached). Everything that I wrote about gold price forecast for May 2025 remains up-to-date. More importantly, however, the (to the rally of which gold reacted by sliding) didn’t encounter any particular resistance level.

In fact, it seems that after the current pullback, its price will rally once again.

USD Index Completes Bullish Pattern

This pullback is completely natural, as the USDX just completed its inverse head-and-shoulders pattern. Corrections after those are common. And since the USDX just bottomed very close to the triangle-vertex-based reversal, it seems that the bottom here is in or about to be in.

This, in turn suggests that the corrective upswing in gold and silver is about to be over.

The same is likely for the stock market, which is likely also connected to the reversal in the USD Index, but in stocks’ case, there’s more to that.

As I explained yesterday, the stock market has its own triangle-vertex-based reversal point, which is due early next week. Consequently, the current pause after a rally is quite natural. We’re still likely to get a (likely big) move lower next week.

Besides, the decline in already indicated what’s likely next for stocks – it moves quite closely with the S&P 500, and it already declined significantly this week.

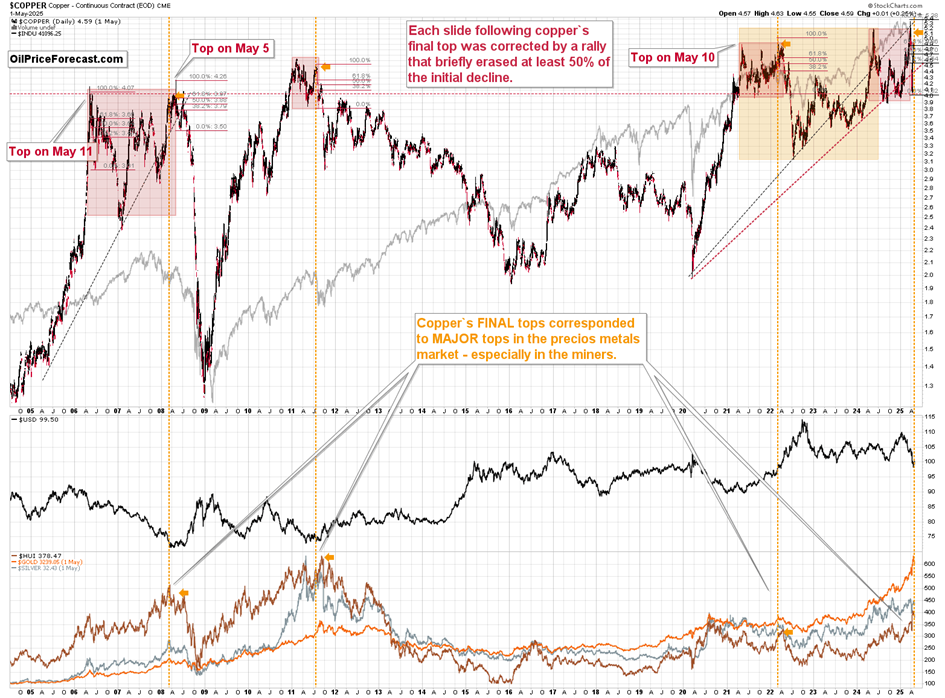

The invalidation of the move above the 61.8% and 50% Fibonacci retracement levels along with copper’s strong tendency to form major tops in early May strongly favors big declines in the following weeks.

Those who don’t know about this tendency might believe copper’s rebound or even FCX’s (or other copper stocks’ strength) here. But you know that it’s all fake. It’s a gimmick. A final shakeout of those making emotional purchase decisions.

In the previous weeks, I wrote a lot about the links between now and 2008. While the history rhymes instead of being repeated to the letter, but sometimes the market does repeat its performance on important anniversaries. And please note that the final top in copper in 2008 was formed on May 5. If this was to be repeated, we’d be looking for the final top to take place on the next trading session – on Monday.

This would be in perfect tune with the stock market’s triangle-vertex-based reversal and with the fact that the USD Index is likely to rally shortly.

Mining Stocks Flash Major Warning Sign

Meanwhile, mining stocks provided us with a huge “things are changing” signal of their own.

Namely, the VanEck Junior Gold Miners ETF (NYSE:) just closed below the highest close of 2020! This is a major invalidation and a clear sell signal. Quoting my yesterday’s comments:

“This is significant, because the highest daily close of 2020 was $59.58. This means, that GDXJ could invalidate the breakout above this high in terms of daily closing prices as early as today.

The lowest weekly close of 2020 was $56.69, so if we were to get this week’s close below that, the invalidation would be perfect. And that’s exactly what we’re likely to get – if not this week, then in the next of the following weeks.

Given gold’s momentum, and – most importantly – USD Index’s likely final bottom, it seems that we won’t have to wait long for this invalidation. And the invalidation itself would serve as a gateway to much lower prices in the following weeks.

My best bet right now is that we’ll get the above-mentioned invalidation in terms of the weekly closing prices next week. The reason is the situation on the stock market.”