Asset-based fee compression among financial advisors is expected to escalate by 2026, according to new research from Cerulli Associates.

In a survey of financial planners, advisors said they expect the average AUM fee for a client with $10 million in investable assets will be 66 basis points by 2026, representing a slight decline from 2024.

Currently, 44% of advisors surveyed by Cerulli generate at least 90% of their revenue from advisory fees. But that figure is projected to rise to 54% by 2026.

Across the industry, advisors earned 72% of their compensation from asset-based fees on average in 2024. That figure is expected to rise to nearly 78% by 2026 as commission-based revenue declines, according to Cerulli research.

READ MORE: What to expect in advisor pay in 2025

That trend could pose a problem for advisors if asset-based fees continue to decline. From 2020 to 2024, asset-based fees declined by two basis points on average for clients with $1.5 million or more in assets, Cerulli research shows. Advisors expect those rates will fall by another basis point by 2026.

“As fee compression continues and a new generation of potential clients emerges, advisors need to adapt and evolve to meet changing expectations,” said Kevin Lyons, a senior analyst at Cerulli. “Expectations for service and pricing structure differ vastly from those of previous generations. Clients — particularly high net worth individuals — increasingly expect their advisors to provide more services beyond investment management.”

Some advisors claim to have experienced fee compression firsthand. But others brush it off as an overblown fear in the industry.

“They have been talking about fee compression for decades,” said Jeremy Finger, founder of Riverbend Wealth Management in Myrtle Beach, South Carolina. “I have not seen it.”

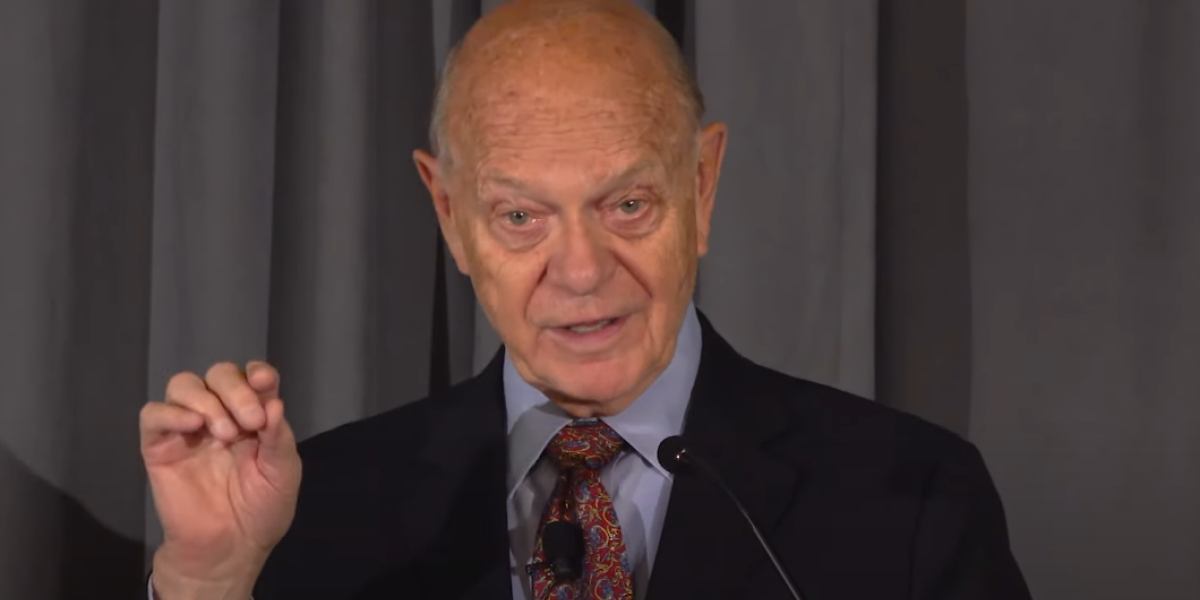

Scott Hanson, co-founder and vice chair of Allworth Financial, said that financial advisors have been relatively insulated from the fee compression that other parts of the wealth industry have experienced.

READ MORE: Edward Jones turns to alts to attract rich clients ‘like never before’

“For years we’ve heard about fee compression in the wealth industry, yet so far, the only compression we’ve seen is in investment management and those who serve advisors,” Hanson said.

But the unique insolation that financial advisors have enjoyed so far is not guaranteed moving forward, Hanson said.

“Past performance is not indicative of future results. Just because fee compression hasn’t materialized over the past two decades does not guarantee it won’t in the future,” he said. “The client-facing advisor has been able to escape the fee compression, but I think this is going to change,” he added.

Advisors looking to navigate that shift have a couple of options, according to Barry Flagg, founder of life insurance research company Veralytic in Tampa, Florida.

“As a practical matter, financial advisors therefore have only two paths to navigate continued fee-compression: 1) increase the amount of assets under management, or 2) expand service offerings to include new and ideally higher-margin lines of advice,” Flagg wrote in an email.

When it comes to increasing AUM — and improving productivity — adopting AI tools early is key, according to Hanson.

READ MORE: Internal AI tools on the rise, with Raymond James at the forefront

“AI will unleash a wave of productivity that we’ve never seen before, and advisors will be able to serve significantly more clients than they currently do. Short-term, this will increase margins and profits. But over the longer term, the productivity bump will result in lower fees to the client,” Hanson said. “Early adopters will dramatically increase productivity, which will enable them to lower fees for their clients. Late adopters will feel a fee compression without increased productivity, resulting in a reduction of profits.”

Even as asset-based fees have held relatively steady, the pressure on advisors to expand their service offerings for the same money is creating a kind of deflation in the industry. That trend may not affect an advisor’s basis point fee, but it does require that they do more work for the same pay.

Finger referred to this phenomenon as “value expansion.”

“The client gets more for that fee, like holistic planning, tax planning, estate coordination, etc.,” he said.

Does this mean financial advisors are in a race to the bottom when it comes to their fees and service offerings? Lyons doesn’t seem to think so.

“The pressure to lower fees while simultaneously meeting clients’ growing demand for additional services creates a challenging environment for financial advisors,” Lyons said. “Advisors who can clearly define their processes, remain flexible in their fee structures and adapt to offer a broader range of services will be better positioned to distinguish themselves from their peers and attract the types of clients they desire.”