In recent years, there’s been uncertainty over whether the Tax Cuts and Jobs Act (TCJA) will be allowed to ‘sunset’ at its scheduled expiration date of December 31, 2025, which would revert many current tax rules to their pre-2018 status. Although the 2024 U.S. elections resulted in a Republican ‘trifecta’ that made a TCJA extension in some form likely, the narrow Republican majorities in the House and Senate have slowed progress toward drafting a bill to extend or replace TCJA. Which has made it difficult for advisors and their clients to plan for the future with less than a year remaining before the scheduled sunset.

Recently, however, the House and Senate agreed to adopt a budget resolution that represents a crucial first step in the process of passing a ‘reconciliation’ bill. Although it doesn’t contain specific provisions for what will be included in the new bill, it provides a general framework for the bill’s overall ‘cost’ to the Federal deficit, offering planners some idea of the bill’s potential scope and providing at least some certainty for clients planning their taxes for 2026 and beyond.

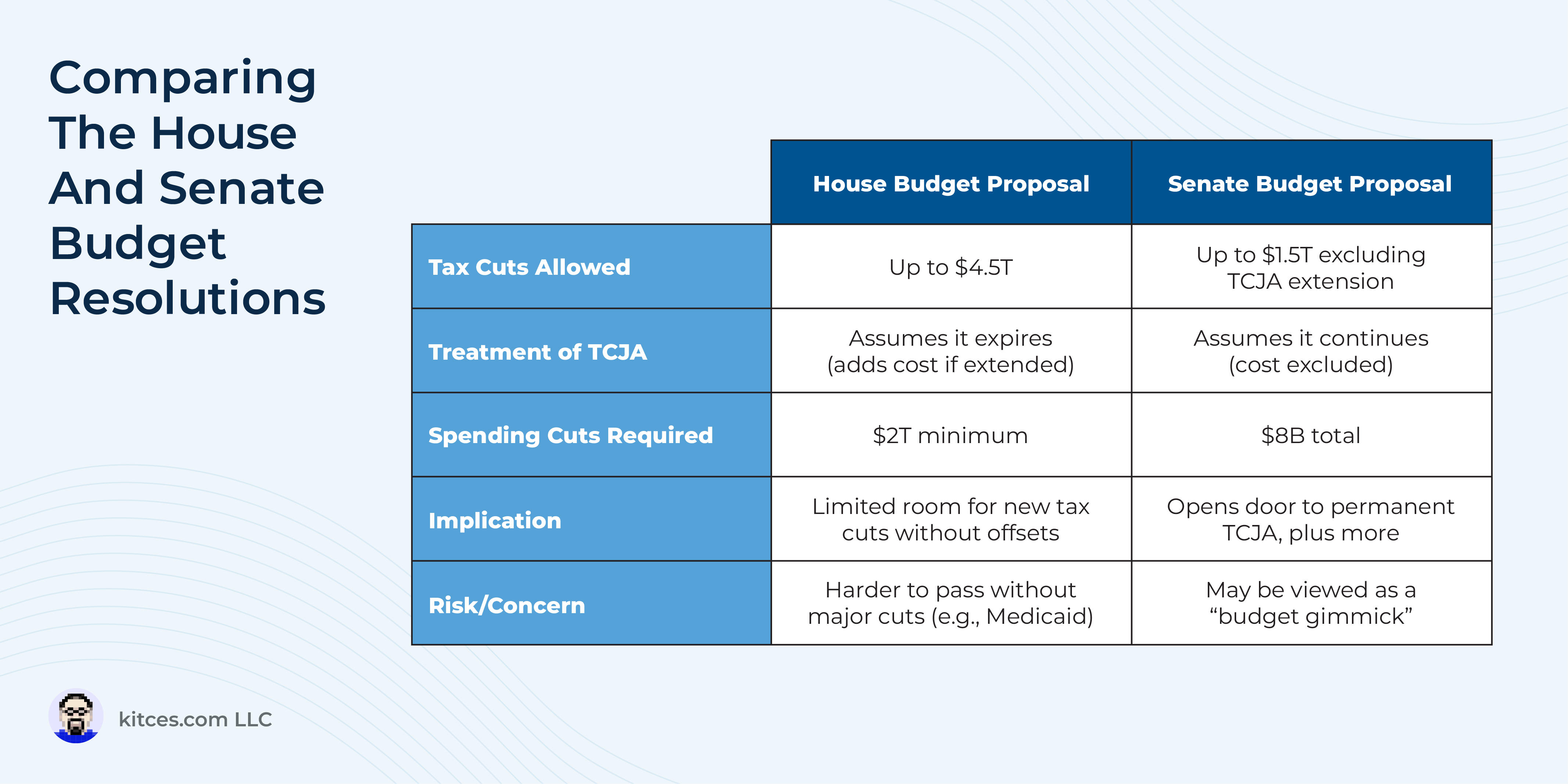

The budget resolution differs in key ways between the framework it provides for the House of Representatives and the Senate, meaning that we could see draft legislation from both chambers that would need to be reconciled to produce a final bill for the president to sign.

In the House’s version, the budget resolution authorizes $4.5 trillion in tax cuts over the next 10 years, which would mostly cover the estimated $4.6 trillion cost of extending TCJA (plus some already-expired provisions). However, the House’s proposal would leave little room for additional tax cuts proposed by President Trump and Republican legislators, including raising the $10,000 limit on State And Local Tax (SALT) deductions and eliminating taxes on tip income. To fit within the House’s budget framework, legislators would need to either shorten the bill’s ‘sunset’ window (e.g., to five or six years versus TCJA’s eight-year window), eliminate some new or existing provisions, or include selective tax increases to offset additional tax cuts.

By contrast, the Senate’s version authorizes ‘only’ $1.5 trillion in tax cuts – but due to a controversial legislative accounting tactic, that amount includes the cost of permanently extending TCJA, meaning the $1.5 trillion represents additional tax cuts beyond TCJA’s extension. In other words, Senate Republicans aim to make TCJA’s rules permanent while layering in new tax cuts that would sunset after 10 years.

The difficulty is that, with only a handful of votes to spare in both the House and Senate, congressional Republicans could struggle to find a bill with enough support to pass in both chambers. For example, many House Republicans say they will only support a bill that includes cuts to programs like Medicaid, while others oppose any substantial Medicaid cuts. So while a bill like the Senate’s proposal could potentially make TCJA permanent and add additional tax cuts, it may prove politically unfeasible if it requires deep spending cuts to reduce its impact on the deficit.

The key point, however, is that even though there may be significant disagreements to overcome among Republicans before they can align on a reconciliation bill, TCJA’s impending sunset deadline will increase pressure to pass something to prevent the tax rules from rolling back to their pre-2018 status. And even though negotiations may continue to drag out the process of drafting and passing a final bill, it still makes sense for advisors and their clients to take a “wait and see” approach to tax planning (while being reasonably confident that there will at least be a tax bill passed by the end of the year!).

Read More…