Is the market finally bottoming out after tumbling more than 17% from its mid-February peak after Trump’s fast-moving tariff plans sparked a major selloff?

No one—not analysts, not experts, not even the loudest talking heads—can predict its next move with certainty.

A fresh wave of bad headlines could send indexes lower again, making knee-jerk reactions to breaking news a costly mistake.

Instead of chasing the latest market noise, consider a smarter approach: focus on individual stocks that may be forming a bottom, aligned with your risk appetite and long-term goals.

For under $10 a month, InvestingPro members have been using a live list of the market’s Most Undervalued and Most Overvalued stocks, which are now also available for local markets.

The idea is simple: rather than trying to call the exact bottom, focus on stocks that are already showing signs of stabilizing and potentially reversing course.

Tools like Fair Value can help with that – it’s grounded in more than 15 widely-used financial metrics and offers a consistent, research-backed view of the true intrinsic valuation of a stock.

Some investors using these undervalued signals have uncovered compelling opportunities amid market downturns. Here are a few standout examples:

1. Warner Bros: Fair Value Sends Undervalued Signal – Stock Pops 56%

Warner Bros Discovery Inc (NASDAQ:) kicked off 2023 with a massive 56% surge in January, peaking at just under $16. But the rally was short-lived.

As the U.S. banking crisis rattled markets, WBD’s stock tumbled, triggering a nearly 18-month downtrend as analysts slashed earnings estimates.

Then, the tide shifted—and Fair Value detected something was changing.

On August 9, 2024, InvestingPro’s Fair Value models flagged WBD as undervalued, identifying a potential turnaround when the stock was trading at just $7.03—well below its intrinsic value estimate of $10.00.

Despite challenges in its traditional TV business, WBD still reported $39.9 billion in revenue and $7.4 billion in EBITDA—key signals of recovery that Fair Value picked up on before the market did.

The results? A powerful 56% rebound in just seven months, as WBD’s stock surged to $10.19—rewarding investors who followed the Fair Value signal.

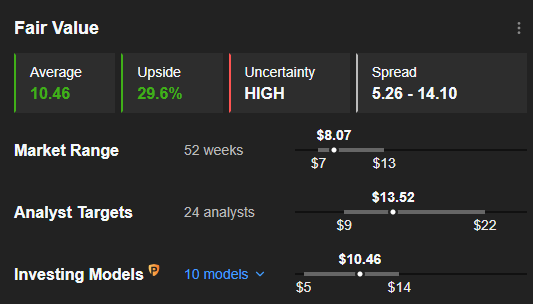

As of last week, this stock experienced a major selloff as it tumbled to $8.09.

Is this dip worth buying?

Fair Value is signaling a potential 29.6% undervalued opportunity once again.

Source: InvestingPro

2. Nokia Shattered Expectations With a Stunning 51% Rally

In April 2024, the Fair Value models identified Nokia (NYSE:) as significantly undervalued while it was trading at just $3.52 per share. The signal pointed to a major disconnect between Nokia’s market price and its true worth.

Fast forward to March 16, 2025, and Nokia surged 51.64%, hitting $5.33—outpacing even Fair Value’s initial 42.53% upside projection.

At the time of the call, Nokia, a global leader in telecom infrastructure and technology solutions, was stuck in a sideways pattern.

Yet, it still reported $22.8 billion in revenue and $3.28 billion in EBITDA, indicators that Fair Value identified as signs of an impending turnaround.

The stock’s rally came alongside notable financial improvements, with EPS climbing from $0.16 to $0.24, reinforcing Fair Value’s bullish outlook.

After the recent market selloff, the stock is currently trading near $4.6 a share.

3. Tencent Perfect Dip-Buy Yields 52%, Outperforming Expectations Again

When fair value identified Tencent Music Entertainment Group (NYSE:) as significantly undervalued in September 2024, the stock traded at just $9.48.

With the abrupt selloff in August 2024, investors wondered if this dip was just a knee-jerk reaction by the market.

The Fair Value tool – while not a market-timing instrument – serves as a crucial metric for investors assessing a stock’s true potential through fundamental data. It flagged Tencent Music as at least 38% undervalued, setting a target price of $14.38.

The company’s previous earnings confirmed the improving fundamentals, with revenue rising to $3.97 billion and EBITDA climbing 13.5% to $1.06 billion.

Fast forward to 27th March 2025, and investors who acted on this insight bagged a remarkable 52% gain.

Tencent Music, China’s top online music and audio entertainment platform had strong fundamentals even before its breakout.

At the time, the company reported $3.77 billion in revenue and $935.5 million in EBITDA—clear indicators of financial strength that many overlooked.

As of now, the stock has entered a downtrend once again, seeming to stabilize at just around $12.75.

Bottom Line

After a volatile March, April has brought another wave of uncertainty as markets price in the impact of Trump’s tariffs and the probability of a global trade war. But seasoned investors know that every dip holds opportunity.

While negative headlines may pressure stocks, they also create golden chances for those prepared to act.

Examples like Warner Bros. Discovery, Nokia, and Tencent are proof – each surged 50% after forming potential bottoms, turning market pullbacks into profit opportunities.

With InvestingPro’s Fair Value insights, you can cut through the noise and spot potential bargains, all for just under $10 a month.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.