The end of last week was one of the most tumultuous two days in the market in decades for price action, fiscal policy, and uncertainty among investors.

However, let’s start with the good news.

U.S. companies and citizens are extremely resourceful and have a history of finding solutions to tough situations. This country is in a tough situation, and we’ll find a solution.

As tactical, active investors, our objective is to adapt to this new economic and geopolitical environment by mitigating the risks and drawdowns of initial shocks and positioning ourselves to capitalize on the winning trends that will emerge in the future.

To be clear, the tough situation (among many), that I’m focused on is an unprecedented fiscal policy with respect to tariffs.

Following the Wednesday evening announcement of the new tariffs, the market lost $6.6 trillion in value in the following two days.

In the two charts below, you can see the size of the weekly change in the relative to weekly changes dating back to 1994.

Weekly Percent Changes Since The Great Recession

Perspective Back To The Dot.com Bull and Bear Markets

As you can see, it was an extraordinary week. Unfortunately, it also represents a market where price action, investor sentiment, and consumer sentiment have deteriorated from bad (as we wrote about last week) to worse.

This was demonstrated by;

Markets plunging – both risk-on and defensive assets

Analyst slashing market forecast targets

Economists raising their predictive probabilities for a recession in the near term

Congressmen (even some Republicans) expressing discontent with how extreme the policy is

Citizens protesting around the country

Companies canceling planned IPO dates

In short, despite the well telegraphed intentions to implement an unusually tough tariff policy, the world found it to be worse than expected.

Markets hate “worse than expected.”

Markets don’t like uncertainty. Many investors were hoping for a “sell the rumor, buy the news event,” in which case bad news is greeted with buying because the news defines and creates certainty around the “worst case” scenario and news flow can then change from getting worse to getting “less bad.”

Opportunistically thinking, the best tactical “buying opportunities” occur when market sentiment shifts from “the worst” to “less bad”. We are not there yet, but for the nimble investor, this should be a key focus, and we will seek to identify that point in time when it arrives.

Additionally, there is a belief that if Trump were to take action that would make the tariff policy less extreme, it would create a “less bad” event capable of slowing, if not reversing, the markets’ decline.

Hoping for a more lenient tariff policy by Trump, however, is part of what led to the shock of Wednesday’s announcement and is not an investment strategy.

In this week’s market analysis video, we look at the state of the market from several perspectives that help identify when a major market decline may bottom.

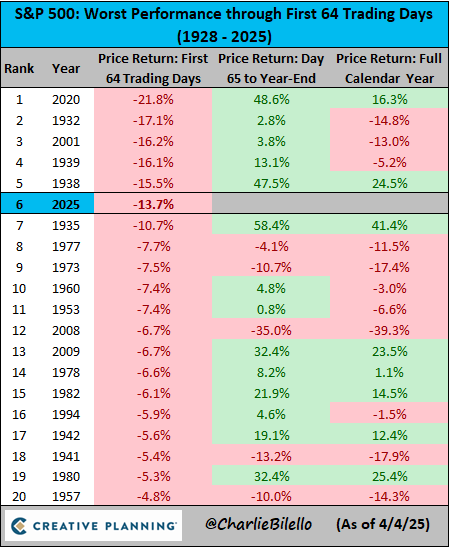

As you can see in the table below, 2025 has gotten off to a historically bearish start, however, there is precedent for tactical, active investors to remain optimistic that such a decline will lead to significant opportunities.

Markets sold off hard as they processed the new round of tariffs and potential retaliation, spiking volatility to the highest in five years and hitting extreme oversold levels in equities. Mean reversion is possible, but it is too early to tell, and given the continued headline risks, continued caution is warranted.

Risk On

Amidst the turmoil, heroically held all week at its current levels and above its 200-day Moving Average. (+)

Neutral

The McClellan Oscillator, after briefly turning positive on Tuesday, swung back negative down to around the -150 level, which is often support. (=)

, after hitting new all-time highs on Monday, finally retreated Friday, but only back into last week’s levels. (=)

The stumbled hard initially on the tariff news but actually mostly recovered to close out the week. (=)

Rates had a slightly subdued reaction to all the chaos this week with the long bonds recovering their 200-Day Moving Average but relatively little change over their trading range for the last six weeks. (=)

Seasonally, April tends to be a good month for equities, though the current headlines will likely dwarf seasonal trends as a catalyst for the market. (=)

Risk Off

Markets absorbed one of their worst weeks in quite a while, down between -7.6% in the to -9.76% in the . Indexes hit extreme oversold levels across the board in price and Real Motion, revisiting six and twelve-month lows. Given the news-driven nature of this correction, technical oversold levels should be approached with caution. (-)

All sectors were down this week, with , , and taking the hardest hits. Homebuilders, , and fared the best. (-)

The color charts (moving average of stocks above key moving averages) were negative across all the indexes and timeframes. (-)

Risk gauges remain fully risk-off. (-)

The new high-low ratio is negatively stacked and sloped and reaching extreme levels. (-)

Cash volatility spiked to its highest levels since 2020, marginally exceeding the spike levels we saw last August in that technology flash-crash. (-)

Value continued to outperform growth in this most recent sell-off, though both were hit about as hard. (-)

Five of the six members of the family are in bearish phases ( lone holdout, but headed similarly) and all of them are well below their 200-Day Moving Averages. Retail () outperformed, down only about half the broader market. (-)

Global equities took a hit from the tariff talk with emerging and developed foreign equities unable to sidestep the rout. Emerging market equities have been outperforming developed markets over the last couple of weeks. (-)

Dr. Copper collapsed back down to its 200-Day Moving Average, erasing the last two months of work with a similar but smaller drop in soft commodities (). (-)

took an outsized hit this week, likely from concerns about global trade amid tariff talk and a shift in the dollar. (-)