Coverdash is an insurance broker that can help you generate quotes and buy business insurance through its partners. Then, you can use Coverdash to pay your premiums, file claims and update your coverage as needed.

If you have relatively simple insurance needs — for example, if you need general liability or workers’ comp insurance to comply with contracts or state laws — Coverdash offers an efficient shopping experience. Quotes come from reputable insurance companies, and the platform provides plenty of detail to help you make an informed decision.

Unfortunately, you’ll have to shop elsewhere for commercial auto insurance. And if you need highly specialized types of coverage, like key person insurance, an in-person insurance broker is probably your best bet.

Coverdash insurance: Pros and cons

Get multiple quotes for general liability, professional liability, business owners’ policies, D&O and workers’ comp insurance with one application.

Pay premiums and file claims through the Coverdash platform.

Coverdash’s insurance partners include some of NerdWallet’s top-rated business insurance companies, including Chubb, Travelers and Nationwide.

No commercial auto insurance.

Coverdash is a brokerage, not an insurance company. Your coverage will be provided by a third party.

How Coverdash works

Coverdash gets insurance quotes from multiple companies based on the information you provide. You’ll need to offer:

Basic information like your name, phone number, email address and business website, if you have one.

Your business type, legal structure, industry, address and year founded.

Annual estimated revenue and payroll.

After that, Coverdash will generate quotes from its partners.

Coverdash insurance partners

What it’s like to get a quote from Coverdash

👋 I’m Rosalie Murphy, NerdWallet’s writer covering business insurance. Here’s what you can expect when you get a quote from Coverdash.

I told Coverdash I operated a new, one-person home business as a florist and needed general liability insurance. I predicted $10,000 in annual revenue. (This is hypothetical; sadly, I’m not a florist on the side.)

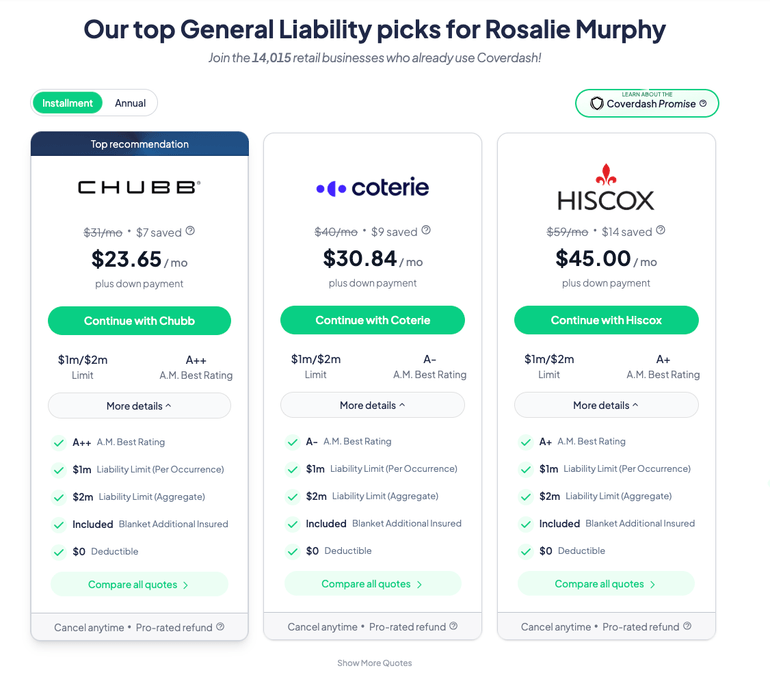

In less than a minute, the service provided multiple quotes for a general liability policy:

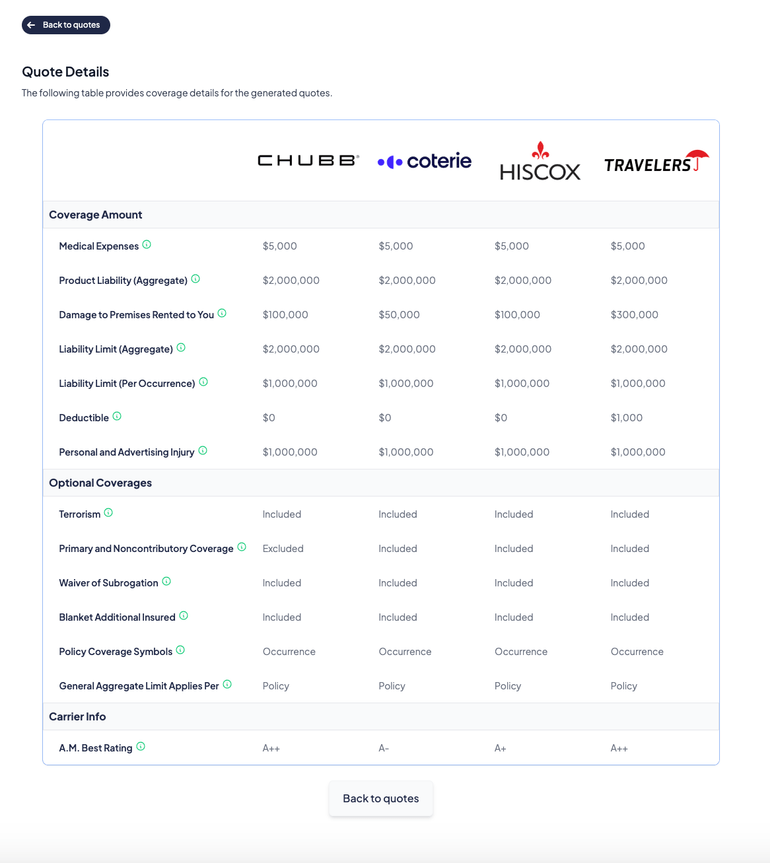

When I dug deeper, Coverdash provided a helpful table that let me compare coverage limits, deductibles and additional coverages. This made it easy to identify differences in policies relative to their prices:

Overall, these policies are quite similar. But for instance, Chubb — the cheapest quote — actually offers more coverage for damage on rented premises than Coterie, which is slightly more expensive.

Chubb doesn’t include primary and noncontributory coverage, though. That means Chubb’s policy won’t pay out before any others that might cover the same claim. For my hypothetical floral business, that probably doesn’t matter. However that coverage is sometimes required for other professions, like contractors.

While I didn’t select an insurer, I did have to provide contact information to see their quotes. Coverdash followed up via email and with two phone calls the next day. (The calls didn’t continue after that, which is always a concern with services like this.)

My quote was also saved when I logged in the next day.

Coverdash insurance: Types of coverage

Through its partners, Coverdash offers the following policies:

All businesses need: General liability insurance

General liability insurance protects your business in case of third-party claims of bodily injury and property damage. NerdWallet recommends that all business owners carry a general liability policy. Some leases and contracts require you to have this coverage.

🤓Nerdy Tip

If your business has a physical location, consider a business owner’s policy instead. BOPs include general liability insurance along with commercial property insurance, which pays out if your stuff is destroyed in a covered event like a fire. Most also include business interruption insurance, which helps cover your expenses while you’re making repairs and can’t operate normally.

For businesses with less than $1 million in revenue, Coverdash says the general liability policies it sells usually have premiums in these ranges:

Retail businesses: $700-$1,500 annually.

Professional, scientific and technical services: $700-$1,300 annually.

Wholesale trade: $700-$2,500 annually.

Accommodation and food services: $1,000-$3,000 annually.

Construction businesses: Up to $5,000 annually.

Many businesses need: Workers’ compensation

Workers’ comp is required in most states, though which companies need it varies by industry and how many employees you have. Coverage kicks in if one of your employees is injured on the job and needs medical care and time off to recover.

Workers’ comp costs can vary widely depending on your industry. For instance, construction businesses tend to have the highest costs since construction workers generally have more risk of injury than retail workers.

For businesses with less than $1 million in revenue, Coverdash says the workers’ comp policies it sells usually have premiums in these ranges:

Retail: $500-$1,600 annually.

Wholesale trade: $500-$1,600 annually.

Accommodation and food service: $900-$2,500 annually.

Construction: $1,000-$10,000 annually (varies by state and what services the company provides)

Many businesses need: Professional liability insurance

Professional liability insurance, also known as errors and omissions insurance, protects your business in case a client accuses you of negligent or inadequate work. If you provide services to customers for a fee, you should have E&O insurance.

For businesses with less than $1 million in revenue, Coverdash says the professional liability policies it sells usually have premiums in these ranges:

Professional, scientific and technical services: $800-$3,500 annually.

Construction (a specific E&O policy for contractors): $1,200-$5,000 annually.

Technology: $1,300-$2,400 annually.