• Trump tariff “Liberation Day” and the latest jobs report loom in the week ahead.

• ExxonMobil appears well-positioned to capitalize on the changing dynamics of energy trade.

• General Motors is expected to face challenges due to the new tariffs set to be unveiled, potentially making it a stock to sell.

• Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

U.S. stocks tumbled on Friday to wrap up a volatile week as a negative mix of news related to inflation, the economy, and President Donald Trump’s trade war triggered a sharp selloff.

For the week, the fell about 1%, the slumped 1.5%, while the tech-heavy declined 2.6%.

With this latest losing week, the Nasdaq is now on pace for a more than 8% monthly decline, which would be its worst monthly performance since December 2022.

Source: Investing.com

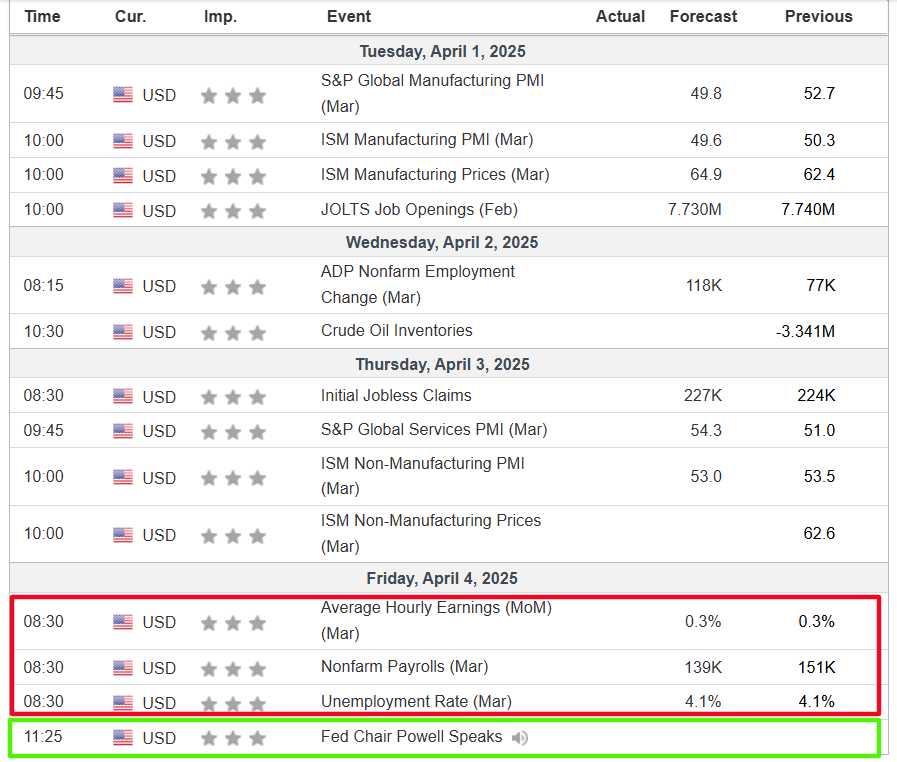

The week ahead is expected to be an eventful one as investors look ahead to Wednesday, when President Trump is expected to announce a fresh round of tariffs, for further clarity.

Most important on the calendar will be Friday’s U.S. employment report for March, which is forecast to show the economy added 139,000 positions. The unemployment rate is seen holding steady at 4.1%.

Source: Investing.com

That will be accompanied by a heavy slate of Fed speakers, including Chairman Jerome Powell. Interest rate futures suggest traders see a 79% likelihood that the Fed will cut interest rates by 25 basis points by its June meeting, according to Investing.com .

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including Conagra Brands (NYSE:), Lamb Weston (NYSE:), RH (NYSE:), Guess (NYSE:), and PVH (NYSE:).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, March 31 – Friday, April 4.

Stock To Buy: ExxonMobil

As the so-called “Liberation Day” approaches, ExxonMobil (NYSE:) is poised to capitalize on the Trump administration’s aggressive trade and energy agenda.

The president’s pursuit of a trade war with allies Mexico and Canada—America’s top sources of imported crude oil—has already seen tariffs slapped on crude from these neighbors.

This move is designed to squeeze foreign oil supplies and bolster domestic production, a clear win for ExxonMobil, one of the U.S.’s energy titans.

Adding fuel to the fire, Trump’s sanctions on Venezuelan oil threaten to tighten global crude markets further. His administration has warned that any country purchasing Venezuelan oil will face a 25% tariff, a policy that could drive oil prices higher.

With crude prices trending upward, ExxonMobil’s robust domestic operations stand to benefit as Trump doubles down on his promise to supercharge U.S. energy independence.

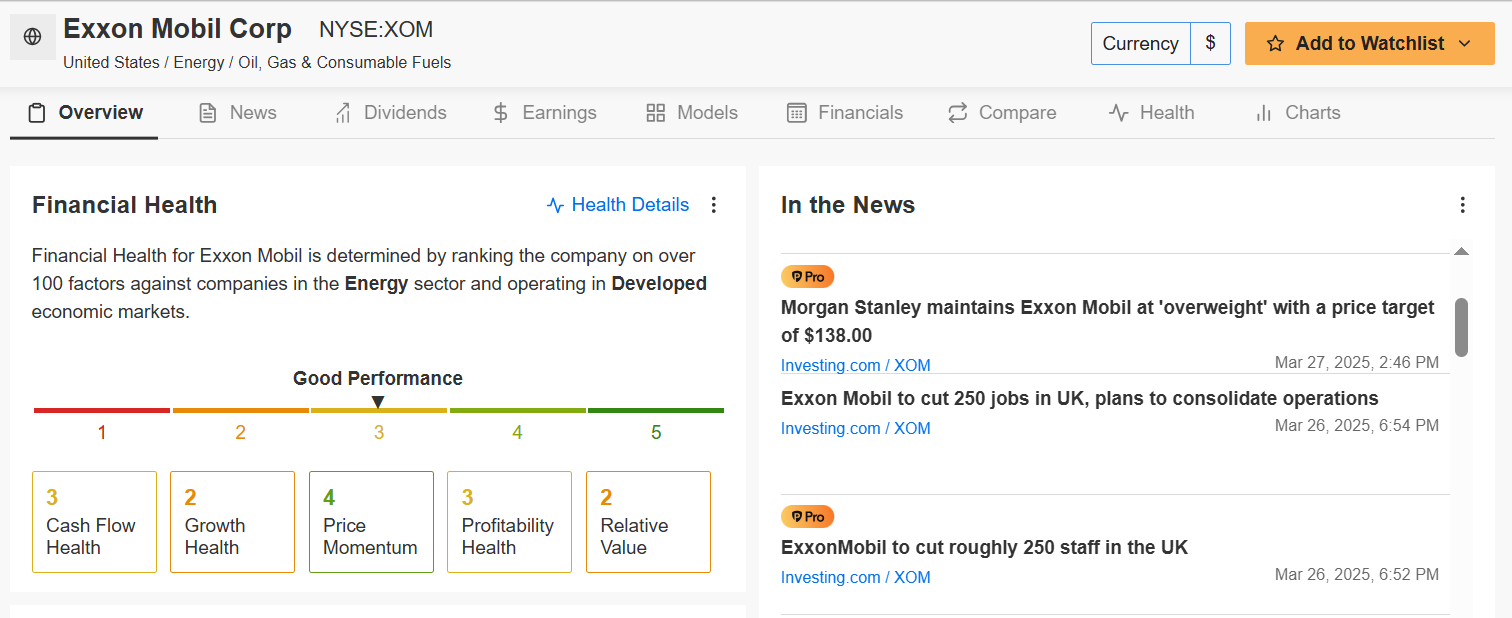

Source: Investing.com

XOM stock ended Friday’s session at $117.73, putting it within sight of its October 2024 record peak of $126.34. ExxonMobil has a market cap of $510 billion at its current valuation, making it the largest U.S. oil producer and the 14th most valuable company trading on the NYSE.

Shares have increased 9.4% since the start of 2024, outperforming the broader market by a wide margin over the same period.

Source: InvestingPro

The Irving, Texas-based oil giant maintains a solid Financial Health score of 2.88, earning it a “GOOD” rating as per the InvestingPro model. This score is bolstered by strong performance in specific areas, particularly price momentum (3.56) and profit metrics (3.41), while cash flow (3.18) also shows strength.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now and position your portfolio one step ahead of everyone else!

Stock to Sell: General Motors

On the flip side, General Motors (NYSE:) finds itself in the crosshairs of Trump’s tariff barrage, making it a stock to avoid this week.

The administration’s decision to impose a 25% tariff on nearly all imported vehicles and components is a significant blow to the U.S. auto industry—and GM in particular. Effective April 3, these tariffs cover a broad range of imports, with limited relief for USMCA-compliant vehicles.

This move introduces a potential $110 billion annual cost increase across the sector, translating to an estimated $6,700 per vehicle.

GM’s reliance on a globally interconnected supply chain makes it particularly vulnerable, as absorbing the tariff costs could erode profit margins, while passing them on to consumers risks a significant decline in sales.

For GM, which relies heavily on imports, the tariffs pose a substantial threat to its earnings power, with a notable hit expected by the second half of 2025.

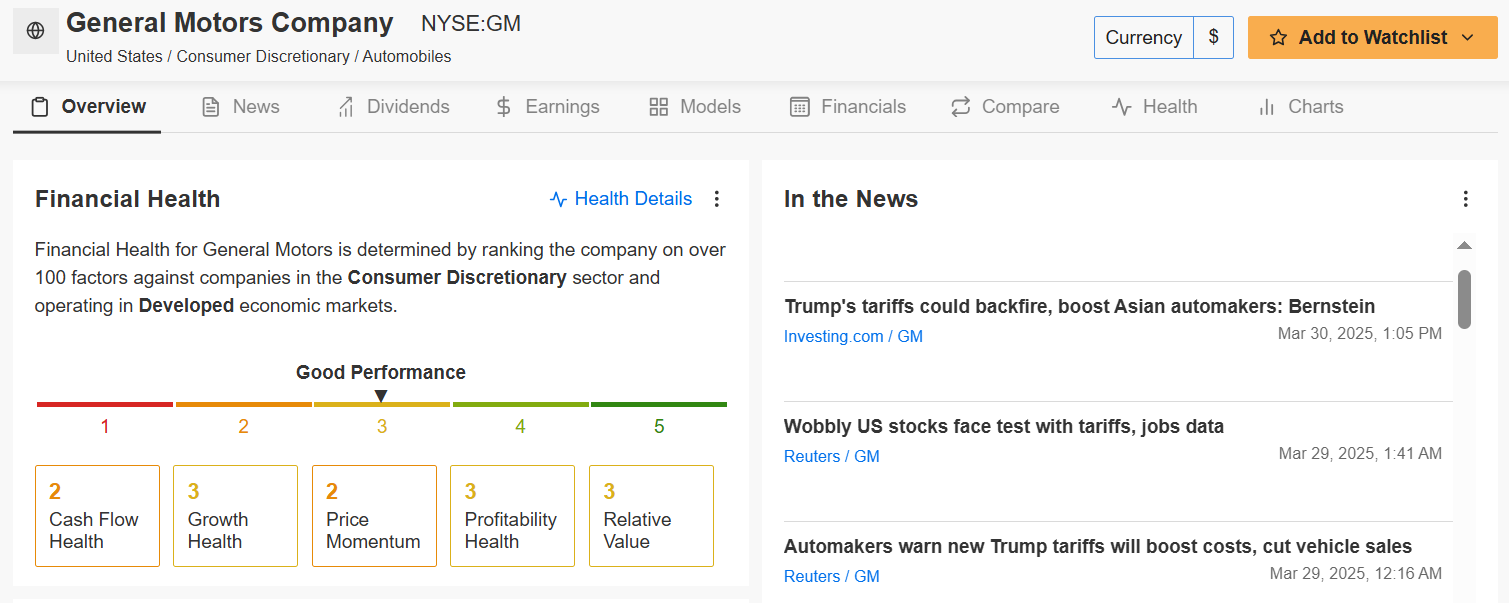

Source: Investing.com

GM stock closed at $46.68 on Friday, not far from a 2025 low of $44.41 touched on March 4. At current valuations, General Motors has a market cap of $46.5 billion, making it the second largest U.S. automaker after Tesla (NASDAQ:).

Shares, which are trading below their key moving averages, are down 12.4% in the year-to-date.

Source: InvestingPro

The automaker maintains a respectable financial health overall score of 2.61, also earning a “GOOD” rating. GM shows balanced performance across profit metrics (2.76) and growth (2.75), but demonstrates some weakness in cash flow (2.03) and price momentum (2.29).

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

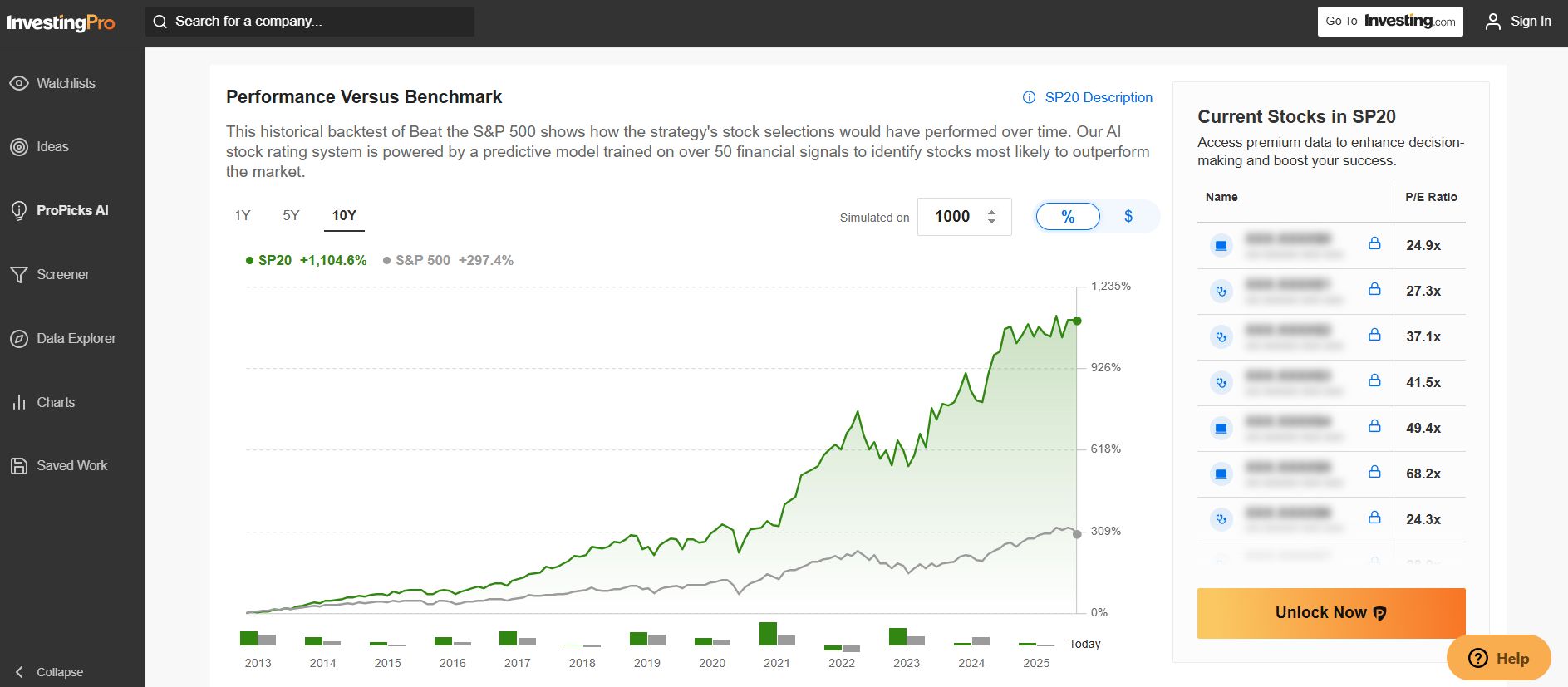

• ProPicks AI: AI-selected stock winners with proven track record.

• InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

• Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

• Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am short on the S&P 500 and via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.