Policy differences between Democrats and Republicans on energy, trade, and fiscal policy are key market drivers

A Republican “red wave” could boost USD/JPY, while a split Congress may pressure the pair lower

Crude oil price outlook hinges on US dollar moves and potential shifts in energy and policy

Risk of kneejerk selling in gold under red or blue sweep of Congress

Overview

, , and are poised for potential extreme volatility around the US election. This stems from the stark differences in energy, trade, foreign relations, and fiscal policies between Democrats and Republicans, as well as the uncertainty over whether either party can take full control of Congress, which could impact the implementation of their policy agenda.

This note focuses on possible market reactions to scenarios likely to trigger big market moves, helping traders align those outcomes with key technical levels.

USD/JPY: Red or Blue Waves Amplify Volatility Risk

As a market that’s been strongly correlated with the US interest rate outlook for several years, USD/JPY screens as one of the easier FX pairs to assess how it may react.

As outlined in the released over the weekend, here are the outcomes that could get USD/JPY moving:

Republican red wave (Trump victory, Senate/House Republican-controlled): USD/JPY likely rallies as the Treasury curve steepens, given the higher chance of expansionary fiscal policy.

Democrat blue wave (Harris victory, Senate/House Democrat-controlled): USD/JPY upside, but not as strong as a Republican sweep given pre-election policy signals.

Trump victory, split Congress: Policy gridlock could slow growth, weaken inflation, and increase chances of more Fed easing. Treasury yields are likely to fall, pulling USD/JPY lower.

Harris victory, split Congress: Most bearish outcome for USD/JPY given likelihood of sizeable falls in US Treasury yields.

Source: TradingView

USD/JPY has entered consolidation mode on the weekly chart after breaking several key technical resistance levels, although it’s notable that momentum remains with the bulls with RSI (14) and MACD continuing to trend higher.

You can see how influential 151.95 remains for USD/JPY with the price now finding support there after being capped below it for so long previously. 150.90 and the 50-week moving average are other key support levels nearby.

In a scenario of a Republican red wave, there is a meaningful risk USD/JPY could retest the multi-decade highs around 162 given the likelihood that higher US Treasury yields may draw capital into the . Even a Democratic blue wave could deliver upside given expansionary fiscal policy may fuel stronger growth in an already robust US economy, reducing the need for the Federal Reserve to cut interest rates further.

A split Congress may see USD/JPY downside materialise, even with Trump as President, limiting the ability to introduce both tax cuts AND tariffs given he’ll need Congressional approval to push through the former. But, even then, downside may be limited to the high 140s considering momentum the US economy is carrying.

Trump Sweep Bearish for Crude Prices

Crude oil is another market that’s interesting ahead of the election, not only because of the domestic US energy policy considerations but also the US dollar impact.

Even though Trump is an oil enthusiast, telling a rally in Detroit in October that “we will frack, frack, frack and drill, baby, drill,” the prospect of a Red wave screens as bearish considering the prospect of increased supply and dollar strength does not bode well for prices.

Some may argue that given his track record during his first Presidential term, Trump may attempt a quick solution to de-escalate tensions in the Middle East, further reducing the geopolitical risk premium built into the crude price.

Other election scenarios screen as far more neutral for the crude price, although a split congress could provide modest upside given the likelihood of a softer US dollar.

Source: TradingView

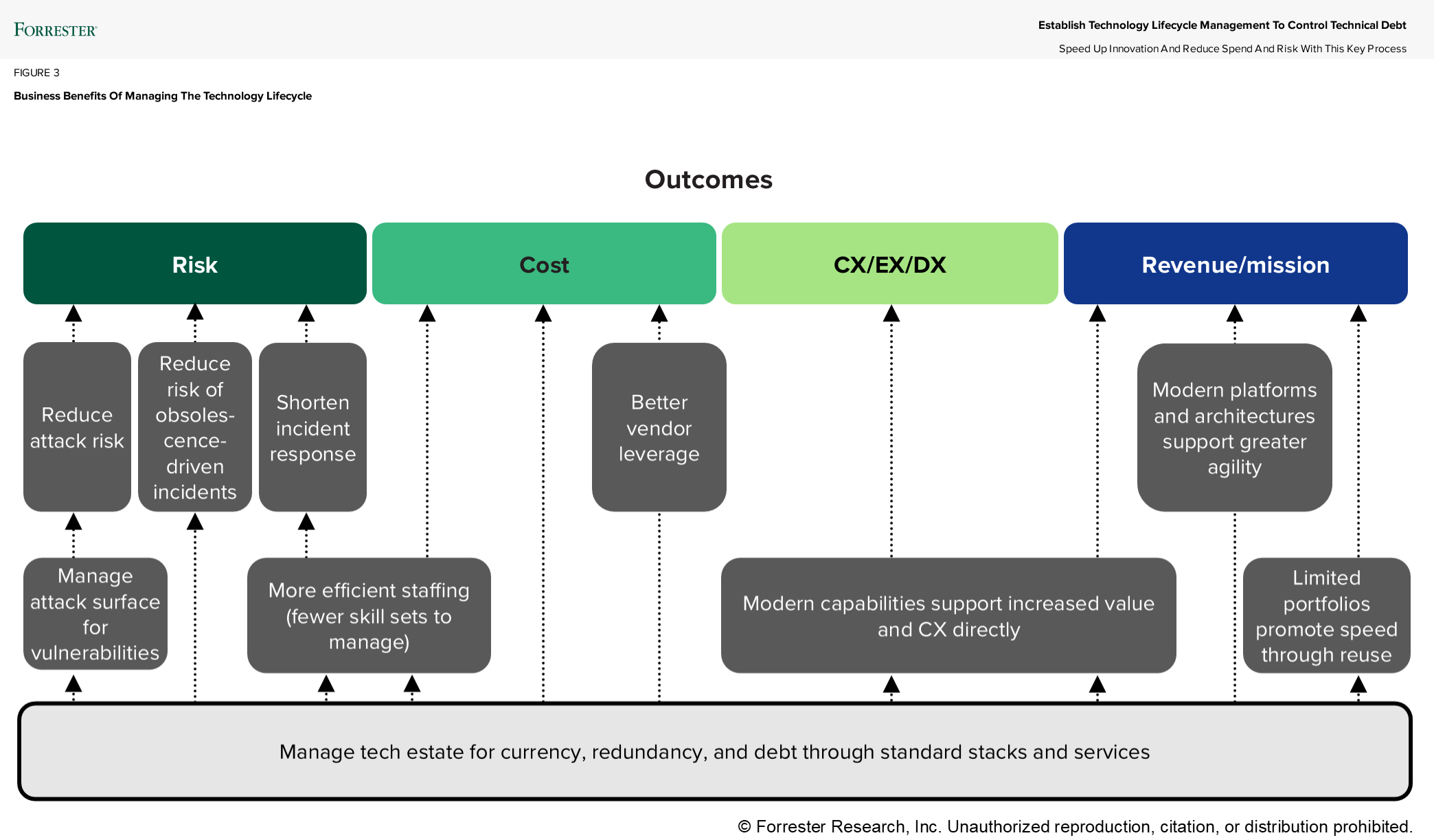

For the volatility seen in the WTI crude price recently, the weekly chart does a good job of cutting through the noise to provide a stronger signal.

The price continues to coil in a triangle pattern dating back many years, with dips continuing to be bought towards and marginally below $66 per barrel. On the topside, downtrend resistance dating back to September 2023 continues to thwart bullish breakout attempts, sitting this week around $79 per barrel.

In between, $72 has acted as a pivot level recently, often tested but rarely broken. The 200-week moving average is another level to keep on the radar, acting as a reliable location to buy dips below for several years prior to price breaking and closing below it July. Will it now act as a reliable level to sell? It hasn’t been tested since, but it’s worth monitoring.

Gold’s Resilience to Higher USD, Rates Put to the Test

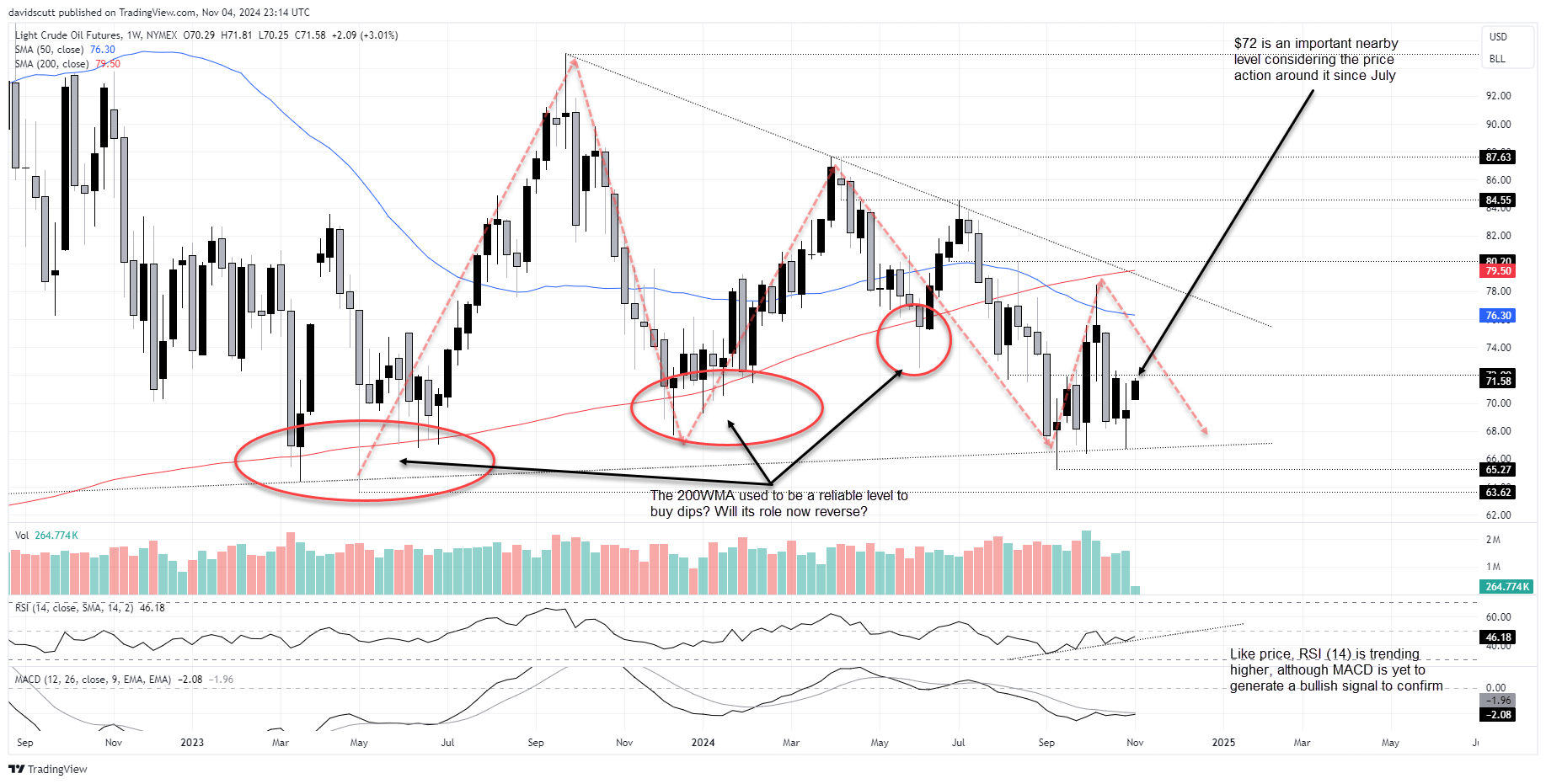

Gold has been largely immune to US dollar strength and higher US interest rates over recent years, deviating substantially from the trend seen for large periods prior to the pandemic. It looks nothing but bullish on the weekly timeframe with price and momentum indicators continuing to trend higher.

Source: TradingView

There’s no one election scenario that looms as particularly bearish for the gold price over the longer-term, even though a red wave is likely to spark dollar strength and higher US interest rates. If that were to take place we could see kneejerk selling, especially if accompanied by extreme volatility in other asset classes that could prompt liquidations to cover losses elsewhere. A Democratic blue wave could also spark near-term downside, although likely less than a Republican sweep.

A split Congress should be deemed a continuation of the status quo, putting the emphasis back on other factors including price action.

Original Post