The tax and accounting landscape is undergoing a seismic shift, driven by rapid technological advancements.

Jump to ↓

The tax and accounting landscape is undergoing a seismic shift, driven by rapid technological advancements. The inaugural Tax Firm Technology Report by the Thomson Reuters Institute sheds light on the current state of technology adoption, challenges, and future expectations within the industry. This executive summary distills the key trends and insights from the report, providing a snapshot for tax and accounting professionals navigating this evolving terrain.

The strategic role of tax technology

The importance of technology in the tax and accounting industry cannot be overstated. The integration of Artificial Intelligence (AI), machine learning, and advanced data analytics is revolutionizing the accounting industry, enabling firms to elevate their performance by improving accuracy, streamlining operations, and delivering exceptional client experiences. According to the report:

88% of respondents believe technology is a significant or integral part of their firm’s overall strategy.

Almost half (49%) of the firms describe their technology posture as proactive, while just over half (55%) have a dedicated person leading their technology strategy.

Despite this strategic emphasis, there is a notable gap in practical implementation.

Only 25% of firms use key metrics to track the success of their technology initiatives, and a majority of respondents feel their staff is only somewhat competent in technology.

This gap underscores the need for a more structured approach to technology adoption and implementation. As one respondent from a small US firm put it, “I don’t know what I don’t know. And working on my own, I’m only implementing changes that I hear about and approve.”

Budget disparities and satisfaction levels

The report reveals stark contrasts in technology budgets between large and small firms:

Large firms spend an average of $312,191 on technology, compared to just $10,459 for small firms.

This disparity is reflected in satisfaction levels, with only 29% of large firm respondents rating their technology stack highly, compared to 37% overall.

The need for a more thoughtful and strategic approach to technology investments is underscored by the tendency to prioritize cheaper, less effective solutions, often resulting from a rushed and constantly changing decision-making process.

This approach can have significant consequences, particularly for smaller firms, which may struggle to keep pace with technological advancements, potentially widening the gap between them and their larger counterparts.

The rise of Generative AI (GenAI)

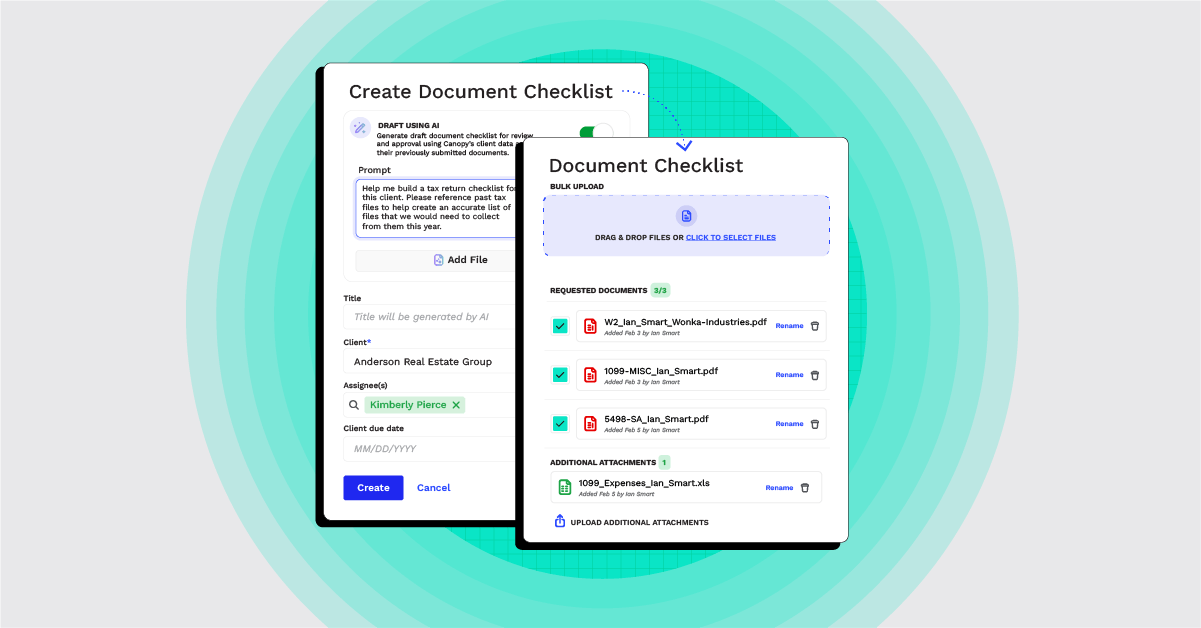

Generative AI (GenAI) is emerging as a transformative force in the industry, enabling tax and accounting professionals at all levels to streamline workflow processes, boost efficiency, and derive meaningful insight from client data, and many survey respondents acknowledged that GenAI is here to stay.

24% of firms are already using publicly available GenAI tools like ChatGPT.

67% of respondents are either exploring or considering GenAI, with 63% believing it will become part of their daily workflow within the next three years.

The successful integration of new technologies into a firm’s operations requires a thoughtful and strategic approach. However, the complexity of these technologies demands proper training and data integration to avoid inefficiencies and staff disillusionment.

Without a comprehensive understanding of GenAI technologies, firms risk implementing changes in a piecemeal fashion, only scratching the surface of their potential. Therefore, it is essential for firms to not only adopt new technologies but also to invest in adequate training, ensuring their teams are equipped to harness their full capabilities and drive meaningful improvements.

Key findings at a glance

Technology as strategy: 88% of firms see technology as crucial to their strategy.

Leadership gap: Only 55% have a dedicated technology leader.

Budget inequality: Large firms spend significantly more on technology.

Competency concerns: Only 30% rate their staff as very competent in technology.

GenAI adoption: 67% are exploring or considering GenAI.

The future trends of tax technology

Looking ahead, the report indicates strong forward momentum in technology adoption:

84% of respondents expect their firm’s technology capabilities to increase over the next 3 to 5 years.

79% anticipate their technology budgets will grow in the same period.

This optimism is tempered by the recognition that many firms still lack the resources, time, or ability to properly implement and operate critical technology tools.

As one small firm owner from the US put it, “Technology is always improving in ways we aren’t even thinking about. Anything we can do to automate our workflows for speedier, more accurate tax returns/processes is a win in my book.”

This sentiment reflects a broader industry trend toward embracing technology to improve efficiency and accuracy in tax and accounting practices.

Strategic takeaways and future directions

The recent Tax Firm Technology Report paints a picture of an industry at a crossroads. While the importance of technology is universally acknowledged, there is a clear need for better implementation, training, and resource allocation to fully harness its potential. The report underscores firms’ need to bridge the gap between strategic intent and practical implementation.

For a deeper dive into these findings and more, we encourage you to read the full Tax Firm Technology Report. It offers comprehensive insights and actionable recommendations to help your firm navigate the complexities of today’s technological landscape and prepare for the future.